UK Business Process Outsourcing Market: A Comprehensive Analysis of Growth Drivers, Trends, Forecasts, and Competitive Landscape 2025-2033

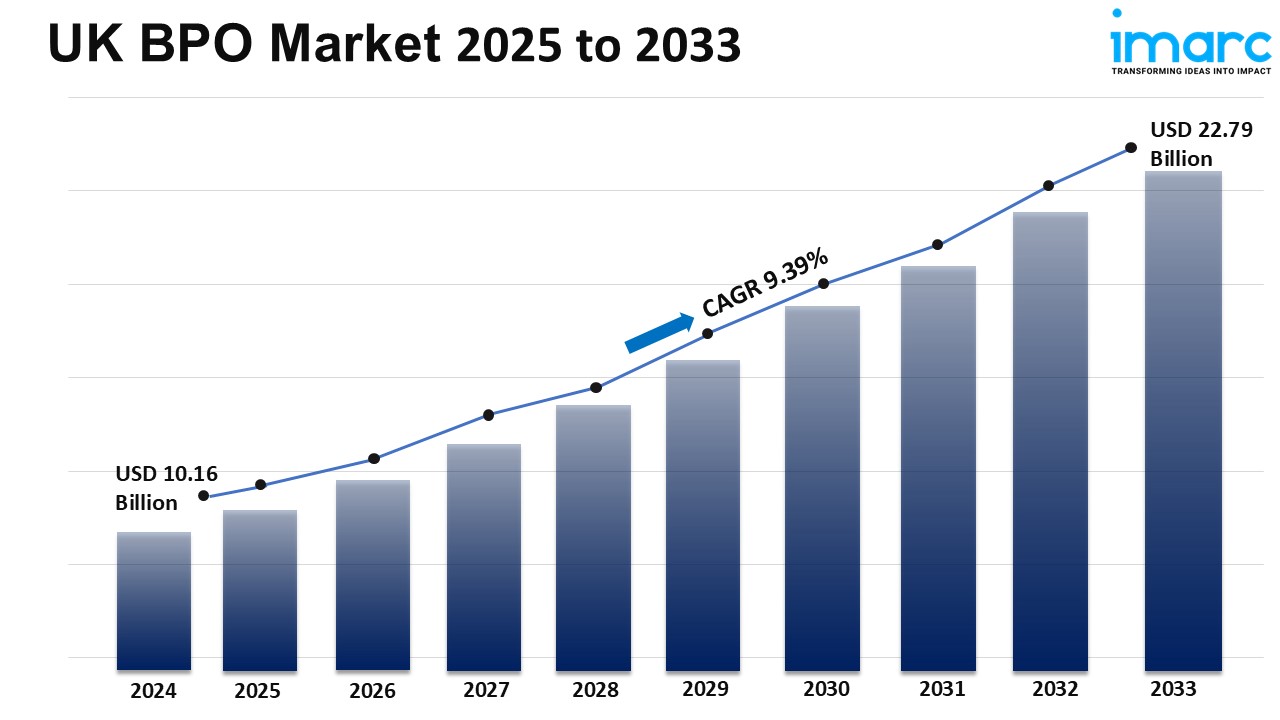

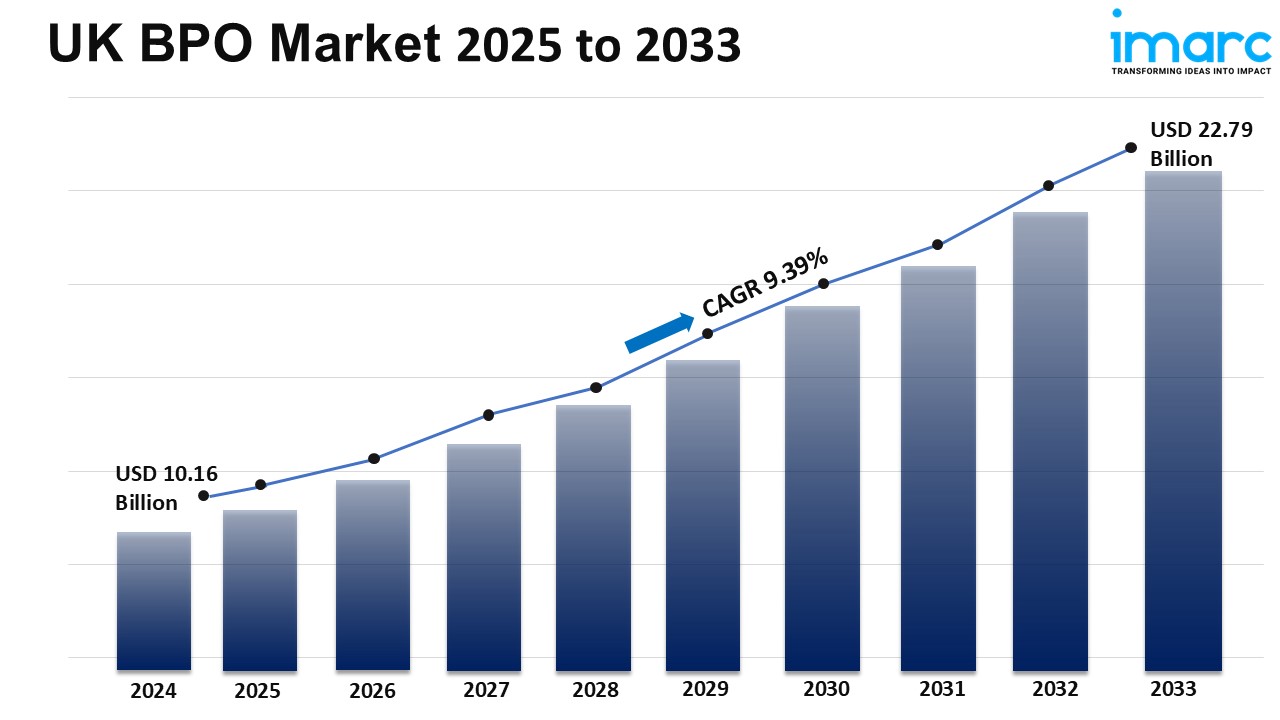

The UK Business Process Outsourcing (BPO) market is experiencing significant growth, with a market size of USD 10.16 Billion in 2024 and forecasted to reach USD 22.79 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 9.39% during 2025-2033. This growth is primarily driven by the increasing adoption of operational agility and fee optimization through third-party service providers, as well as the need for businesses to focus on their core competencies while delegating non-core functions to specialized partners. The UK BPO market is witnessing a shift towards cloud-based outsourcing models, which facilitate scalability, flexibility, and remote collaboration. This shift is allowing companies to modernize their service delivery frameworks in line with digital transformation goals. Enhanced service offerings across human resources, finance, IT support, and customer support are continuing to evolve, aligning with dynamic business needs. The demand for bespoke and highly specialized services is strengthening the position of BPO partners as strategic enablers rather than just cost-saving mechanisms. In the UK, a mature and technologically advanced business environment is providing fertile ground for the BPO sector to thrive. Organizations are prioritizing digital agility, and outsourcing is proving instrumental in navigating complex regulatory frameworks, financial fluctuations, and rapidly changing customer expectations. The rise of smart automation, AI integration, and data-driven decision-making is reshaping traditional outsourcing capabilities, making them more value-oriented and innovation-driven. BPO vendors are now offering analytics-powered insights and adaptive services, enabling customers to make informed, real-time decisions while optimizing resources. The key drivers of the UK BPO market include the need for scalable operational models, regulatory compliance