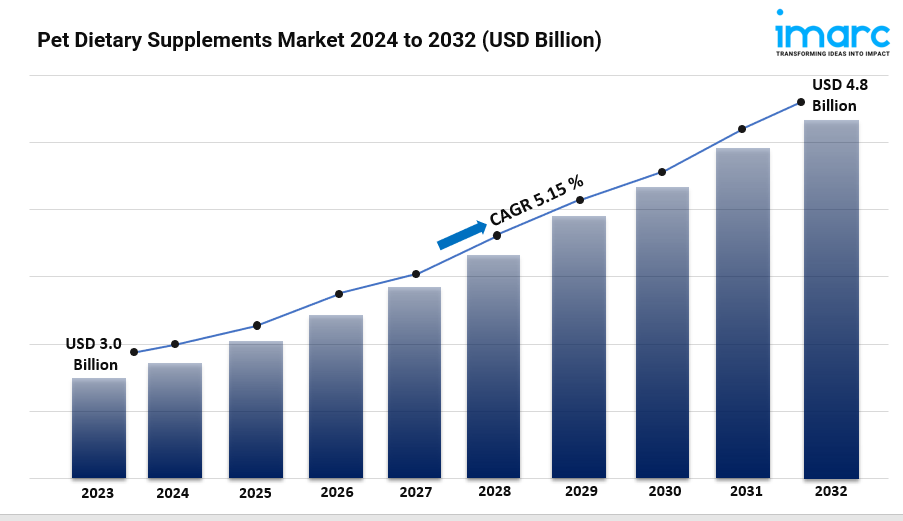

Fastly FSLY shares have declined 26.4% year to date, underperforming the Zacks Internet Software industry’s appreciation of 14.8% and the broader Zacks Computer & Technology sector's return of 5.7%.The decline reflects macroeconomic uncertainty and near-term softness in enterprise IT spending, even as Fastly continues to execute on its strategic priorities.

However, we believe this dip presents an attractive entry point for investors seeking exposure to a differentiated edge cloud platform. Fastly’s strong partner ecosystem, expanding product portfolio and consistent enterprise traction provide visibility into sustained execution. The recent dip offers a chance to accumulate the stock at a more reasonable price as the company scales across content delivery, security and AI-driven workloads.

FSLY YTD Performance

Image Source: Zacks Investment Research

Expanding Portfolio Boosts Fastly’s Prospects

Fastly continues to build on its platform strengths by introducing capabilities that address modern infrastructure challenges across security, observability and developer control. While content delivery remains core to its business, Fastly is evolving into a full-stack edge cloud platform, supported by continued product enhancements.

In the first quarter of 2025, Fastly introduced Client-Side Protection, a browser-based security feature that defends against unauthorized script modifications. The solution supports PCI-DSS compliance and helps protect sensitive data in high-risk, customer-facing applications. Fastly has expanded its Bot Management capabilities with Dynamic Challenges, Advanced Client-Side Detection and Compromised Credential Checking. These features allow enterprises to reduce fraud, secure login flows and limit CAPTCHA fatigue, which are key concerns for large-scale digital platforms.

Fastly added HTTP Cache API support for programmatic cache control, allowing faster content updates and lower origin traffic in dynamic environments thereby improving developer experience. It released Custom and Media Shield dashboards within its observability suite, enabling better monitoring of performance-intensive, media-driven workloads.

These innovations are driving measurable adoption. Packaging deals more than doubled year over year, while new logo wins rose over 80% in the reported quarter. As customers increasingly deploy across product lines, Fastly is positioned to benefit from stronger attach rates and deeper enterprise relationships.

Strong Partner Base: A Key Catalyst

Fastly is benefiting from a rich partner baseincluding Microsoft MSFT, Alphabet GOOGL and Palo Alto Networks PANW, among others.

Through Alphabet’s Google Cloud Marketplace, enterprises can access Fastly’s platform via unified billing and faster provisioning, making adoption smoother in multi-cloud environments. On Microsoft’s Azure platform, Fastly supports hybrid workloads with optimized delivery and low-latency performance, helping developers build responsive applications at the edge. Meanwhile, compatibility with Palo Alto Networks enhances Fastly’s positioning in security-led use cases, where protection of APIs and application traffic is critical.

Fastly closed the first quarter of 2025 with 577 enterprise customers, who contributed 93% of total revenue. Remaining performance obligations rose 33.5% year over year to $303 million, signalling stronger adoption across Fastly’s product portfolio and continued traction within its growing customer base.

FSLY Stock Trades Cheap

Fastly shares appear attractively valued compared with the industry. The stock is currently trading at a forward 12-month price-to-sales (P/S) of 1.63X, significantly lower than the industry’s 5.76X.

FSLY Valuation

Image Source: Zacks Investment Research

Fastly Offers Stable 2Q25 Outlook

Fastly expects revenues between $143 million and $147 million for the second quarter of 2025, indicating sequential growth from the March quarter. The company expects a non-GAAP operating loss between $8 million and $4 million, with a non-GAAP net loss per share in the range of 8 cents to 4 cents.

The Zacks Consensus Estimate for second-quarter 2025 revenues is pegged at $145.07 million, indicating 9.59% year-over-year growth.

Fastly, Inc. Price and Consensus

Fastly, Inc. price-consensus-chart | Fastly, Inc. Quote

The consensus estimate for the second quarter loss is pegged at 5 cents per share, unchanged over the past 30 days. This implies an improvement of 28.57% from the year-ago quarter.

Conclusion

Fastly’s differentiated edge cloud platform, expanding partner ecosystem and product innovations in areas like security, observability and developer control continue to support enterprise traction. Strength in packaging and new logo deals, alongside improving customer metrics and rising performance obligations, reflects growing platform adoption. The company’s stable second-quarter outlook and disciplined execution offer added visibility. At current levels, the stock’s attractive valuation, combined with positive estimate trends, supports the case for accumulation.

Fastly with Zacks Rank #2 (Buy) and a Growth Score of A offers a strong investment opportunity, per the Zacks Proprietary methodology. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Fastly, Inc. (FSLY) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The recent 26.4% year-to-date plunge in FSLY stock creates a compelling entry point with promising growth potential, signaling to investors that the dip may be an opportunity的门 by which smart traders can capitalize on projected demand.

Despite FSLY stock's recent 26.4% YTD plunge, such volatility often presents opportunities for long-term investors to buy the dip and capitalize on potential growth once fundamentals stabilize or improve; henceforth patience with a strategic investment approach could prove fruitful in due course.$

While FSLY stock has indeed plunged 26.4% YTD, the recent dip might present a compelling entry point for investors with long-term horizons who believe in its potential growth despite short term volatility; accommodation and careful research are key to navigating this opportunity successfully.}

With FSLY stock experiencing a 26.4% yearly-to date plunge, evaluating its current market position and fundamental health is crucial before considering purchasing dips—especially given the maximum risk associated with timing also involves potential for gains.

FSLY's 26.4% year-to-date decline may present an attractive opportunity for investors willing to take a calculated risk and capitalize on potential long term growth amidst short term volatility; however, it is crucial to conduct indepth analysis before jumping into the dip.

Absolutely not the right time to invest in FSLY at this dip. The share's sharp drop of almost a quarter YTD points toward underlying concerns that require thorough investigation before initiating new purchases, combining fundamental and technical analysis would be prudent."

With FSLY stock experiencing a 26.4% decline year-to-[sic] date, investors are faced with the temptation to purchase at its low point; but caution is advised amidst volatile markets and specific concerns that might not be fully considered in deplorable dips.