Institutions Are Driving Ethereum's 'Comeback'

For a year, Ethereum, the second largest blockchain, has lived in the shadows of its competitors, as cryptocurrencies like bitcoin and solana jumped in price and dominated the conversation. Amid criticism from investors and some community members, ETH languished at levels below $1500 as recently as April.

But on Monday ETH was near $3800, up 13% year-to-date, and analysts pointed to numerous signs of a turning point for the project.

Some have pointed out that the momentum of the ecosystem has returned partially thanks to the explosion of stablecoins and tokenization on Ethereum.

“For institutions looking to get exposure, Ethereum is the primary on-chain option, leading in real-world asset (RWA) tokenization with $7.8 billion in tokenized assets, or nearly 60% of the total RWA market cap,” said Jake Koch-Gallup, a research analyst at Messari, to CoinDesk.

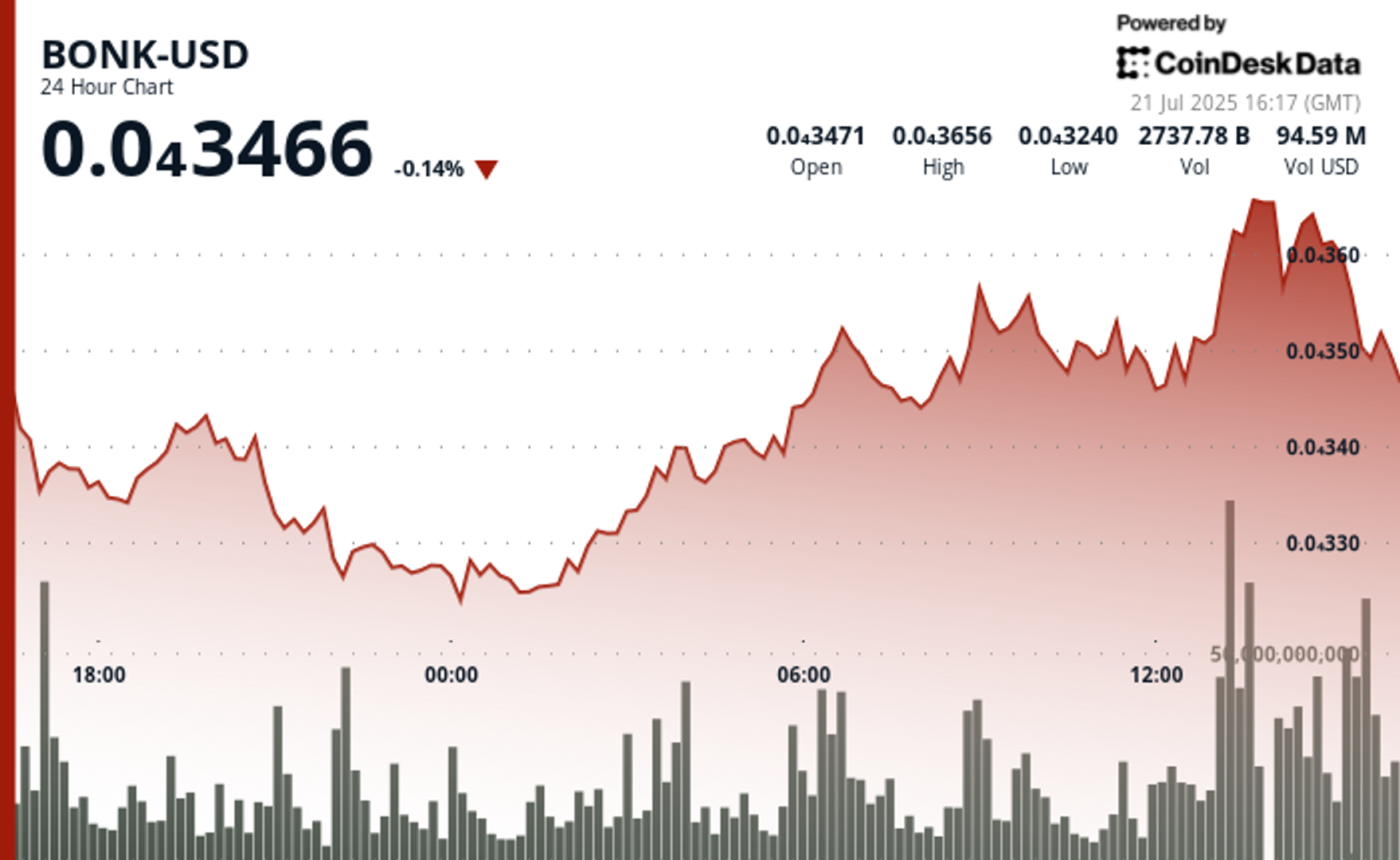

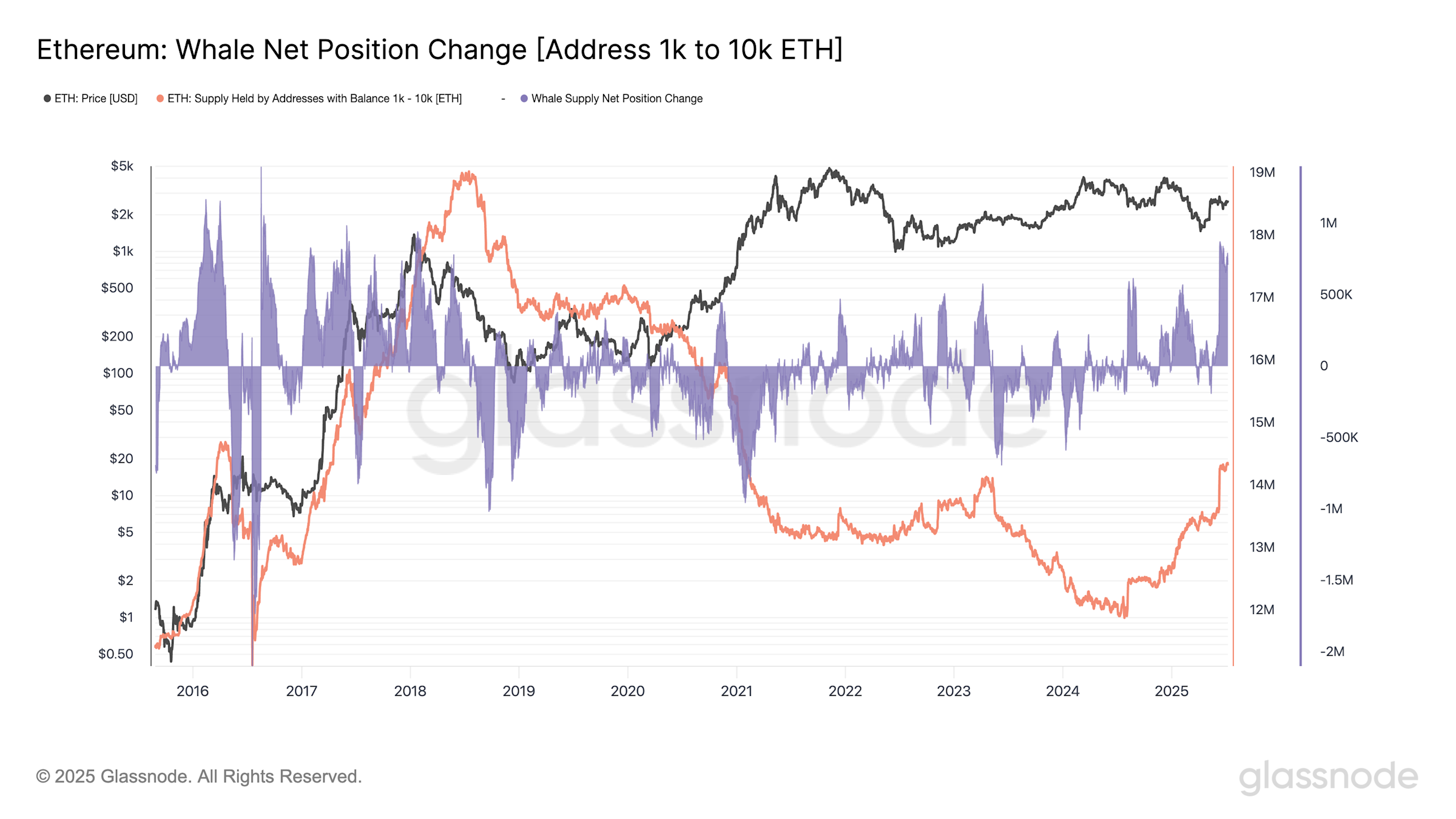

As of the beginning of July 2025, Whales with addresses that hold between 1,000-10,000 in ETH have increased their holdings of the token, according to data from Glassnode. Collectively they hold about 14 million ETH units, up from roughly 12 million at the end of 2024.

Vivek Raman, who founded Etherealize and spends his time speaking with institutions to market ETH as an asset class, believes that ETH should be seen like BTC as “a store of value," comparing it to “digital oil.”

