Better Artificial Intelligence (AI) Stock: Advanced Micro Devices vs. Micron Technology

Key Points

-

Shares of AMD and Micron Technology have soared impressively in the past three months.

-

Both are set to benefit from identical end markets, but one of them is growing at a much faster pace.

-

The valuation will make it clear which of these semiconductor stocks is worth buying right now.

-

10 stocks we like better than Micron Technology ›

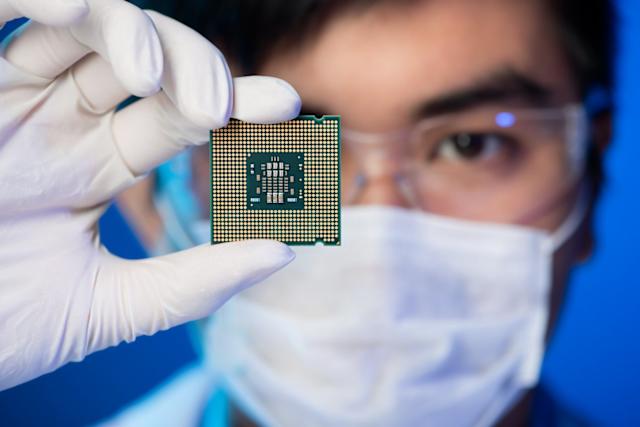

The demand for artificial intelligence (AI) chips has been increasing at a nice pace in the past few years. Major cloud service providers (CSPs), hyperscalers, and governments have been spending a lot of money on shoring up their cloud infrastructure so that they can run AI workloads.

This explains why the businesses of Advanced Micro Devices (NASDAQ: AMD) and Micron Technology (NASDAQ: MU) have gained terrific traction in recent quarters. As a result, shares of both these chip designers have clocked impressive gains in the past three months. AMD has jumped 32% during this period, and Micron stock is up 36%.

But if you had to put your money into just one of these AI semiconductor stocks right now, which one should it be? Let's find out.

The case for Advanced Micro Devices

AMD designs chips that go into personal computers (PCs), servers, and gaming consoles, and for other applications such as robotics, automotive, and industrial automation. AI has created impressive demand for the company's chips in these areas, leading to healthy growth in its top and bottom lines.

The company's revenue in the first quarter of 2025 was up by 36% from the year-ago period to $7.4 billion, while non-GAAP earnings per share shot up by 55% to $0.96. This solid growth was primarily driven by the data center and PC markets, which accounted for 81% of its top line. AMD's data center revenue was up by 57% from the year-ago period, while the PC business reported a 68% increase.

In the data center business, AMD sells both central processing units (CPUs) and graphics processing units (GPUs) that are deployed in AI servers. The demand for both these products is strong, which is evident from the terrific growth the company recorded in Q1. Importantly, AMD estimates that the market for AI accelerator chips in data centers could create a $500 billion annual revenue opportunity in 2028.

So, the outstanding growth that AMD clocked in the data center business in Q1 seems sustainable, especially considering that it generated $12.6 billion in revenue from data center chip sales last year -- nearly double the 2023 revenue. AMD is pushing the envelope on the product development front with new chips that are expected to pack in a serious performance upgrade and may even help it take market share away from Nvidia.

Story ContinuesMeanwhile, AMD's consistent market share gains in PC CPUs make it a solid bet on the secular growth of the AI PC market, which is expected to clock an annual growth rate of 42% in shipments through 2028. All this indicates that AMD is on track to take advantage of the growing adoption of AI chips in multiple applications, and that's expected to lead to an acceleration in its bottom-line growth.

Consensus estimates are projecting a 17% jump in AMD's earnings this year, followed by a bigger jump of 45% in 2026. As such, this semiconductor company is likely to remain a top AI stock in the future as well.

The case for Micron Technology

Micron Technology manufactures and sells memory chips that are used for both computing and storage purposes, and the likes of AMD and Nvidia are its customers. In fact, just like AMD, Micron's memory chips are used in AI accelerators such as GPUs and custom processors, PCs, and the smartphone and automotive end markets.

Micron has been witnessing outstanding demand for a type of chip known as high-bandwidth memory (HBM), which is known for its ability to transmit huge amounts of data at high speeds. This is the reason why HBM is being deployed in AI accelerators, and the demand for this memory type is so strong that the likes of Micron have already sold out their capacity for this year.

