XRP $3 Bets Dominate Trading Volumes as XRP/BTC's 'Wedge' Suggests Further Rally

Payments-focused cryptocurrency XRP (XRP) has risen by over 3.5% in the past 24 hours, with volume in the Deribit-listed options market suggesting bullish expectations.

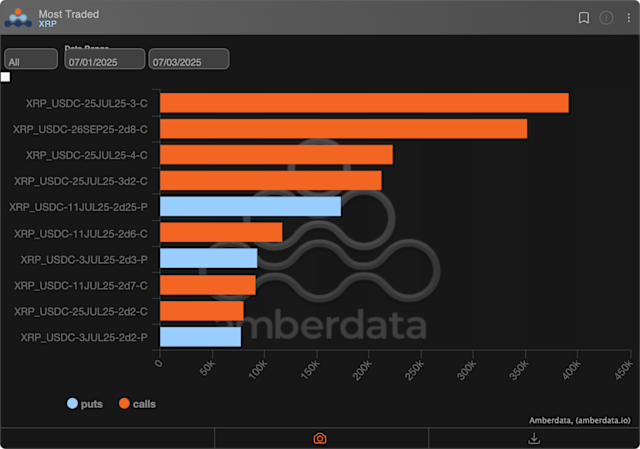

Since July 1, higher-level July 25 call options at strikes of $3.00 and $4.00 and the Sept. 28 expiry call at the $2.80 strike have emerged as the most traded bets, according to data source Amberdata.

A call option gives the buyer the right to buy the underlying asset at a predetermined strike price at a later date. The option represents a bullish view on the market. For instance, the $3 strike call buyer is betting that XRP's spot price will top that level by July 25. On Deribit, one options contract represents one XRP.

A closer look at the flows reveals that the higher volume ranking for the $3 calls primarily stems from buy trades. In the past 24 hours, the $3 strike call has seen 2 million contracts change hands in investor buy trades (market makers on the opposite side). Conversely, investors have been mostly sellers or writers in the $2.8 call.

The $3 call is also the most popular bet in terms of the increase in open interest, or the number of active or open contracts, in the past seven days.

The increased activity in the higher strike calls follows strengthening expectations for a spot ETF debut in the U.S. According to Bloomberg's analysts Eric Balchunas and James Seyffart, the probability that the U.S. SEC will approve a spot XRP ETF now stands at 95% – almost a done deal.

On Wednesday, fintech firm Ripple, which utilizes XRP to facilitate cross-border transactions, announced that it has applied for a national banking license at the Office of the Comptroller of the Currency (OCC).

"If approved, we would have both state (via NYDFS) and federal oversight, a new (and unique!) benchmark for trust in the stablecoin market," Ripple's CEO Brad Garlinghouse said on X.

XRP/BTC breakout

XRP's bitcoin-denominated price, represented by the Binance-listed XRP/BTC pair, may be headed higher, having broken out of a falling wedge pattern.

The falling wedge is a bullish reversal pattern, characterized by two converging trendlines that indicate a narrowing range of price movement. The converging nature of trendlines suggests that sellers are slowly losing steam. Hence, a subsequent move above the upper trendline is said to confirm renewed bull dominance.

XRP/BTC has risen above the upper trendline, confirming the bullish breakout. The pattern indicates that the correction from the April highs has ended and the broader XRP bullish trend has resumed.

Story ContinuesWhile the wedge breakout indicates that the path of least resistance is on the higher side, popular averages, 50-day, 100-day and 200-day SMAs disagree.

Both the 50- and 100-day SMAs are trending south, having recently crossed bearishly below the 200-day SMA. Note, however, that moving averages are lagging indicators and take backseat to the bullish wedge breakout.

Read more: Ripple Applies for Federal Bank Trust Charter, XRP Jumps 3%

XRP's recent rise is no surprise given it carries potential to outperform, and the increasing trading volumes against $3 per XRP signals a strong commitment from traders amidst its formation of a 'wedge', which often precedes an upward movement.

The sudden surge in XRP trading volumes associated with $3 bets highlights a promising turnaround, while the 'wedge'-shaped pattern for pairs like XRPCN/BTC hints at possible further rally actions.

The surge in XRP trading volumes amidst the $3 billion bets sees the 'wedge' pattern on its pairedBTC chart as an indication of potential further price gains, hinting at a bullish outlook for investors alike.

The recent surge in trading volumes centered around $3 XRP bets, with the 'wedge' formation observed for both USD to BTC and specifically on Xenial Ripple Protocol (XPR), indicating a high probability of further price consolidation followed by an upward momentum.

As XRP's gambling-inspired betting of $3 million hits trading volumes, the 'wedge formation’ on its chart alongside Bitcoin implies a potential for further price rally in favor oftenancy and shows how profoundly sentiment plays into crypto markets.

With XRP's recent $3 bet placement resulting in dominant trading volumes, the 'wedge'-like pattern observed on itsX RP / BTC pair portends further price rally developments.

Observers note the significant surge in XRP trading volumes, particularly due to $3 bets on its value outperforming BTC'S 'wedge pattern', indicating potential for further upward price movement.