Annaly Capital Managements Diversified Portfolio: A Key to Long-Term Growth and Stability in the Mortgage Market

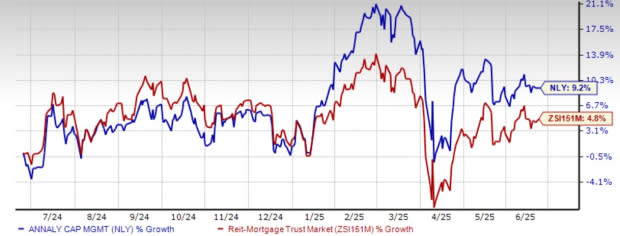

Annaly Capital Management (NLY) has a well-diversified capital allocation approach that encompasses residential credit, mortgage servicing rights (MSR), and agency mortgage-backed securities (MBS). This comprehensive strategy aims to lower volatility and sensitivity to interest rate changes while generating appealing risk-adjusted returns. As of March 31, 2025, NLY's investment portfolio aggregated $84.9 billion. The company's diversified investment strategy is likely to be a key contributor to long-term growth and stability. By diversifying its investments across the mortgage market, Annaly is better positioned to capitalize on opportunities in multiple areas while limiting risks associated with overexposure to any particular location. In 2022, NLY sold its Middle Market Lending portfolio and exited its commercial real estate business, enhancing capabilities across its core housing finance strategy and allocating capital to residential credit businesses, the MSR platform, and Agency MBS. Annaly is also focusing on improving its capabilities by acquiring newly originated MSRs from its partner network, which will continue to provide a strong advantage in expanding its MSR business. The inclusion of MSRs in the portfolio is notable because these assets tend to increase in value as interest rates rise, offsetting reductions in the value of agency MBS. This hedging impact may produce more consistent returns over time and enable Annaly to perform well in a scenario of interest rate change. In terms of competition, AGNC Investment Corp. (AGNC) has been taking a proactive and defensive approach to portfolio management, which can drive growth over the long term. By frequently adjusting asset allocations and hedging strategies, AGNC Investment is positioning itself to reduce risks while capturing yield opportunities. Meanwhile, Starwood Property Trust (STWD) operates in a different niche, focusing primarily on commercial real estate, including commercial mortgage-backed securities (CMBS) and real estate debt investments. From a valuation standpoint, Annaly trades at a forward price-to-tangible book (P/TB) ratio of 0.98X, above the industry's average of 0.96X. The Zacks Consensus Estimate for NLY's 2025 and 2026 earnings implies a year-over-year rise of 6.3% and 1.4%, respectively. The estimates for 2025 and 2026 have been revised upward over the past 60 days. Annaly currently carries a Zacks Rank #3 (Hold). In summary, Annaly Capital Management's diversified investment strategy and focus on improving capabilities through acquisitions of newly originated MSRs position it well for long-term growth and stability in the mortgage market. Its competitive positioning against AGNC and STWD in portfolio management is strong, and its price performance, valuations, and estimates indicate positive growth prospects for the company.

Annaly Capital Management's Diversified Portfolio stands as a pivotal strategy for achieving both long-term growth and stability in the ever more unstable mortgage market, demonstrating robust risk management amidst marketplace fluctuations.

The Annaly Capital Management's diversified portfolio strategically navigates the complex mortgage landscape, serving as a reliable beacon for achieving long-term growth amidst uncertainties in today’n ever evolving financial markets.

Annaly Capital Management's diversified portfolio offers a strategic insight into achieving long-term growth and stability within the ever complex mortgage sector, demonstrating its resilience through consistently navigating market volatility.

The use of Annaly Capital Management's diversified portfolio as a strategic tool in navigating the mortgage market, offers key insights for achieving long-term growth and stability amidst volatile financial climates.

ANNALY CAPITAL MANAGEMENT'S DIVERSIFIED PORTFOLIO OFFERS A CRITICAL SOLUTION FOR LONG-TERM GROWTH AND STABILITY WITHIN THE MORTGAGE INDUSTRY.

Annaly Capital Management's diversified mortgage portfolio represents a strategic cornerstone for achieving long-term growth and stability in the volatile housing market, highlighting its capacity to navigate through varying economic cycles.

Annaly Capital Management's diversified portfolio represents a potent strategy for both long-term growth and stability in the ever volatile mortgage market, outperforming numerous competitors through smart investments across varying interest rate tiers.

The Annaly Capital Management's Diversified Portfolio represents a brass key to unlock long-term growth and stability in the ever volatile mortgage market, illustrating an exemplary path for navigational security amidst unpredictable currents.

![Isothermal Bags Containers Market [2028]: Top Trends, Size, and Competitive Intelligence - TechSci Research](https://antiochtenn.com/zb_users/upload/2025/07/20250719012446175285948669203.jpg)