Investing in AXIS Capital Holdings Limited: A Discounted Stock with Strong Growth Potential and Attractive Dividend Yield

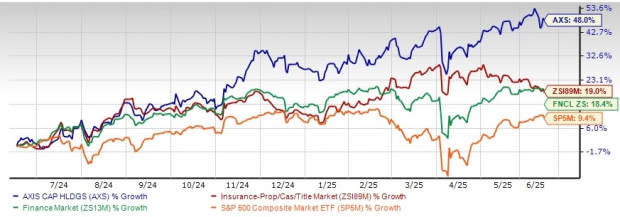

AXIS Capital Holdings Limited (AXS) has been a standout performer in the past year, gaining 48% compared to the 19% growth of its industry, the 18.4% growth of the Finance sector, and the 9.4% growth of the Zacks S&P 500 composite. The insurer has a market capitalization of $8.13 billion and an average volume of shares traded in the last three months of 0.7 million.

AXS has a solid track record of beating earnings estimates in each of the last four quarters, with an average of 13.89%. The company's shares are trading at a discount compared to the industry, with a forward price-to-book value of 1.51X, lower than the industry average of 1.56X and the Zacks S&P 500 Composite's 8.04X. AXS also has a Value Score of A and is cheaper compared to The Travelers Companies, Inc. (TRV), Arch Capital Group Ltd. (ACGL), and American Financial Group, Inc. (AFG).

The stock is trading above both its 50-day and 200-day simple moving averages, indicating solid upward momentum. The Zacks Consensus Estimate for AXS's 2025 earnings per share indicates a year-over-year increase of 3.4%, with a consensus estimate for revenues of $6.58 billion, implying a year-over-year improvement of 7.8%. The consensus estimate for 2026 earnings per share and revenues indicates an increase of 8% and 7.8%, respectively, from the corresponding 2025 estimates.

Each of the four analysts covering AXS has raised estimates for 2025, and one analyst has raised the same for 2026 over the past 60 days. The Zacks Consensus Estimate for 2025 and 2026 earnings has moved up 2.4% and 0.5%, respectively, in the past 60 days. Based on short-term price targets offered by eight analysts, the Zacks average price target is $112.38 per share, suggesting a potential 9.1% upside from the last closing price.

AXIS Capital's return on equity in the trailing 12 months was 19%, better than the industry average of 7.8%. The company aims to be a leading specialty underwriter and focuses on growth areas such as wholesale insurance and lower middle markets. Its strategic initiatives have been driving improvement in its operating earnings over the past few years, and it stays focused on expanding digital capabilities to create new business growth in desirable smaller accounts.

Axis Capital's dividend track record is impressive, with a dividend hike for 18 straight years and currently yielding 1.7%, way above the industry average of 0.2%. The insurer boasts one of the highest dividend yields among its peers.

In conclusion, AXIS Capital Holdings Limited is poised for growth with its focus on prudently deploying resources while enhancing efficiencies, improving its portfolio mix and underwriting profitability. The company has a VGM Score of A, indicating a potential upside and instilling confidence in investors. Higher return on capital, favorable growth estimates, and attractive valuations should continue to benefit Axis Capital over the long term. The stock currently carries a Zacks Rank #3 (Hold).

Investing in AXIS Capital Holdings Limited at a discount offers an enticing opportunity to capitalize on its robust growth potential while enjoying the allure of their attractive dividend yield – presenting investors with both long-term financial stability and sustainable income prospects.

Investing in AXIS Capital Holdings Limited presents an extremely诱人的 opportunity as a discounted stock packed with strong growth potential and boasting appealing dividend yields for patient investors seeking stable returns amidst market uncertainties.

With its strong growth trajectory, attractive dividend yield potential coupled with a currently discounted stock price relative to underlying value at AXIS Capital Holdings Limited investors are anticipated for promising returns.

Investing in AXIS Capital Holdings Limited can be a strategic move with its robust growth potential and an appealing dividend yield, despite the discounted stock price. It's clear to see why astute investors are increasingly considering it for their portfolios.

The analysis on Investing in AXIS Capital Holdings Limited, highlighting its strong growth potential and attractive dividend yield despite a discounted stock price; perfectly captures the essence of strategic value investing at an enthicing opportunity cost.

Buying shares of AXIS Capital Holdings Limited at a discounted valuation offers investors significant potential for growth, bolstering by its impressive dividend yield and proven financial resilience. An enticing opportunity to secure long-term returns amid the unpredictable market landscape.

![Electric Axle Drive System Market on the Rise [2028]- A Deep Dive into the Growth & Forecast](https://antiochtenn.com/zb_users/upload/2025/07/20250717215054175276025475810.jpg)