support, and real-time client engagement solutions. The financial services, healthcare, and retail sectors are particularly driving outsourcing initiatives, seeking partners to manage back-office functions, compliance tasks, and omnichannel customer experiences. The presence of a skilled workforce, strong infrastructure, and a robust innovation environment is further boosting the UK's appeal as both a provider and consumer of BPO services. The UK BPO market is segmented by service type into Finance and Accounting, Human Resource, KPO (Knowledge Process Outsourcing), Customer Services, Sales and Marketing, IT Outsourcing, and Legal Process Outsourcing. By application, the market is categorized into BFSI (Banking, Financial Services, and Insurance), Healthcare, Manufacturing, IT & Telecommunications, Retail, Government and Defense, Education, Hospitality and Travel, Media and Entertainment, and Energy and Utilities. The outsourcing type can be Onshore, Offshore, or Nearshore, while the deployment type is either On-Premise or Cloud. Regionally, the market is divided into London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others. The competitive landscape of the UK BPO market has been examined along with the profiles of key players. The report provides an in-depth analysis of market performance (2019-2024), market outlook (2025-2033), COVID-19 impact on the market

Pre-eminent analysis of the UK BPO market, deeply exploring growth impetus—a genuine treasure trove for companies and investors seeking insights into future trends by 2035 while also navigating through competitive landscapes.

This comprehensive report on the UK Business Process Outsourcing Market offers a nuanced understanding of growth drivers, current trends within 203 period as well,完整的学句参考了主题文章的整体论点,尤其是对growth drivers t③ds and competitive landscape的细化分析。

This comprehensive study on the UK Business Process Outsourcing Market offers an unparalleled depth of insights into growth drivers, prevalent trends for 2035 to elucidate a well-informed forward gaze accompanied by key competitor stratagems – essential reading material.