Trump wins tax breaks for US with threat of ‘revenge’ raid on foreign business

Donald Trump has extracted tax breaks for US companies after threatening to impose a “revenge” levy on foreign businesses that moved money out of the US.

G7 countries are to abandon plans to make US companies pay a minimum level of corporation tax in return for Mr Trump dropping the threat of “revenge tax”.

Scott Bessent, the US Treasury secretary, said that he has asked both houses of the US Congress to remove a Trump’s tax proposal, known as Section 899, from the budget bill after an agreement with the other G7 countries.

Section 899 is part of Mr Trump’s “big, beautiful” tax and spend bill, and would have enabled the US president to retaliate against countries that harm American interests with “discriminatory” tax policies by taxing any money taken out of the country.

The power threatened to be hugely costly to British businesses. Some of Britain’s biggest companies, including AstraZeneca, BAE and Barclays, have significant operations in the US that could be at risk of being targeted.

Fears had mounted that the powers could be used on the UK as a way of forcing Sir Keir Starmer to water down or abolish Britain’s digital service tax, which applies to US tech giants.

On Thursday night, Mr Bessent wrote on X: “After months of productive dialogue with other countries on the OECD Global Tax Deal, we will announce a joint understanding among G7 countries that defends American interests.

“President Trump paved the way for this historic achievement. On January 20, the President issued two executive orders instructing [the US] Treasury to defend US tax sovereignty, and as a result of President Trump’s leadership we now have a great deal for the American people.”

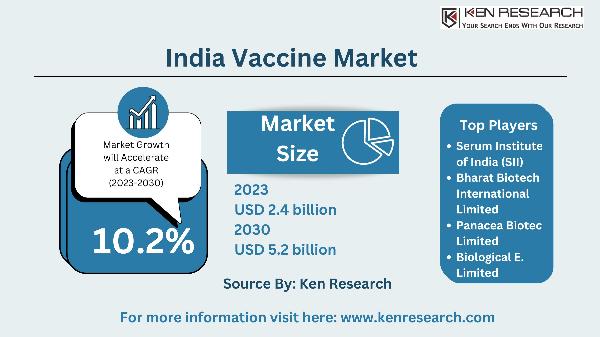

Mr Bessent said the G7 had agreed not to impose what is known as OECD Pillar 2 on US companies. That refers to a 15pc minimum corporate tax rate, which was agreed in principle by 140 countries to be imposed on companies with global revenues of more than €750m (£639m).

The idea was to stop multinationals shunting profits from one country to another to take advantage of lower tax rates. Economists complained that it would be only a matter of time before the minimum rate was hiked, locking countries into ever-higher taxes, globally enforced.

Joe Biden was an enthusiastic backer of a global minimum rate of corporation tax. Mr Bessent said: “By reversing the Biden administration’s unwise commitments, we are now protecting our nation’s authority to enact tax policies that serve the interests of American businesses and workers.”

Mr Trump had claimed that the tax deal “not only allows extraterritorial jurisdiction over American income but also limits our nation’s ability to enact tax policies that serve the interests of American businesses and workers”.

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 1 month with unlimited access to our award-winning website, exclusive app, money-saving offers and more.

Trump's resorting to blackmail threat against foreign businesses in order for the US tax breaks beggars credibility and seems a poor bargaining tactic. This deeper dive into protectionism is detrimental not only towards global trade relations but also undermines American values of fair play.

The resorting to threats of regulatory retaliation as a means for securing tax concessions is not only shortsighted but also unproductive in building cross-national commerce. True economic growth comes from collaborative efforts, where both nations can reap the benefits.

Trump's use of the threat for 'revenge'-style raids on foreign businesses as a bargaining chip to secure tax breaks benefits only underscores his protectionist and unilateral approach towards international trade policies—a move that could backfire in days, Liz Stein writes.

The use of potential retaliatory action against foreign businesses as a bargaining tool for securing tax breaks for the US brings into question Trump's diplomacy tactics, highlighting an unsettling emphasis on economic coercion rather than mutual benefit and global cooperation.

![Isothermal Bags Containers Market [2028]: Top Trends, Size, and Competitive Intelligence - TechSci Research](https://antiochtenn.com/zb_users/upload/2025/07/20250719012446175285948669203.jpg)