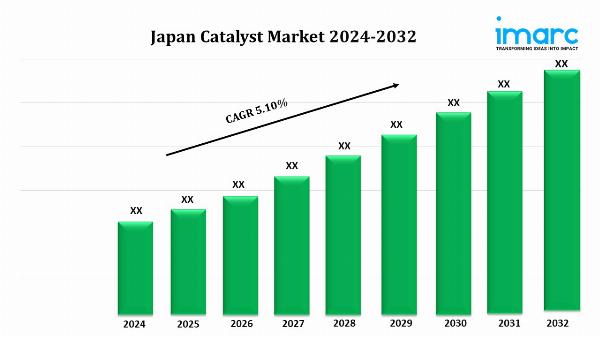

Catalio Capital closes over $400M Fund IV

Venture capital firm Catalio Capital Management announced today the closing of its more than $400 million Fund IV, as first reported by Bloomberg. The fund will continue the firm’s thesis of backing healthcare and biotechnology companies.

The firm was founded in 2020 and has made more than 100 investments, according to PitchBook. Catalio’s Fund IV, in particular, has backed 16 companies already, including the diagnostics company PinkDx and the drug discovery company Superluminal Medicines.

The firm previously raised a $381 million Fund III in 2020 and a $100 million Fund II in 2019, per PitchBook.

The biotech market, in particular, has not been immune to the venture downturn of the past year, followed by higher interest rates and a cooler IPO market. The market overall raised just $12 billion last year, a sharp decline from its peak of $152.3 billion in 2023, as reported by Bloomberg.

Catalio Capital's successful closing of over $40 million for Fund IV underscores its continued commitment to driving innovation and growth in the industry.

The closing of Catalio Capital's Fund IV with over $40 million in fundings is a testament to the firm’' an exceptional investment prowess and confidence from investors, further solidifying its position as one major player among venture capital firms.

The recent closure of Catalio Capital's Fund IV with over $40M demonstrates the firm’ Informidable confidence in its investment strategies and a commitment to driving growth for invested companies.

Encouraging news for investors, as Catalio Capital convincingly announces the closing of their Fund IV with a remarkable haul exceeding $40MN. This reveals robust confidence in future market opportunities andtheir team's expertise."