Bitcoins $14B Options Expiry: Cash-Secured Puts and Market Expectations

Bitcoin's BTC put-call ratio has surged ahead of Friday's multi-billion-dollar options expiry on Deribit, but its traditional bearish interpretation may not tell the full story this time. The put-call open interest ratio, which refers to the ratio of active put contracts to active call contracts at a given time, has increased, indicating a bias towards put options and protection against downside risks. However, the latest spike is at least partly driven by "cash-secured puts" – a yield-generation and BTC accumulation strategy.

The strategy involves selling (writing) put options, which is analogous to selling insurance against price drops in return for a small upfront premium. At the same time, the writer keeps enough cash (in stablecoins) on the sidelines to buy BTC if the prices decline and the buyer decides to exercise the right to sell BTC at the predetermined higher price. The premium collected by writing the put option represents a yield with the potential for BTC accumulation if the put buyer exercises the option.

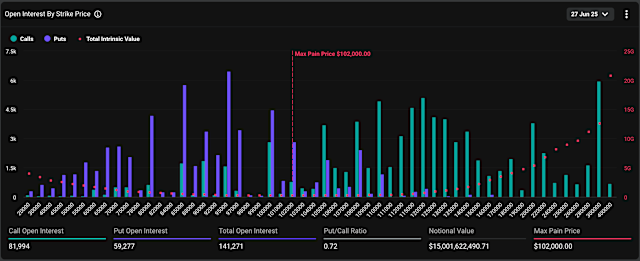

According to Deribit's head of business development - Asia, Lin Chen, the put/call ratio has risen to 0.72 – up from just above 0.5 in 2024 – indicating a growing interest in put options, often structured as cash-secured puts. On Friday, at 08:00 UTC, a total of 141,271 BTC options contracts, worth over $14 billion, representing more than 40% of the total open interest will expire on Deribit. Of the total due for settlement, 81,994 contracts are calls, while the rest are put options.

Nearly 20% of expiring calls are "in-the-money (in profit)," meaning that a large number of market participants hold calls at strikes that are below BTC's current spot market rate of $106,000. This suggests call buyers have performed well this cycle, aligning with the persistent inflows into BTC ETFs. Holders of in-the-money (ITM) calls are already profitable and may choose to book profits or hedge their positions as expiry nears, which can add to market volatility.

Broadly speaking, most of the calls are set to expire out-of-the-money or worthless. Notably, the $300 call has the highest open interest, a sign traders likely hoped for an outsized price rally in the first half. The max pain for the expiry is $102,000, a level where option buyers would suffer the most.

Latest market flows indicate expectations for back-and-forth trading, with a slight bullish bias as we approach the expiry. According to data tracked by leading crypto market maker Wintermute, the latest flows are skewed neutral, with traders selling straddles – a volatility bearish strategy – and writing calls around $105,000 and shorting puts at $100,000 for the June 27 expiry.

In conclusion, while the surge in Bitcoin's put-call ratio may initially suggest a bearish market sentiment, it's important to consider the role of cash-secured puts in driving this increase. As we approach Friday's options expiry, market participants should be aware of the potential for heightened volatility and the possibility of a slight bullish bias in trading activity.

This analysis of Bitcoin's $14B options expiry showcasing cash-secured put strategies and their alignment with market expectations is a masterclass in risk management for cryptocurrency investors.

As Bitcoins approach the $14 billion options expiration, traders deploy cash-secured puts to hedge their positions in line with a market that anticipates volatile price swings within expiry days.

The $14B options expiry of Bitcoin is set to shape its market trajectory as traders strategically navigate the CSP horizon, leveraging their position amidst a tapestry which reflects both investors' optimism and blended expectations.