(Bloomberg) -- Japan’s efforts to maintain a steady, friendly approach to trade negotiations are being tested as President Donald Trump ramps up pressure for a deal ahead of a looming tariff deadline.

Most Read from Bloomberg

-

Struggling Downtowns Are Looking to Lure New Crowds

-

Sprawl Is Still Not the Answer

-

California Exempts Building Projects From Environmental Law

With higher US tariffs set to take effect on July 9, Tokyo’s cautious strategy has yet to deliver a breakthrough, raising the risk that it could become an easy target in the Trump administration’s push for fast wins.

Unlike China, which has taken a more retaliatory stance to US pressure, Japan remains dependent on Washington for trade and security, leaving Tokyo with little appetite for direct confrontation. Instead, chief trade negotiator Ryosei Akazawa is likely to stick to his playbook of keeping talks frequent, polite and firm, not wanting to risk a bad deal with a national vote looming on July 20.

“The government is stuck between US expectations and domestic pressure not to give up too much before the election,” said Rintaro Nishimura, an associate at The Asia Group.

Trump has stepped up his rhetoric. He suggested Monday that across-the-board tariffs could end up much higher than the 24% penciled in for Japan on July 9.

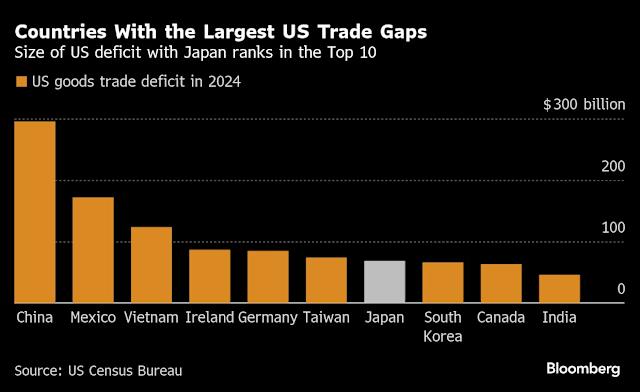

Japan should be forced to “pay 30%, 35% or whatever the number is that we determine, because we also have a very big trade deficit with Japan,” Trump said. “I’m not sure we’re going to make a deal. I doubt it with Japan, they’re very tough. You have to understand, they’re very spoiled,” Trump said.

Those comments marked the third-straight day that Trump zoomed in on Japan in his comments on trade. He lambasted Japan for not buying enough US cars in an interview that aired Sunday, he followed up with a social media post singling out Japan for not importing US rice even when the nation is experiencing a shortage.

Japanese officials have so far responded cautiously, trying not to inflame tensions. Akazawa — who’s made seven trips to Washington in recent months — may have had the most reason to be frustrated. On his latest visit, he didn’t get to meet Treasury Secretary Scott Bessent, and two of his three conversations with Commerce Secretary Howard Lutnick happened over the phone.

“Most times I’m taking off from Haneda Airport without a confirmed schedule of meetings,” Akazawa said Tuesday on his return to Tokyo.

Yet despite the hurdles, he projected confidence that repeated talks and relationship-building will eventually lead to a mutually acceptable deal.

Story Continues“We expect a package to span various fields and become quite extensive, so there are still points where the two sides are not on the same page,” he said. “We find both the reciprocal and sectoral tariffs unfortunate. So we won’t be able to say we have protected our national interests unless both of them are addressed.”

Investors, for now, are keeping calm amid the trade negotiations. “The bark is worse than the bite,” said Rajeev De Mello, Geneva-based portfolio manager at Gama Asset Management SA. “I expect that the US will delay most of the excess tariffs but keep a 10% rate.”

Japan’s Strategy

Japan’s pitch to Washington has centered on jobs and investment, especially in the auto industry. Ishiba’s team is pushing to reduce a steep 25% tariff on Japanese cars and lower the planned across-the-board duties from 24% set to take effect on July 9. Tokyo is also offering cooperation on shipbuilding and increased spending on US semiconductors and liquefied natural gas as sweeteners.

That jobs-first message has worked before. Trump dropped his opposition to Nippon Steel’s takeover of US Steel after Japan stressed its commitment to American workers. But a strategy that worked in the boardroom may not be enough to move the dial at the national level.

“The message from the Trump administration is that it wants something big. The Japanese are patching things together and hoping that it sticks,” Nishimura said.

The stakes are high for Tokyo. Japan’s auto industry accounts for nearly 10% of the country’s gross domestic product and employs around 8% of the workforce, making it a vital growth engine Ishiba is under pressure to defend. While some level of tariffs on cars seems inevitable, officials hope to bring them down closer to 10% to show progress at home.

One option could be to open Japan’s rice market in exchange for concessions on cars. But that’s politically sensitive. The ruling Liberal Democratic Party has long relied on support from the farming sector to retain seats in rural areas, and any move seen as giving up the agricultural lobby to protect the auto industry would risk alienating that voting base.

Akazawa has said Japan won’t sacrifice farmers in the trade deals. Agriculture Minister Shinjiro Koizumi said he will support talks that maximize the benefits for Japan.

Japan will need to make broader gestures, such as removing non-tariff barriers on car imports and lowering duties on its agricultural products including rice, according to Kenichi Kawasaki, a professor at the National Graduate Institute for Policy Studies. Even then, he expects US car tariffs of about 10% to remain.

Akazawa has chosen his words carefully as Japan navigates the looming July 9 trade deadline. While acknowledging the milestone, he has made clear Tokyo won’t be pressured into a deal it doesn’t want.

Trump for weeks has sought to exert leverage with negotiating partners ahead of the deadline, vowing to cut short talks with those he sees as being difficult and instead send them letters setting tariff rates.

Asked if Akazawa will quickly disclose to the media if a letter from Trump arrives, he smiled.

“If it comes to that, I think you’ll find that President Trump will have announced it already on Truth Social,” Akazawa said.

--With assistance from Umesh Desai and Gina Turner.

(Adds latest comments from Trump.)

Most Read from Bloomberg Businessweek

-

SNAP Cuts in Big Tax Bill Will Hit a Lot of Trump Voters Too

-

How to Steal a House

-

America’s Top Consumer-Sentiment Economist Is Worried

-

China’s Homegrown Jewelry Superstar

-

Pistachios Are Everywhere Right Now, Not Just in Dubai Chocolate

©2025 Bloomberg L.P.

This piece, while uncovering the intense negotiations between Japan and USA under President Trump's pressure for quick trade deals highlights a critical moment in Japanese economic diplomacy that will likely make or break their future influence within international trading structures.

Under Trump's demand for expedited deals, Japan’s carefully crafted trade strategy is faced with a crucial test of adaptability and resilience in the global economic landscape.

The ongoing negotiation between the US under President Trump's advocacy for swift trade deals and Japan, with its traditionally cautious approach to international economic agreements.

Japan's delicate trade strategy is being tested under Trump’l insistence on swift deals, revealing a unique challenge in balancing economic realities and diplomatic perfection amidst the shifting global landscape.

With Donald Trump's insistence on immediate trade agreements, Japan finds itself in a momentous test of its diplomatic and economic strategy amidst potentially dramatic renegotiations with major global players.

The trade strategy of Japan stands at a crucial juncture, as President Trump's push for swift deals challenges traditional diplomatic negotiating dynamics and forces co-operation cautious but necessary changes.

This article exposes the ongoing negotiation challenges faced by Japan as it tests its trade strategy against President Trump's push for quick deals, highlighting aspects where compromise on traditional Japanese economics could be a gamble towards uncertain outcomes.