Why Did Alphabet Stock Pop Today, Then Drop?

Key Points

-

Canada has rescinded a threatened Digital Services Tax, which would have hurt Alphabet's profits.

-

That's good news for Alphabet stock.

-

The bad news: Alphabet stock is pretty expensive.

-

10 stocks we like better than Alphabet ›

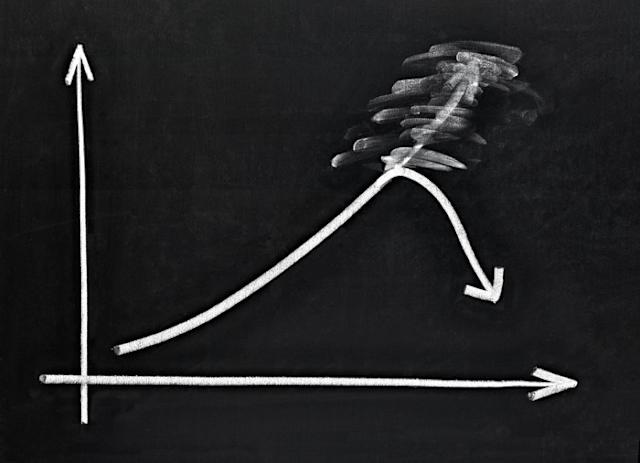

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) stock is acting a bit erratic Monday morning, first rising nearly 2% in early trading, and then giving up all its gains and falling into the red. As of 11:05 a.m. ET, the Google parent company is down 0.3%.

And why?

Good news from Canada

The "up" part of this story is easier to explain than the "down." On Sunday, Canada announced it will rescind a proposed Digital Services Tax (DST) that threatened to impose high costs on tech companies like Google. The DST was designed to extract revenue from companies providing social media, advertising, and data services (so basically, Google).

But President Trump specifically called out the DST as an obstacle to reaching a new trade agreement with Canada. So yesterday, Canada rescinded the DST, hoping this will help move along the trade talks.

That's good news for Google parent Alphabet, and explains why the stock popped early today.

Is Alphabet stock a sell?

It's less clear why investors have so quickly abandoned their optimism about the DST repeal, however, and have turned to selling Alphabet stock.

Valuation might be a concern. Although Alphabet reported earnings as calculated according to generally accepted accounting principles (GAAP) of more than $110 billion over the last 12 months, the company's still spending heavily on its artificial intelligence (AI) efforts. Those may work out, they may not. One thing that's certain though is that the work is costing Alphabet massive amounts of capital expenditure that reduce its free cash flow to less than $75 billion.

That means for every $1 Alphabet reports as GAAP "profit," it's actually making just $0.67 in real free cash flow. At a price-to-free cash flow valuation of nearly 29, Alphabet stock looks more like a "sell" than a "buy" to me.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $713,547!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $966,931!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 177% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

Story Continues*Stock Advisor returns as of June 30, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Rich Smith has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.

Why Did Alphabet Stock Pop Today, Then Drop? was originally published by The Motley Fool

The fluctuating fortunes of Alphabet's stock, rising and then plunging today on the market despite positive news initially ignited an intraday whipsaw effect in traders', signaling mixed sentiment surrounding future earnings potential for its diverse businesses.

The sudden rise and subsequent decline of Alphabet stock today echoes the typical intraday volatility often seen in technology-related equities, fueled by various factors including market sentiment shifts or quarterly earnings expectations.

Alphabet stock's sudden surge followed by a subsequent decline today can be partly attributed to investors reacting positively towards the latest technological announcements, only for sentiment later reversals following potential concerns on future regulatory challenges.

The sudden pop and subsequent drop in Alphabet's stock price today can partially be attributed to a mix of favorable earnings reports, speculation over future projects announced during its Q&A session balanced by cautious commentary on current market conditions.

Alphabet's stock market swings - a morning surge followed by an afternoon drought, likely illustrating the complex interplay between investor sentiment and varying reports affecting its quarterly earnings or prospects in general.

The volatile movements of Alphabet stock today—initial pops followed by later drops – are likely influenced both by positive corporate news announcements that boosted sentiments initially and subsequent second-thoughts due to broader market shifts or technical factors in color.

Alphabet's stock price rollercoaster today can largely be attributed to mixed earnings reports, market speculation over unforeseen factors in the tech sector MBA(finance) coupled with short-term fluctuations of buy and sell orders.

The sudden spike and subsequent decline in Alphabet's stock today can be attributed to a mix of good earnings report optimism, followed by investors reassessing near-term company prospects amidst broader market volatility.

The volatility in Alphabet's stock price today, initially spiking then坠落”; suggests an intricate combination of positive and negative market dynamics beyond the current trading session’s headlines.

The sudden fluctuation of Alphabet stock today—rising then subsequently dropping, demonstrates the volatile nature and unpredictability inherent in short-term market dynamics.

The volatility of Alphabet stock today, initially spiking and then contracting is an illustration that market sentiments swing rapidly depending on macroeconomic factors like the ongoing pandemic situation or short-term corporate news releases."

The volatile movements in Alphabet stock today reflect the changing sentiments of investors likely responding to both positive earnings reports and tangible concerns about future prospects, painting an intricate picture for market participation.

The sudden rise and subsequent decline of Alphabet stock today hint at the volatility within a highly competitive tech market where sentiment shapes short-term movements, despite strong fundamentals.

Alphabet Inc.'s stock experiences a rollercoaster today, initially popping on strong earnings and recent innovations but subsequently dropping amid speculation about future growth prospects—highlighting the volatility of short-term market reactions to corporate news.

The volatility seen in Alphabet's stock today can be attributed to a combination of positive earnings-related news initially boosting the shares, followed by wider market uncertainties and investor reevaluation that led later on. This expectedly created swift price action after an initial pop.