Not surprisingly, Micron is ramping up its HBM production capacity, and it's going to increase its capital expenditure to $14 billion in the current fiscal year from $8.1 billion in the previous one. The company's focus on improving its HBM production capacity is a smart thing to do from a long-term perspective, as this market is expected to grow to $100 billion in annual revenue by 2030, compared to $35 billion this year.

Micron's memory chips are used in PCs and smartphones as well. Apart from the growth in unit volumes that AI-enabled PCs and smartphones are expected to create going forward, the amount of memory going into these devices is also expected to increase. CEO Sanjay Mehrotra remarked on the company's latest earnings conference call:

AI adoption remains a key driver of DRAM content growth for smartphones, and we expect more smartphone launches featuring 12 gigabytes or more compared to eight gigabytes of capacity in the average smartphone today.

Similarly, AI-enabled PCs are expected to sport at least 16GB of DRAM to run AI workloads, up by a third when compared to the average DRAM content in PCs last year. So, just like AMD, Micron is on its way to capitalizing on multiple AI-focused end markets. However, it is growing at a much faster pace than AMD because of the tight memory supply created by AI, which is leading to a nice increase in memory prices.

The favorable pricing environment is the reason why Micron's adjusted earnings more than tripled in the previous quarter to $1.91 per share on the back of a 37% increase in its top line. Analysts are forecasting a 6x jump in Micron's earnings in the current fiscal year, and they have raised their earnings expectations for the next couple of years as well.

So, Micron stock seems poised to sustain its impressive growth momentum, thanks to the AI-fueled demand for HBM.

The verdict

Both AMD and Micron are growing at solid rates, with the latter clocking a much faster pace thanks to the favorable demand-supply dynamics in the memory industry. What's more, Micron is trading at a significantly cheaper valuation compared to AMD, despite its substantially stronger growth.

Investors looking for a mix of value and growth can pick Micron over AMD, considering the former's attractive valuation and the phenomenal earnings growth that it can deliver. However, one can't go wrong with AMD either. The company should be able to justify its valuation in the long run, considering its ability to clock stronger earnings growth.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $699,558!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $976,677!*

Now, it’s worth noting Stock Advisor’s total average return is 1,060% — a market-crushing outperformance compared to 180% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of June 30, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

Better Artificial Intelligence (AI) Stock: Advanced Micro Devices vs. Micron Technology was originally published by The Motley Fool

Herein lies a high-stakes battle of technological prowess – AMD versus Micron, both claiming crowns in the realm where AI and semiconductor convergence redefine industries.OptionsItemSelected在这个高风险的技术竞赛——AMD与Micron的对决中,双方都在AI和半导体融合重塑行业的领域里争夺着至高的王座。

Selecting the superior AI play: When it comes to harnessing advanced computing technology, Advanced Micro Devices shines brighter than Micron Technology with their focused efforts on supporting and fuelling modern day algorithms through optimized chip solutions.

Analyzing the prowess of AI advancement in tech stocks, Advanced Micro Devices emerges as a superior choice against Micron Technology due to its robust GPU solutions pivotal for enhancing neural network capabilities and speed.

In the race for better Artificial Intelligence (AI) stock performances, it's a close call between Advanced Micro Devices and Micron Technology; each offers distinct competitive edges in terms of AI-driven chipset innovation.

AI's next leap forward lies in the stock of Advanced Micro Devices, bridging real-time processing power and AI capabilities unparalleled by Micron Technology as a mere memory solutions provider.

Among the leaders in AI advancement, Advanced Micro Devices (AMD) excels with its cutting-edge silicon solutions for deep learning and processing applications that offer a more robust platform than Micron Technology's storage technology portfolio alone.

AMD's progress with Advanced AI functionalities outshines Micron Technology, making it a better investment choice for those seeking companies poised to lead in the burgeoning field of Artificial Intelligence.

Focusing on Advancing AI abilities, Advanced Micro Devices presents a more formidable platform for future-proofed Artificial Intelligence applications compared to Micron Technology's focus on memory solutions.

For a better AI stock in the tech landscape, Advanced Micro Devices (AMD) stands out with its superior computational power and cutting-edge processing assets when compared to Micron Technology's focus on memory solutions.

Of the two prominent tech stocks in AI-focused industries, Advanced Micro Devices demonstrates a superior edge with its innovation at intersecting computational power and artificial intelligence potentials compared to Micron Technology's pure memory chip industry focus.