Is Toll Brothers Inc. (TOL) a Buy Now? A Comprehensive Analysis of Key Factors and Zacks Rank

Toll Brothers (TOL) has recently been a popular topic of discussion on Zacks.com, with many investors showing interest in the stock's potential. As a result, it's essential to consider the key factors that could influence the stock's performance in the near future.

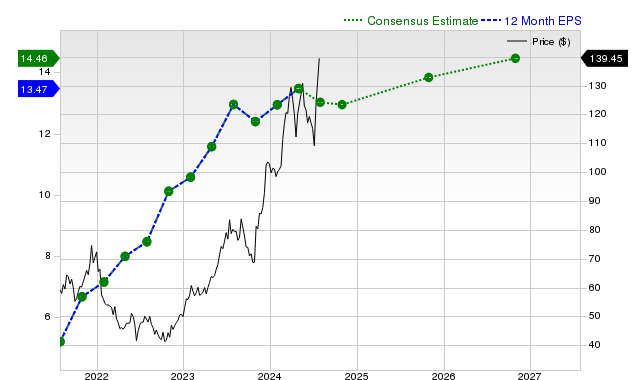

Earnings Estimate Revisions

At Zacks, we prioritize appraising the change in the projection of a company's future earnings over anything else. For Toll Brothers, the consensus earnings estimate of $13.95 for the current fiscal year points to a change of -7.1% from the prior year. Over the last 30 days, this estimate has changed +2.1%. For the next fiscal year, the consensus earnings estimate of $14.41 indicates a change of +3.3% from what Toll Brothers is expected to report a year ago. Over the past month, the estimate has changed -2.4%.

With an impressive externally audited track record, our proprietary stock rating tool -- the Zacks Rank -- is a more conclusive indicator of a stock's near-term price performance. The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for Toll Brothers.

Projected Revenue Growth

Even though a company's earnings growth is arguably the best indicator of its financial health, nothing much happens if it cannot raise its revenues. In the case of Toll Brothers, the consensus sales estimate of $2.85 billion for the current quarter points to a year-over-year change of +4.6%. The $10.93 billion and $11.18 billion estimates for the current and next fiscal years indicate changes of +0.8% and +2.3%, respectively.

Last Reported Results and Surprise History

Toll Brothers reported revenues of $2.74 billion in the last reported quarter, representing a year-over-year change of -3.5%. EPS of $3.5 for the same period compares with $3.38 a year ago. Compared to the Zacks Consensus Estimate of $2.5 billion, the reported revenues represent a surprise of +9.53%. The EPS surprise was +22.38%. Over the last four quarters, Toll Brothers surpassed consensus EPS estimates three times. The company topped consensus revenue estimates three times over this period.

Valuation

No investment decision can be efficient without considering a stock's valuation. As part of the Zacks Style Scores system, the Zacks Value Style Score (which evaluates both traditional and unconventional valuation metrics) organizes stocks into five groups ranging from A to F (A is better than B; B is better than C; and so on). Toll Brothers is graded A on this front, indicating that it is trading at a discount to its peers.

Conclusion

The facts discussed here and much other information on Zacks.com might help determine whether or not it's worthwhile paying attention to the market buzz about Toll Brothers. However, its Zacks Rank #3 does suggest that it may perform in line with the broader market in the near term. If you're interested in learning more about Toll Brothers and other stocks, consider downloading our free report today and exploring our latest recommendations from Zacks Investment Research. Click here to get your free report now!

Toll Brothers Inc. (NASDAQ: TOL), assessed for its solid fundamentals, growing market demand in the luxury home segment and anticipated recovery post-pandemic slowdown according to Zacks' comprehensive analysis; appears a strategic buy opportunity currently provided by favorable factors.

This in-depth analysis of Toll Brothers Inc. (TOL), exploring key factors from various angles and the accompanying Zacks Rank, provides a strong case for considering this stock as an attractive buy now due to its consistent financial performance despite industry headwinds.

Through a comprehensive analysis of key financial factors, market performance and the Zacks Rank for Toll Brothers Inc. (TOL), investors will be wise to consider this stock as an attractive buy opportunity with strong long-term growth potential.

Based on the comprehensive analysis of key factors and considering Toll Brothers Inc. (TOL)'s current Zacks Rank, a cautious yet promising outlook suggests that investors with an eye towards long-term growth might consider building this stock as part of their portfolio now.

After a meticulous analysis of key factors and the Zacks Rank assessment, Toll Brothers Inc. (TOL) exhibits promising prospects for an investment with moderate risk profiles at present market conditions - suggesting 'Buy Now' based on solid financial performance backed by stable customer demand.