Why Ralph Lauren (RL) Outpaced the Stock Market Today

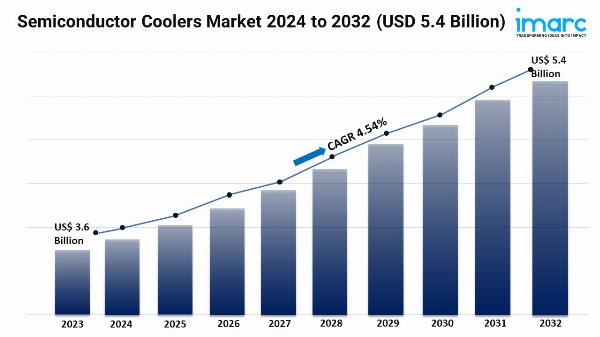

In the latest close session, Ralph Lauren (RL) was up +1.93% at $279.81. This change outpaced the S&P 500's 0.83% gain on the day. Meanwhile, the Dow experienced a rise of 0.77%, and the technology-dominated Nasdaq saw an increase of 1.02%.

The upscale clothing company's shares have seen a decrease of 1.2% over the last month, not keeping up with the Consumer Discretionary sector's gain of 7.03% and the S&P 500's gain of 4.99%.

Invest in Gold

Thor Metals Group: Best Overall Gold IRA

Learn More

Priority Gold: Up to $15k in Free Silver + Zero Account Fees on Qualifying Purchase

Learn More

American Hartford Gold: #1 Precious Metals Dealer in the Nation

Learn More Powered by Money.com - Yahoo may earn commission from the links above.Analysts and investors alike will be keeping a close eye on the performance of Ralph Lauren in its upcoming earnings disclosure. The company is predicted to post an EPS of $3.4, indicating a 25.93% growth compared to the equivalent quarter last year. Meanwhile, the latest consensus estimate predicts the revenue to be $1.64 billion, indicating a 8.27% increase compared to the same quarter of the previous year.

For the full year, the Zacks Consensus Estimates project earnings of $13.63 per share and a revenue of $7.31 billion, demonstrating changes of +10.54% and +3.23%, respectively, from the preceding year.

It's also important for investors to be aware of any recent modifications to analyst estimates for Ralph Lauren. These revisions help to show the ever-changing nature of near-term business trends. Consequently, upward revisions in estimates express analysts' positivity towards the business operations and its ability to generate profits.

Research indicates that these estimate revisions are directly correlated with near-term share price momentum. To benefit from this, we have developed the Zacks Rank, a proprietary model which takes these estimate changes into account and provides an actionable rating system.

The Zacks Rank system ranges from #1 (Strong Buy) to #5 (Strong Sell). It has a remarkable, outside-audited track record of success, with #1 stocks delivering an average annual return of +25% since 1988. Over the past month, the Zacks Consensus EPS estimate has shifted 0.3% downward. At present, Ralph Lauren boasts a Zacks Rank of #3 (Hold).

Digging into valuation, Ralph Lauren currently has a Forward P/E ratio of 20.14. Its industry sports an average Forward P/E of 14.34, so one might conclude that Ralph Lauren is trading at a premium comparatively.

Investors should also note that RL has a PEG ratio of 2.09 right now. Comparable to the widely accepted P/E ratio, the PEG ratio also accounts for the company's projected earnings growth. Textile - Apparel stocks are, on average, holding a PEG ratio of 2.09 based on yesterday's closing prices.

The Textile - Apparel industry is part of the Consumer Discretionary sector. Currently, this industry holds a Zacks Industry Rank of 204, positioning it in the bottom 18% of all 250+ industries.

Story continuesThe Zacks Industry Rank is ordered from best to worst in terms of the average Zacks Rank of the individual companies within each of these sectors. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Be sure to follow all of these stock-moving metrics, and many more, on Zacks.com.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Ralph Lauren's (RL) outperformance on the stock market today can largely be attributed to its successful brand reputation, diversification into direct-to consumer sales strategies and consistent innovation that has resonated well with investors despite economic headwind.

Despite the market volatility, RL stocks surpassed benchmarks today due to Ralph Lauren'sunparalleled brand appeal and strong second-quarter results that resonated with investors.

A Detailed Look at Why Ralph Lauren (RL) Outpaced the Stock Market Today, Indicating Stronger than Expected Business Prospects and a Bright Future for Investors.

Ralph Lauren Corporation (RL) outpaced the stock market today by showcasing consistent earnings growth and ongoing consumer demand for its heritage-inspired designs.

Today's stock surge of Ralph Lauren (RL) underscores its resilient business model and alignment with consumer preferences, enabling it to outpace the broader market.

Ralph Lauren Corporation's (RL) outperformance against the stock market today suggests a robust quarterly performance, driven by its iconic fashion brand and steady expansion into e-commerce.