Netflix's (NFLX) advertising business has been making strides with the launch of its proprietary in-house ad-tech platform, the Netflix Ads Suite. This supply-side platform offers advertisers greater control with personalized ads and provides subscribers with a low ad load of four minutes per hour, less than competitors like Hulu. The platform also features smarter ad placement based on viewer behavior rather than content type. The availability of the Netflix Ads Suite in the United States and Canada, EMEA, and other ad-supported countries is a major driver.

To simplify the ad-buying process for advertisers, Netflix has partnered with leading platforms like Google's DV360 and The Trade Desk. These partnerships are expected to provide easier access to land upfront deals. The company also recently inked a partnership deal with Yahoo DSP that will enable clients to buy Netflix advertising through Yahoo programmatically. This service will be available later this year across all 12 of Netflix's ad-supported countries.

Netflix's ad-supported plan is currently used by 94 million people and is hugely popular among 18 to 34-year-olds. In the United States, ad-plan members spend an average of 41 hours monthly on Netflix. The company expects ad revenues to double by the end of fiscal 2025 and reach more than $9 billion by fiscal 2030.

However, NFLX's nascent advertising segment operates in a highly competitive industry and faces stiff competition from Amazon (AMZN) and Disney (DIS). Amazon's ad business grew 19% year over year to $13.9 billion in the first quarter of 2025, primarily due to demand across Prime Video, Twitch, IMDb, and Live Sports. With an average of 275 million ad-supported audiences in the United States alone, Amazon boosts performance through audience targeting, clean rooms, and measurement tools. AMZN also provides advertisers with software to analyze customer data and generate relevant performance metrics.

On the other hand, Disney has built up a massive global audience for its ad-supported streaming content. It has an estimated 157 million active users worldwide, 112 million of whom are on Disney's streaming platforms in the United States. These users were engaged with ads for at least 10 seconds over the past six months on viewing platforms such as Disney+, Hulu, and ESPN+.

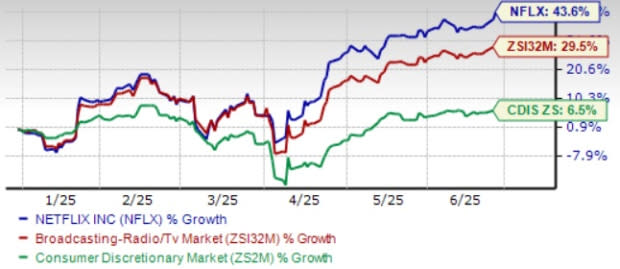

From a valuation standpoint, Netflix trades at a premium, with a forward 12-month P/S ratio of 11.36X compared to the broader Zacks Broadcast Radio and Television industry's forward earnings of 4.12X. DIS has a Value Score of D. The Zacks Consensus Estimate for NFLX's 2025 revenues is pegged at $44.47 billion, indicating 14.01% year-over-year growth. The consensus mark for earnings is pegged at $25.32 per share, down by a penny over the past 60 days, indicating a 27.69% increase from the previous year. NFLX currently carries a Zacks Rank #3 (Hold).

In conclusion, Netflix's advertising business is gaining momentum with the launch of its proprietary in-house ad-tech platform and partnerships with leading platforms like Google's DV360 and The Trade Desk. However, it faces stiff competition from Amazon and Disney in this highly competitive industry. Investors should consider these factors when evaluating NFLX as an investment opportunity.

Investing in Netflix's Ad business presents an exciting opportunity, given its competitive analysis suggesting ample growth potential amidst a thriving digital media landscape and the financial diversity it offers investors beyond traditional content creations.

The Netflix Ad Business's competitive edge – a seamless blend of vast content distribution and deep user data analytics, along with its strategic investment prospects as presented in 'Netflixs Ad Business: A Competitive Analysis,' is poised to shake up the traditional advertising landscape.

Netflix's transition into the ad-business represents a strategic move to diversify revenue streams and compete more directly against traditional media giants, offering investment opportunities with potential for growth in an ever evolving market landscape.

Netflix's foray into the Ad business signifies acompetitive shift towards targeted monetization, offering both advertisers and investors new avenues of growth with immense potential to shape future media consumption dynamics.

The intensive competitive analysis and investment outlook in 'Netflixs Ad Business: A Competitive Analysis, Investing Perspective' offers valuable insights into navigating the evolving advertising landscape within an increasingly streaming-centric ecosystem.

In analyzing the net profitability, customer retention strategies & audience attractiveness of Netflixs' ad business: its competitive advantages against traditional broadcast media and prospective growth metrics indicate a promising investment outlook.