Entergy Corporation ETR focuses on consistent investments in infrastructure upgrades to better serve its customers. The company is also steadily expanding its renewable generation portfolio. Given its strong growth, ETR makes for a solid investment option in the Zacks Utility Electric Power industry.

Let’s focus on the reasons that make this Zacks Rank #2 (Buy) stock a robust investment pick at the moment.

ETR’s Growth Forecast & Surprise History

The Zacks Consensus Estimate for ETR’s 2026 earnings per share (EPS) has increased 0.7% to $4.35 in the past 60 days.

The Zacks Consensus Estimate for 2025 sales is pegged at $12.54 billion, indicating year-over-year growth of 5.6%.

ETR’s long-term (three to five years) earnings growth rate is 9.5%. The company surpassed expectations in the last four reported quarters and delivered an average earnings surprise of 12.06%.

ETR’s Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing its funds to generate higher returns. Currently, Entergy’s ROE is 11.43% compared to its industry’s average of 10.09%. This indicates that the company has been utilizing its funds more constructively than its peers in the industry.

ETR’s Solvency

Entergy’s times interest earned ratio (TIE) at the end of the first quarter of 2025 was 2.4. The TIE ratio greater than 1 suggests that the company will be able to make its interest payment obligations in the near term without difficulty.

ETR’s Capital Allocation Strategy

Entergy has a defined capital investment strategy with the goal of modernizing, decarbonizing and diversifying its portfolio. The company intends to invest $37 billion between 2025 and 2028, mostly to upgrade its distribution, generation and transmission while supporting renewable expansion.

Entergy has also made considerable investments in grid hardening to make its transmission and distribution networks more resilient, resulting in improved customer service. During the first quarter of 2025, the company spent $144 million on distribution construction to improve the reliability of its distribution system.

ETR’s Return to Shareholders

Entergy has been increasing shareholders’ value through solid dividend payments. Currently, the company’s quarterly dividend is 60 cents per share, resulting in an annualized dividend of $2.40. The company’s current dividend yield is 2.95%, better than the Zacks S&P 500 Composite's average of 1.22%.

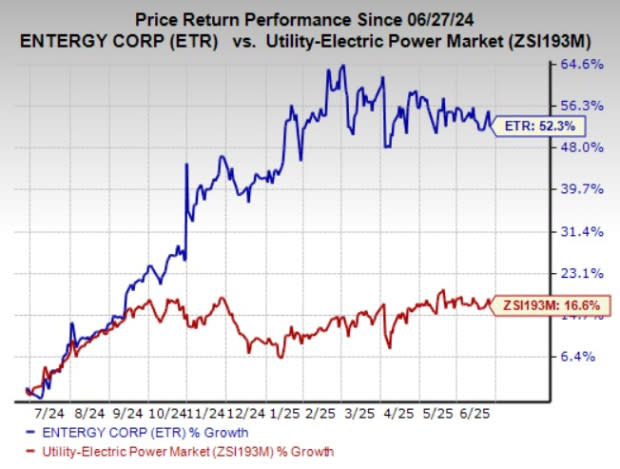

ETR Stock Outperforms Industry

In the past year, ETR shares have risen 52.3% compared with the industry’s growth of 16.6%.

Story Continues

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are Fortis FTS, NiSource Inc. NI and Portland General Electric POR, each holding a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

FTS’ long-term earnings growth rate is 5%. The Zacks Consensus Estimate for its 2025 EPS stands at $2.47, which indicates a year-over-year jump of 3.4%.

NI’s long-term earnings growth rate is 7.9%. The Zacks Consensus Estimate for 2025 EPS is pegged at $1.88, which suggests a year-over-year rise of 7.4%.

POR’s long-term earnings growth rate is 3.4%. The Zacks Consensus Estimate for 2025 EPS is pegged at $3.21, which calls for a year-over-year improvement of 2.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

Portland General Electric Company (POR) : Free Stock Analysis Report

Fortis (FTS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Entergy's diverse energy assets, solid financial foundation amid a rapidly evolving industry landscape coupled with consistent dividend payouts and future growth prospect potential make it an attractive investment ready to snag the spot in your portfolio now.

Entergy stock holds immense potential at this juncture, making it a compelling addition to your investment portfolio due not only its stable dividends but also the ongoing development opportunities in energy infrastructure – precisely why every astute investor should consider diving into now.