The layer-2 ecosystem, which are auxiliary blockchains atop of Ethereum used to transact for faster and cheaper, have appeared en masse over the past few years, and institutions have started to also build with them. JP Morgan recently announced they launched a proof-of-concept for tokenizing their deposits on Coinbase’s Base chain, while Robinhood, the retail trading giant, shared its plans to build its own layer-2 with the Arbitrum stack. If it works, it could bring Ethereum’s technology to an even broader mainstream audience and deepen its position as the backbone for a new generation of financial applications.

Some believe layer-2 networks were taking away value from the Ethereum base layer and making user experience more disconnected, but Raman argues that institutions view them differently. According to Raman, the customizability of a layer-2 network is a plus for these institutions.

“You can be a landlord and get access to the liquidity of Ethereum,” said Raman in an interview. “So the validation of the L2 ecosystem is now pretty undeniable.”

Koch-Gallup, at Messari, believes that protocol changes that enhance the scaling of Ethereum as a base layer will position the network well for the future.

Story continues“A 100-1,000x throughput jump collapses gas fees, reopens the space for consumer-grade apps, and refutes the “L2s are eating the L1” narrative,” he said. “Concurrently, bigger blocks and more activity feed back into base-fee burn, tightening ETH’s supply during periods of high demand.”

Ethereum is also benefitting from the corporate treasury trend, with a growing number of companies adopting ETH as a strategic treasury asset. That is, not just for holding, but for staking to generate yield, signaling a shift from traditional treasury strategies, often limited to cash or bitcoin, to one that leverages Ethereum’s staking rewards, programmability, and integration into DeFi and stablecoin ecosystems.

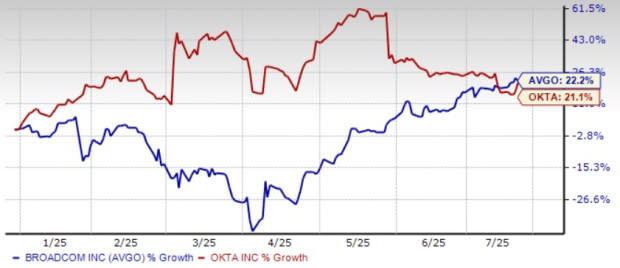

SharpLink Gaming, a NASDAQ-listed sports betting firm, BitMine, and BitDigital, both crypto mining firms, have all shifted their crypto treasury strategies to this.

“SharpLink Gaming (SBET) saw its stock price [rise 412%] after announcing its ETH treasury strategy, showing there’s a clear market appetite for publicly traded companies holding ETH on their balance sheets,” Koch-Gallup told CoinDesk. The company is chaired by Joseph Lubin, one of the founders of Ethereum.

BitMine, which recently saw Wall Street personality Tom Lee join, also shared that it holds over 300,000 ETH in its treasury.

“Collectively, these trends suggest a deeper institutional re-rating of Ethereum, not just as infrastructure, but as a yield-bearing, balance-sheet-worthy asset and a directional bet on the future of on-chain finance,” Koch-Gallup said.

Read more: The Node: Is Ether Back From the Dead?

Institutions' embrace marks a pivotal turn in Ethereum’s 'Comeback,' fueling the blockchain network with unparalleled growth and stability.