Hawkish BOJ Policymaker Signals Decisive Rate Hikes to Combat Inflation Risks: Naoki Tamura Calls for Aggressive Action

FUKUSHIMA, JAPAN - The Bank of Japan may have to raise interest rates "decisively" to address inflation risks, even if uncertainties over U.S. tariffs persist, according to a hawkish member of the bank's board. Naoki Tamura, a board member, stated that inflation is speeding up and moving faster than projected at the BOJ's previous policy meeting in May. He added that companies may start to pass on labor costs more substantially by hiking service prices.

"If upward inflation risks heighten, the BOJ may need to act decisively as a guardian of price stability," Tamura said at a news conference on Wednesday. While U.S. tariffs will weigh on Japan's economy and prices for the time being, consumer inflation is likely to move around the 2% handle through fiscal 2027, he added in a speech earlier in the day to business leaders in Fukushima.

Tamura's remarks are more hawkish than those of Governor Kazuo Ueda, who has stressed the need to pause rate hikes due to "extremely high" uncertainty surrounding U.S. trade policy. In current forecasts made in May, the BOJ expects underlying inflation to stagnate for some time before re-accelerating to levels consistent with its price target in the latter half of its three-year projection period through fiscal 2027.

Tamura said the forecasts should be viewed as provisional and susceptible to big revisions depending on developments over U.S. tariff policy. U.S. tariffs may slow but not derail Japan's economic recovery as they mainly hit the manufacturing sector, which makes up just around 20% of gross domestic product (GDP).

However, Tamura offered few clues on when exactly the BOJ could raise interest rates, saying the decision will depend largely on how U.S. tariff policy evolves and its impact on the economy. "We need a bit more information to judge whether underlying inflation has reached 2%," Tamura told the news conference.

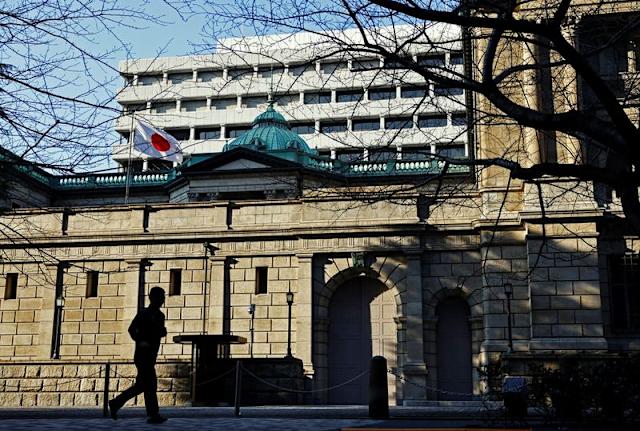

The BOJ ended a decade-long, massive stimulus program last year and in January raised short-term rates to 0.5% on the view that Japan was on the cusp of durably meeting its 2% inflation target. While the central bank has signaled readiness to raise rates further, the economic impact of higher U.S. tariffs forced it to cut its growth forecasts and complicate decisions around the timing of the next rate increase.

Further muddling the policy outlook, consumer inflation has exceeded the BOJ's 2% target for more than three years as companies continue to pass on rising raw material costs. Japan's consumer inflation has been stronger than expected in April and May, Tamura said, adding that the recent increase in food prices may be driven by permanent factors like chronic labor shortages and climate change.

Tamura also said Japan's medium- to long-term inflation expectations have been rising gradually as price hikes become widespread. "I personally believe focus should be placed on inflation expectations of firms and households, who are the actual drivers of economic activity," he said. "When the likelihood of achieving our price stability target increases, or when upside risks to prices grow, we may face a situation where we should act decisively, despite heightened uncertainties."

The BOJ kept rates steady at 0.5% at last week's policy meeting. Tamura was the sole dissenter on the central bank's decision to decelerate the pace of its balance sheet drawdown next year, calling instead to maintain the current pace of bond tapering. At last week's meeting, BOJ policymakers were divided between those stressing the need to keep ultra-low rates to gauge the impact of U.S. tariffs and others who highlighted mounting domestic inflationary pressure.

As Naoki Tamura from the Bank of Japan advocates for aggressive rate hikes to combat inflation risks, it is clear that a more forthright and decisive approach by policymakers will be required if we aim at addressing this escalating economic challenge.

The bold stance of the BOJ's hawkish policymaker, exemplified by Naoki Tamura calling for aggressive interest rate hikes to combat inflation risks signals a commitment towards swift and decisive action from central bank authorities in Japan.

The forthright policy statement by Naoki Tamura, a hawkish member of the BOJ's policymaking body signaling decisive interest rate increases to combat inflation risks underscores their commitment towards price stability amidst escalating global economic uncertainties.

Tamura's call for an aggressive hike in interest rates by the BOJ demonstrates a decisive approach to combat inflation risks, echoing hawkish sentiments among policymakers aimed at preserving Japan’njdash;the line between economic stability and price explosion.

In a bold move to tame inflation, the hawkish policy decision by Japan's Bank of Japan is met with excitement as Naoki Tamura advocates aggressive interest rate increases; an approach that while decisive risk seeking.

Hawkish monetary policy signals from Japan's central bank policymaker to aggressively tackle inflation risks demonstrate a commitment that may help restore consumer confidence but raise concerns about the potential for economic slowdown if not appropriately balanced.