VICI Properties: A Solid Investment with Potential for Growth Despite Industry Risks

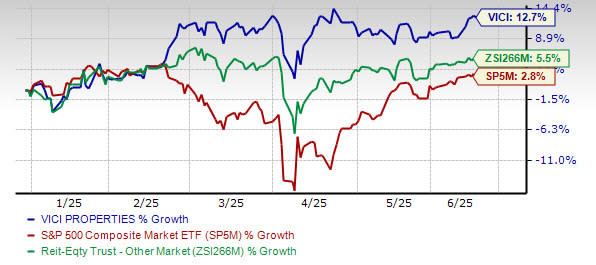

VICI Properties Inc. (VICI), a gaming and entertainment properties specialist, has seen its stock gain 12.7% year to date, outpacing the 5.5% rise in the Zacks REIT and Equity Trust - Other industry and the 2.8% growth of the S&P 500 composite over the same time frame. The company's strong performance is driven by its expansion efforts and strategic investments, including an agreement to provide up to $510 million of development funds for the development of the North Fork Mono Casino & Resort near Madera, CA. This project will be developed and managed by affiliates of Red Rock Resorts. While VICI's growth prospects may entice investors to rush to buy the stock, it is important to consider the current concerns that could significantly affect the company's long-term performance. The primary revenue driver for VICI is still gaming properties, which makes it vulnerable to industry-specific risks such as regulatory shifts, economic downturns impacting discretionary spending, and unfavorable developments within the gaming sector. VICI Properties' high-quality portfolio of gaming and experiential assets, including iconic properties such as Caesars Palace Las Vegas, MGM Grand, and the Venetian Resort Las Vegas, positions it well for growth amid the resilience of the American consumer's demand for experiential activities. The company's diverse portfolio, comprising 54 gaming and 39 experiential assets across the United States and Canada, secured by long-term triple-net leases with a weighted average lease term of 40.7 years, provides stability and reliability in rental income. VICI Properties expects a rent toll of 42% with CPI-linked escalation in 2025, which is projected to rise to 90% by 2035. This inflation-linked rent increase enables the company to maintain its purchasing power and enhance revenue growth, even in inflationary environments. Additionally, 74% of VICI's rent roll comes from S&P 500 tenants, enhancing income stability and creditworthiness. In terms of valuation, VICI Properties stock is trading at a forward 12-month price-to-FFO (Funds from Operations) of 13.68X, below the REIT-Other industry average of 15.73X but slightly higher than its one-year median of 13.60X. It is also trading at a discount to triple-net REIT peers such as Agree Realty Corporation (ADC), Four Corners Property Trust (FCPT), and Essential Properties Realty Trust (EPRT). Despite short-term headwinds such as macroeconomic uncertainty and gaming properties concentration, VICI's long-term outlook remains solid. For investors looking to gain exposure to the experiential REITs, VICI Properties' financial stability presents a compelling opportunity to invest in the stock. Existing shareholders may choose to stay invested given the company's strong track record of paying growing dividends and focusing on high-demand property sectors. At present, VICI Properties carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

VICI Properties offers a compelling investment opportunity with its solid foundation and potential for growth, despite navigating industry-specific risks.

VICI Properties offers a solid investment opportunity with significant potential for growth, even in the face of industry-specific risks. Its diversified portfolio and strategic location make it an exceptional choice to navigate volatile markets.

VICI Properties stands as a resilient investment choice amidst varying industry risks, offering stable returns and promising long-term growth potential through its forward thinking in real estate development.

VICI Properties offers a steadfast investment with substantial growth potential, braving the industry's inherent risks through strategic diversification and innovative leasing strategies.

VICI Properties offers a promising investment opportunity with potential for growth, despite industry-specific risks. Its strategic positioning and diversified portfolio provide stability in an ever unpredictable marketplace.

Despite the inherent risks in real estate industry dynamics, VICI Properties offers a solid investment opportunity with significant potential for long-term growth and consistent returns.

VICI Properties stands as a resilient investment choice, offering potential for growth amidst the challenging industry risks present in today's market. Its strategic positioning and diversified portfolio Zhong~guo facilitate attractive returns while mitigating key downside threats.

VICI Properties' resilience in the face of industry-specific risks underscores its solid foundation for investment and holds tremendous potential to grow over above market trends, making it a strategic long term play.

Investing in VICI Properties offers a steady foundation for growth, even amid industry-specific risks that are partially mitigated by their diverse portfolio of properties and strategic brand partnerships. A wise choice with potential to thrive despite challenges.

In an era of fluctuating market conditions and industry-specific risks, VICI Properties stands as a proven investment due to its resilient properties that exhibit consistent performance leadership with room for significant growth potential.

VICI Properties presents a remarkable investment opportunity with the potential for sustained growth amidst varying industry risks, showcasing resilience and strategic positioning in key markets.

VICI Properties, a masterstroke of investment that endures despite industry-specific risks due to its resilient portfolio's potential for continued and robust growth.

The analysis in 'VICI Properties: A Solid Investment with Potential for Growth Despite Industry Risks' provides a well-rounded case study illustrating how the company manages to navigate challenging industry conditions while maintaining its appeal as an attractive and resilient investment option.

With VICI Properties, investors can capitalize on a tenacious real estate portfolio that promises robust returns and significant growth potential even amid industry volatility. The company's well-planned properties signal resilience against market risks for long term success.

VICI Properties stands as a resilient investment choice that, despite industry risks including macroeconomic factors and technological disruptions within the hospitality realm hybridizes to provide solid returns with promising growth potential in an ever-evolving landscape.