Should You Hold or Fold: Super Micro Computer (SMCI) Stock Amid Strong Performance and Challenges?

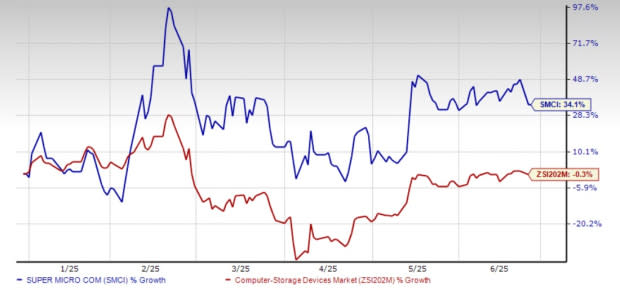

Super Micro Computer (SMCI) has been a volatile stock recently, but it has returned 34.1% in the year-to-date period. Despite this strong performance, investors are left wondering whether to hold onto SMCI stock or take caution.

Traction in Server Demand Boosting SMCI

Super Micro Computer is experiencing strong traction in its high-performance and energy-efficient servers as AI data centers and hyperscalers are strongly adopting them. The server and storage system segmental revenues surged 19% year over year in the third quarter of fiscal 2025, crossing the $4.5 billion mark, accounting for 97% of its top line.

High Yield Savings Offers

Powered by Money.com - Yahoo may earn commission from the links above.

- Earn 4.10% APY** on balances of $5,000 or more

- Earn up to 4.00% APY with Savings Pods

- Earn up to 3.80% APY¹ & up to $300 Cash Bonus with Direct Deposit

Super Micro Computer's server and storage revenues are being driven by its direct liquid cooling (DLC) solutions for data-center usage. The DLC production reached a manufacturing volume of more than 2000 DLC racks per month. Super Micro Computer is further enhancing its portfolio with Data Center Building Block Solutions, petascale storage systems for AI workloads, and kit-integration of NVIDIA Blackwell GPUs in its product line to achieve high compute power. These will keep it at the forefront of the server and storage space.

As a growing number of enterprises are adopting AI, SMCI's enterprise data center customer vertical recorded $1.9 billion in revenues. This vertical accounted for 42% of revenues in the third quarter of fiscal 2025 compared to 25% in the previous quarter. This reflects the growing representation of AI products in SMCI's product sales.

SMCI is also broadening the reach of its server and storage solutions through global manufacturing expansion across Malaysia, Taiwan, and Europe to ramp up the deployment of these solutions while mitigating geopolitical and tariff barriers of local governments. However, SMCI is also facing some challenges.

Key Challenges Faced by SMCI

Super Micro Computer is facing some near-term headwinds like delayed purchasing decisions from customers as they are evaluating the adoption of next-generation AI platforms. Strong competition from the global storage and server market by leading players like Pure Storage (PSTG), Dell Technologies (DELL), and Hewlett Packard Enterprise (HPE) is also a concern for investors. Pure Storage provides a range of modern storage solutions through its offerings like FlashArray, FlashBlade, and Pure Cloud Block Store to serve the purpose of providing All-Flash performance, cloud integration, AI, and simplified management.

Dell Technologies is also experiencing massive traction in its AI-optimized servers, which grew 16% year over year. In the first quarter of 2026, DELL announced that it received orders worth $12.1 billion for its AI servers, which has surmounted to become $14.4 billion in AI backlogs. Hewlett Packard Enterprise offers a range of server services, including HPE ProLiant, HPE Synergy, HPE BladeSystem, and HPE Moonshot servers. In the second quarter of fiscal 2025, Hewlett Packard Enterprise's server segment sales grew 6% year over year due to strong demand for its AI servers.

Due to these factors, SMCI is facing margin contraction due to the growing price competition from established competitors. Furthermore, price adjustments from its clients as they are second-guessing their shift from older to newer platforms like Blackwell are also weighing on SMCI's margins. In the last reported quarter, Super Micro Computer also incurred a one-time inventory write-down on older-generation GPUs and related components, further affecting its margins. The Zacks Consensus Estimate for SMCI's fiscal 2025 earnings implies a year-over-year decline of 6.33%. The estimates for fiscal 2025 have been revised downward in the past 30 days.

Conclusion: Sell SMCI Stock Now

SMCI is facing near-term challenges stemming from delayed purchasing decisions from customers and margin contraction from pricing pressure. Stiff competition from industry leaders like HPE, PSTG, and DELL in the rising AI-server space is also a concern for investors. Considering all these factors, we suggest that investors should stay away from this Zacks Rank #4 (Sell) stock at present. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report:

- Dell Technologies Inc. (DELL) : Free Stock Analysis Report

- Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

- Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

- Pure Storage, Inc

Despite Super Micro Computer's (SMCI) impressive performance amid evolving industry challenges, investors must carefully weigh their patience against potential future market dynamics before determining whether to hold or fold on this highly capable technology stock.

Navigating the decision to hold or fold on Super Micro Computer's (SMCI) stock boils down热度到 weighing its recent robust performance against potential industry-wide headwind that require a strategic eye and direct assessment of future trends.

Navigating the decision between holding or folding SMCI's stock amid its impressive performance and pending challenges requires a nuanced assessment of both immediate returns potential along with long-term industry outlook - ultimately weighing risk tolerance against growth prospects.

In the midst of Super Micro Computer (SMCI)'s impressive performance amidst industry challenges, investors must weigh its resilience against potential future uncertainties to decide whether holding on or cutting their losses remains a prudent strategy.