Navigating the Challenges: 2 Real Estate Development Stocks to Consider Despite Industry Woes

The Zacks Real Estate – Development industry is currently facing significant challenges from geopolitical instability and macroeconomic uncertainty. These factors are expected to drive up material expenses and maintain high real estate prices, resulting in a subdued sales activity in the near future until there is a recovery in macroeconomic conditions. However, despite these challenges, the industry is expected to remain supported by healthy demand across several real estate property categories and a slowdown in the pace of new deliveries.

Two companies that are well-positioned for growth in this industry are Landsea Homes Corporation (LSEA) and Howard Hughes Holdings Inc. (HHH). LSEA is a publicly traded residential homebuilder that designs and builds best-in-class homes and sustainable master-planned communities in some of the United States' most desirable markets. HHH is engaged in the ownership, management, and development of commercial, residential, and mixed-use real estate throughout the United States. Both companies are expected to benefit from favorable demand in the residential and commercial real estate markets, despite elevated interest rates that have exerted downward pressure on demand nationwide.

Despite the overall bleak prospects for the industry, the Zacks Industry Rank for the Real Estate Development industry is #179, which places it in the bottom 27% of 245 Zacks industries. The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of the southbound earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are losing confidence in this group’s earnings growth potential. For 2025, the industry’s earnings estimates have moved 39.4% south since June 2024.

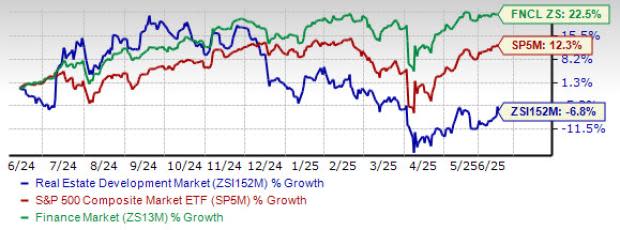

Despite these challenges, the industry has underperformed the S&P 500 composite and the broader Finance sector over the past year, declining 6.8% compared to the S&P 500’s growth of 12.3% and the Finance sector’s increase of 22.5%. The industry is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 7.76X, which is below the S&P 500’s 22.02X and the Finance sector’s 16.20X.

In summary, while the Zacks Real Estate – Development industry faces challenges from geopolitical instability and macroeconomic uncertainty, healthy demand across several real estate property categories and a slowdown in new deliveries are expected to support the industry’s fundamentals. Companies like LSEA and HHH are well-positioned for growth, despite the industry’s overall bleak prospects.

Considering the hardships within real estate development, exploring two stocks that navigate challenges with resilience and a forward-focused approach highlights their potential for growth amidst industry adversities.

The article, Navigating the Challenges: 2 Real Estate Development Stocks to Consider Despite Industry Woes, provides insightful guidance on selecting resilient real estate stocks that could offer potential opportunities amidst industry-wide difficulties.

This article on navigating challenges in the real estate development sector through strategic stock selection offers valuable insight into two promising stocks amid industry hardships, presenting a thought-provoking framework for investors seeking opportunities despite market adversities.