Reconsidering Apple Stock Amid Trade War Challenges and Market Corrections: A Valuation Analysis and Strategic Outlook

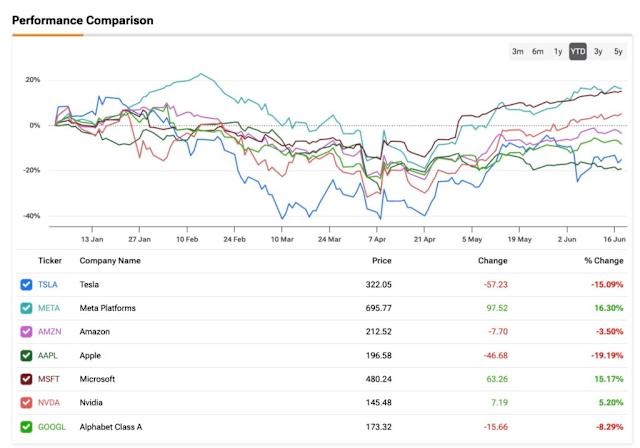

The year 2025 has not been kind to Apple (AAPL) shareholders. The stock is trading below the $200 mark, about 25% off its all-time highs, making it the worst performer among the top seven tech stocks. This is a sharp contrast to the 22% total annualized returns Apple has delivered to shareholders over the past decade.

Despite the recent bearishness, I don't believe the stock is doomed for an extended correction. Historically, Apple has proven to be a great stock to own during periods of relative weakness, especially when valuations reset to more reasonable levels. However, buying just because momentum looks weak isn't always the best strategy for high-quality stocks like AAPL. For now, until the trends start to improve, I remain Neutral on AAPL stock.

Understanding Apple's Position Amid Trade War Challenges

Among the Magnificent 7 stocks, Apple's recent performance reflects that markets view the company's thesis as one of the most fragile, mainly due to growing concerns around the ongoing trade war. The possibility of new tariffs on imported products resurfaced after the U.S. president threatened to impose a 25% tariff on iPhones manufactured outside the U.S. This would be a blow to Apple's bullish case, and growth estimates are likely to be revised downward for the coming quarters—and possibly even years.

However, if we step back and look at the bigger picture, these fears might actually be somewhat exaggerated. History shows that tariff threats are often more a political negotiation tool than something that is actually enforced. Additionally, under the highly efficient leadership of CEO Tim Cook, Apple has consistently demonstrated its ability to navigate supply chain challenges. We saw this play out back in 2018-2019, during Trump's first administration, when the U.S.-China trade war intensified. Apple responded quickly by expanding its production outside of China, significantly reducing its reliance on the country.

The Valuation Story Behind Apple's Recent Moves

Naturally, when tariffs threaten to impact Apple's core business, combined with a broader "crash correction" where markets rush for cash and liquidity, and the stock is trading at elevated valuation multiples, the outcome tends to be a bearish reaction. Currently, Apple trades at 27.3x forward earnings, which is significantly below the 36x peak reached in January and also below its 12-month average of 31x. While long-term EPS growth expectations aren't particularly exciting at around 10% CAGR, a PEG ratio of 2.5 honestly doesn't seem outrageous for a company with fundamentals as strong as Apple's.

But the key point in this case may be that Apple shouldn't be trading at cheap multiples and probably never will, simply because it's a company with a historically low risk of underperformance. While tariffs might seem like a threat, as I've highlighted before, Apple has faced similar headwinds not long ago and managed to navigate them successfully. After all, we're talking about a business with one of the strongest brands and the highest customer loyalty in the world. And when the numbers are crunched, Apple's services segment alone is arguably worth $1.7 trillion—that's more than half of the company's current market cap.

Why 'Buy Low, Sell High' Isn't Always Right

Although it may seem counterintuitive, I tend to believe that when it comes to high-quality stocks, the old saying "buy low, sell high" is somewhat of a misnomer, mainly because no one actually knows where "low" and "high" truly are. If you think about it, "sell high" would've meant selling AAPL (or any other high-quality tech name like MSFT, AMZN, and NVDA) multiple times over the past decade