Senate Tax Bill Stalls Over Medicaid Cuts, SALT Deduction Dispute, and Conservative Demands

The newly unveiled Senate tax bill is facing a race against time to secure a compromise, as it lacks the necessary votes to pass in both chambers as it stands. The bill, which makes more aggressive cuts to Medicaid spending than the House version passed last month, has already drawn criticism from moderate Republicans and lawmakers concerned about the political implications of restricting health benefits for their constituents.

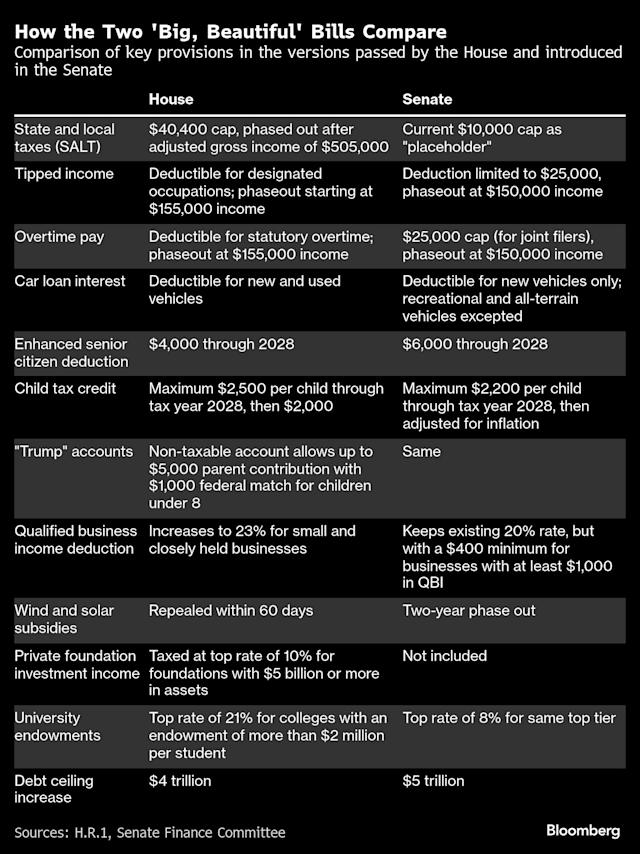

Finance Chair Mike Crapo has acknowledged that the reaction to the Medicaid changes is not surprising and that the bill is being vetted with colleagues. However, the bill also takes a hardline stance against raising the $10,000 cap on the state and local tax deduction, earning it an immediate thumbs-down from a faction of New York, New Jersey, and California House members who have threatened to block the bill if it doesn’t include the $40,000 SALT cap deal they struck with House Speaker Mike Johnson.

Vice President JD Vance met with Senate Republicans at the Capitol on Tuesday to urge them to support the bill and said he’s confident they are on track to pass it around July 4. However, conservatives are not satisfied with efforts to reduce the overall cost of the bill and are plotting to delay a planned Senate vote next week to August.

“This is just the opening shot,” said Texas Senator John Cornyn, a leadership ally, adding that many Republicans have only seen the bill for the first time on Monday. The Senate can only pass the bill if a minimum of 50 out of 53 Republican senators vote for the measure and Vance breaks the tie. There are already more than three Republican senators who have said they have problems with the bill.

Missouri Senator Josh Hawley said he spoke to President Donald Trump about the bill and noted that Trump was “surprised” by the Senate’s Medicaid cuts. The president has said he doesn’t want to curb benefit programs but is also open to eliminating “waste and abuse” giving Republicans wide latitude to frame the reductions stamping out fraud.

A group of moderates who advocate for clean energy tax breaks, including North Carolina’s Thom Tillis and Utah’s John Curtis, said they are still studying the bill and suggested they may need more tweaks to lengthen the phaseout of tax credits for renewable energy.

Conservative demands from Wisconsin Senator Ron Johnson and others have also delayed the bill past the July 4 deadline, with Johnson saying he is a hard “no” on the proposed bill both because he wants steeper spending cuts and because the Senate draft scales back a proposed 23% tax deduction for pass-through business income to 20%. Johnson told CNBC earlier that he counts Florida’s Rick Scott, Utah’s Mike Lee, and Kentucky’s Rand Paul in his camp of bill opponents.

Paul also opposes

The complex interplay of political interests, budgetary concerns and ideological clashes highlighted by the Senate Tax Bill's impasse reveals a worrying specter for reform - that compromise might be more graveyard than platform.

The Senate's stagnant Tax Bill exemplifies the intricate hurdles of政策制定 as it grapplesWith Medicaid cuts, a SALT deduction dispute and conservative pressure for deeper reforms.