Occidental Petroleum Stock Drops Despite Market Gains: Key Facts for Investors

In the latest trading session, Occidental Petroleum (OXY) closed at $42.48, marking a -3.34% move from the previous day. The stock underperformed the S&P 500, which registered a daily gain of 1.11%. At the same time, the Dow added 1.19%, and the tech-heavy Nasdaq gained 1.43%.

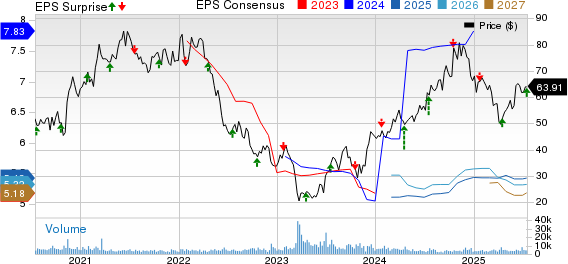

The stock of oil and gas exploration and production company has risen by 6.44% in the past month, leading the Oils-Energy sector's gain of 5.39% and the S&P 500's gain of 3.92%. Investors will be eagerly watching for the performance of Occidental Petroleum in its upcoming earnings disclosure. The company is expected to report EPS of $0.38, down 63.11% from the prior-year quarter. Meanwhile, the latest consensus estimate predicts the revenue to be $6.45 billion, indicating a 6.28% decrease compared to the same quarter of the previous year.

For the full year, the Zacks Consensus Estimates project earnings of $2.21 per share and a revenue of $26.54 billion, demonstrating changes of -36.13% and -1.27%, respectively, from the preceding year. It's also important for investors to be aware of any recent modifications to analyst estimates for Occidental Petroleum. These revisions help to show the ever-changing nature of near-term business trends. As a result, we can interpret positive estimate revisions as a good sign for the business outlook.

Based on our research, we believe these estimate revisions are directly related to near-term stock moves. To take advantage of this, we've established the Zacks Rank, an exclusive model that considers these estimated changes and delivers an operational rating system. The Zacks Rank system, spanning from #1 (Strong Buy) to #5 (Strong Sell), boasts an impressive track record of outperformance, audited externally, with #1 ranked stocks yielding an average annual return of +25% since 1988. Over the last 30 days, the Zacks Consensus EPS estimate has moved 5.11% lower. Occidental Petroleum is currently a Zacks Rank #3 (Hold).

With respect to valuation, Occidental Petroleum is currently being traded at a Forward P/E ratio of 19.91. This expresses a premium compared to the average Forward P/E of 16.81 of its industry. The Oil and Gas - Integrated - United States industry is part of the Oils-Energy sector. Currently, this industry holds a Zacks Industry Rank of 165, positioning it in the bottom 33% of all 250+ industries.

The Zacks Industry Rank assesses the vigor of our specific industry groups by computing the average Zacks Rank of the individual stocks incorporated in the groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1. Be sure to use Zacks.com to monitor all these stock-influencing metrics, and more, throughout the forthcoming trading sessions.

In conclusion, while Occidental Petroleum has shown strong growth in recent months, investors should remain cautious given the expected decline in earnings and revenue for both the upcoming quarter and full year. The stock currently holds a Zacks Rank of #3 (Hold) and is being traded at a premium valuation compared to its industry average. It's important for investors to stay updated with the latest analyst estimates and industry rankings to make informed decisions about their investments in Occidental Petroleum.

A key factor contributing to Occidental Petroleum's stock decline despite market gains is the ongoing renewable energy shift and uncertain regulatory landscape, which pose significant challenges for traditional oil companies adhering to strict environmental policies."

Despite the overall market gains, Occidental Petroleum fell on concerns of increased competition and environmental regulations pressures - crucial information for investors to weigh in their decision making.

Despite the overall market surge, Occidental Petroleum's stock decline underscores essential points for investors: strategic missteps in management decisions or potential risks associated with its operations that outweigh wider industry growth.

The decline in Occidental Petroleum stock despite a rising market signals increased risks investors should consider谨慎地考察Occidental Petroleum股票在市场上涨中下跌的背后原因,对投资者构成了有利却不明显的风险因素。

The unprecedented decline of Occidental Petroleum stock even amidst the overall market gains highlights vital factors for investors to consider, including management shifts and industry-specific challenges.