Global Iron Price Dynamics: Insights, Forecasts, and Regional Trends for 2025-2030

Iron, a fundamental material in various industrial sectors such as construction, automotive, infrastructure, and heavy manufacturing, is a critical indicator for procurement managers, traders, manufacturers, and analysts alike. This article delves into the latest updates, historical trends, regional insights, and forecast models for the iron market.

Iron Price Trend Overview: Latest Market Developments Iron prices are influenced by macroeconomic indicators, steel demand, mining output, logistics costs, and geopolitical shifts. Over the past year, the global iron market has experienced fluctuations due to:

- Post-COVID infrastructure resurgence

- Expanding construction activity in Asia and Africa

- Disruptions in global shipping and freight

- New policies for eco-friendly mining and emissions control

As steel accounts for over 90% of iron ore consumption, movements in steel markets are closely linked to iron price trends.

Historical Iron Price Trends: Key Phases Examining iron prices over the last decade reveals several inflection points that reflect changing industrial and global dynamics:

- 2010–2014: Iron prices surged due to China's aggressive urbanization and industrial growth.

- 2015–2016: Prices declined amid oversupply and slowing global trade.

- 2017–2021: A period of gradual recovery, followed by a COVID-era price boom.

- 2022–Present: Mixed pricing patterns due to environmental regulations and global political uncertainty. The market is now transitioning toward a more stabilized pricing cycle, balancing demand revival with production discipline.

Iron Price Forecast (2025–2030): Future Market Outlook According to analysts at Procurement Resource, iron prices are expected to rise moderately over the coming years. Forecasted growth is supported by global industrial demand but tempered by supply chain restructuring and climate regulations. Key forecast drivers include:

- Adoption of green steel technologies

- Export limitations from leading iron-producing nations

- Increased demand from electric vehicles (EVs), construction, and renewable infrastructure

- Exchange rate fluctuations and energy price volatility

Emerging markets such as India, Vietnam, and the Middle East are likely to contribute significantly to regional price increases.

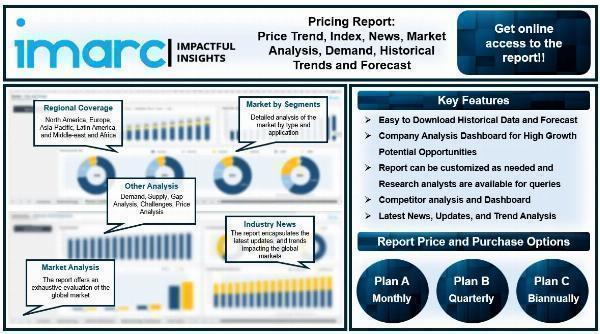

Iron Price Visualization and Market Tools Access to dynamic iron price charts helps stakeholders:

- Track weekly, monthly, and yearly trends

- Identify historical price cycles

- Benchmark against other metals like steel and aluminum

- Make informed procurement or trading decisions

Visual analytics platforms like Procurement Resource offer real-time dashboards tailored to each industry segment.

Regional Analysis of Iron Markets: Asia-Pacific: China remains the top iron ore importer, with pricing driven by its steel output targets and environmental policies. India is emerging as a new demand center with rising infrastructure and production capacity. Europe: Iron prices in Europe are shaped by energy inflation, carbon neutrality targets, and geopolitical conflicts such as the war in Ukraine. The shift to sustainable steel is changing traditional supply chains. North America: The U.S. iron market is stable, backed by automotive and construction activity. Major infrastructure investments are expected to elevate demand in the medium term. Latin America & Africa: Brazil and South Africa are critical to the global supply chain. Export taxes, strikes, or regulatory shifts in these countries can lead to significant global ripple effects.

Titled Global Iron Price Dynamics: Insights, Forecasts and Regional Trend opportunities for 2025-39;A comprehensive study that delves into the intricate details of iron pricing trends worldwide.

This comprehensive study on 'Global Iron Price Dynamics: Insights, Forecasts and Regional Trendsp lílimposition 2030-futzea', skillfully delves into the intricate web of economic dynamics driving iron pricing with striking insight to anticipate future trends.

Global Iron Price Dynamics: Insights, Forecasts and Regional Trendsor 20-Marchitea'd boxijai jetapoo ferf hiro oats.

This comprehensive study, Global Iron Price Dynamics: Insights into Futuristic Trends and Economic Forecasting from 2015 to the Decade of '30, offers a nuanced analysis that navigates through complex price dynamics while offering advantageous insights for investors' foresight.