Beyond Wall Street Bulls: A Critical Analysis of RTX Investment Potential and the Importance of Zacks Rank

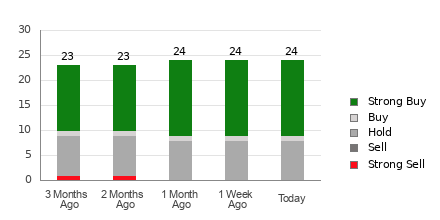

Wall Street analysts' recommendations are often a source of guidance for investors when deciding whether to buy, sell, or hold a stock. However, the question remains: do these recommendations truly hold the key to successful investment decisions? Let's delve into the case of RTX (RTX), a company whose current average brokerage recommendation (ABR) is 1.71 on a scale of 1 to 5 (Strong Buy to Strong Sell). The ABR for RTX is based on the actual recommendations made by 24 brokerage firms, with 15 being Strong Buy and one being Buy. However, relying solely on this information to make an investment decision may not be the best approach. According to several studies, brokerage recommendations have little to no success in guiding investors to choose stocks with the most potential for price appreciation. One reason for this is the vested interest of brokerage firms in the stocks they cover. Their analysts tend to rate these stocks with a strong positive bias, assigning five "Strong Buy" recommendations for every "Strong Sell" recommendation. This means that the interests of these institutions are not always aligned with those of retail investors, giving little insight into the direction of a stock's future price movement. To validate your own analysis or make a profitable investment decision, it is better to use a tool like the Zacks Rank. The Zacks Rank is a proprietary stock rating tool with an impressive externally audited track record. The Zacks Rank categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock's price performance in the near future. Using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision. In the case of RTX, the Zacks Consensus Estimate for the current year has declined 1.1% over the past month to $5.97, indicating analysts' growing pessimism over the company's earnings prospects. This has resulted in a Zacks Rank #4 (Sell) for RTX. Therefore, it would be wise to take the Buy-equivalent ABR for RTX with a grain of salt and consider other factors when making an investment decision. In conclusion, while Wall Street analysts' recommendations can provide some guidance, it is important to use additional tools and perform thorough research before making an investment decision. The Zacks Rank is a valuable resource that can help investors make more informed decisions and potentially increase their chances of success in the stock market.

In assessing RTX's investment potential beyond the hype of Wall Street bullish enthusiasm, a critical examination reveals that its Zacks Rank stands as an invaluable indicator for understanding both short-term volatility and long term growth prospects.

This insightful analysis, Beyond Wall Street Bulls: A Critical Examination of RTX Investment Potential and the Weighty Significance Of Zacks Rank, deeply dives into navigating investment decisions beyond盲目乐观 biases with a fresh view on technical indicators like Zack'ss crucial rank.