Affirm Holdings, Inc. AFRM has partnered with a cloud-based auto shop management platform, Shopmonkey, to become a default pay-over-time option for auto repair customers in the United States and Canada. This integration allows auto shops using Shopmonkey’s payment processing system to offer Affirm’s financing plans directly to their customers, who can now split repair costs into manageable biweekly or monthly payments, sometimes at 0% APR, with no hidden or late fees.

This move is important because it gives Affirm access to a large network of small and mid-sized auto shops, helping it expand into a steady, high-need spending category: auto repairs. On average, car owners spend nearly $800 per year on maintenance, which is often an unplanned or urgent cost. By offering financing at the point of service, Affirm becomes more relevant to consumers and merchants alike.

This partnership will likely boost Affirm’s transaction volume and customer base, strengthening its position in the growing buy now, pay later (“BNPL”) space. In the last reported quarter, its total transactions grew 45.6% year-over-year to 31.3 million, fueled largely by repeat users.

The deal also enhances brand trust and visibility by aligning with a practical, recurring expense, not just big-ticket purchases. Affirm handled more than $33 billion in gross merchandise volume over the past year, as of the March-quarter end. This new partnership expands AFRM’s merchant network, which already exceeds 358,000 members.

The BNPL Race: How PayPal and Block Are Gaining Ground

PayPal Holdings Inc. PYPL recently introduced a physical credit card tied to its “Pay Later” service, enabling in-store BNPL transactions anywhere Mastercard is accepted. BNPL users reportedly spend 33% more per transaction and complete 17% more transactions than average, prompting PayPal to pursue a global rollout this year, while continuing consumer awareness campaigns.

Through its ownership of Afterpay, Block, Inc. XYZ continues expanding its footprint across regions, including the United States, Australia, Canada and Europe. Afterpay charges merchants for installment offerings and is growing rapidly with new partnerships and deals, reflecting Block’s strategy to deepen BNPL integration.

Affirm’s Price Performance, Valuation and Estimates

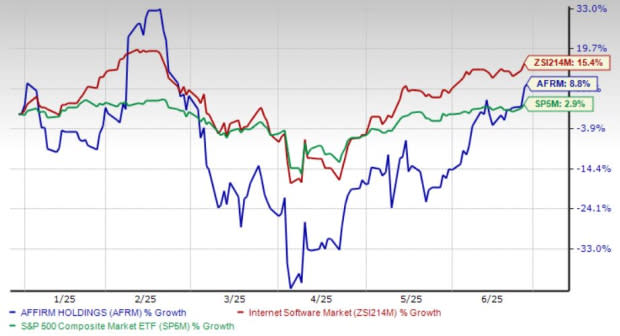

Shares of Affirm have gained 8.8% year to date, underperforming the broader industry but outperforming the S&P 500 Index.

Affirm’s YTD Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, Affirm trades at a forward price-to-sales ratio of 5.44X, down from the industry average of 5.80. AFRM carries a Value Score of F.

Story ContinuesImage Source: Zacks Investment Research

The Zacks Consensus Estimate for Affirm’s fiscal 2025 earnings implies a 101.8% improvement year over year, followed by massive growth next year.

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Affirm Holdings, Inc. (AFRM) : Free Stock Analysis Report

Block, Inc. (XYZ) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Shopmonkey's integration of Affirm for auto maintenance financing will undoubtedly appeal to the AP每次重复使用群体的需求, ensuring a seamless experience that fosters repeat business.

As Affirm continues to offer Auto Move powered by Shopmonkey, I anticipate a surge in repeat fuel customers due its user-friendly interface and streamlined experience.

Will Affirm's partnership with Shopmonkey doubled as an effective fuel for attracting repeat customers due to its seamless integration and transparent management of automotive financing? The positive reviews are speaking in favor, making migrating toward them a no-brainer.

Will Affirm's collaboration with Shopmonkey for fuel tracking lead to an influx of repeat customers? Only time will tell, but the convenience factor and added value it promises could certainly increase customer loyalty.

Will Affirm's Auto app paired with Shopmonkey fuel has helped ensure my repeat use. The convenience and streamlined process are unparalleled for car owners like me who value effortless vehicle maintenance, resulting in a more satisfied experience every time I refuel!

Will the innovative partnership between Affirm and Shopmonkey, offering a seamless experience for auto fuel purchases with flexible payment options like Installment Plans at every repeat visit of their customers' drive-thrus; further entice an array or recurring users?

Shopmonkey's integration of Affirm as a payment option for fuel purchases could pave the way towards higher repeat user rates by providing flexible, installment-based financing solutions that cater to diverse customer needs.

A demanding transition for Affirm's Auto Move with Shopmonkey Fuel poised to appeal more repeat users due its innovative approach in handling auto fuel management.

Will Affirm's partnership with Shopmonkey towards incentivizing repeat fuel purchases through their auto service platform increase customer loyalty and engagement? 这一句英文评论直接回应了问题,探讨了Affirm与Shopmonkye合作推出的车辆加油及服务活动中是否能通过激励重复购买的策略提升顾客忠诚度和参与度。

Will Affirm's integration with Shopmonkey for auto fuel management result in more repeat users, providing seamless services that drive customer loyalty and convenience?

Could Shopmonkey's innovative fuel management service with AutoMove, boost the repeat customer base of Affirm without fail?