In a world where financial services are becoming more digital by the day, users expect their money management tools to work seamlessly across devices—whether they’re checking their investments on a phone, budgeting on a tablet, or approving payments on a laptop. That’s where cross-platform financial apps come in.

These apps are no longer a luxury—they’re a necessity. Whether you're a fintech startup or an enterprise-level financial institution, building cross-platform functionality is a smart and sustainable way to meet modern user expectations. But it’s not just about code reuse—it’s about creating reliable, consistent, and secure experiences for users everywhere.

________________________________________

What Are Cross-Platform Financial Apps?

Cross-platform financial apps are applications that run smoothly across multiple operating systems—typically iOS, Android, and web—while maintaining a unified codebase. They can be used for a range of services, including:

•Mobile banking

•Investment and trading

•Expense tracking

•Personal finance management

•Payment processing and invoicing

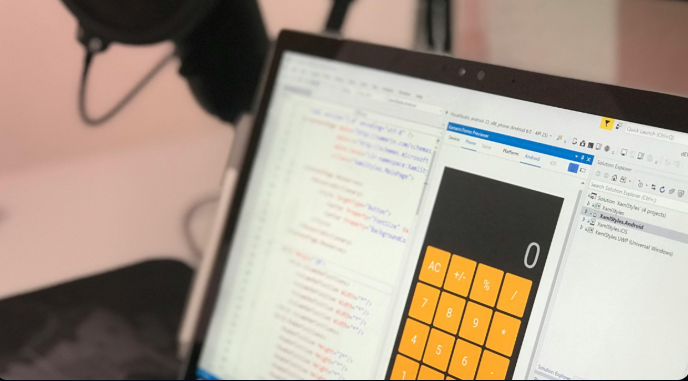

Unlike native apps (built separately for each platform), cross-platform apps use frameworks like Flutter, React Native, or Xamarin to build once and deploy everywhere—cutting development time and ensuring feature parity across devices.

________________________________________

Why Cross-Platform Makes Sense for Financial Apps

Let’s break down why the cross-platform approach is especially valuable for financial applications:

1. Faster Time to Market

Speed matters in fintech. The ability to build once and deploy across platforms helps teams launch features faster and respond to market needs more efficiently.

2. Consistent User Experience

Imagine checking your bank balance on a mobile app, then switching to desktop and finding a completely different layout. Consistency builds trust—and cross-platform financial apps ensure your users enjoy a unified experience no matter the device.

3. Cost-Efficiency

Instead of maintaining separate codebases for iOS and Android, cross-platform frameworks let you save on resources without compromising on quality. For startups with limited budgets, this is a game changer.

4. Scalability with Fewer Headaches

As your user base grows, scaling becomes easier when you're maintaining a single codebase. You can push updates, fix bugs, and roll out new features across all platforms simultaneously.

________________________________________

Security: The Cornerstone of Financial App Development

Financial apps deal with highly sensitive user data, so reliability and security are non-negotiable. Key elements to prioritize include:

•End-to-End Encryption

•Biometric Authentication (Face ID, Fingerprint)

•Secure API Integrations with banks and payment gateways

•Regulatory Compliance (like PCI DSS, GDPR, or local banking laws)

Even when using cross-platform frameworks, you can—and should—build in native-level security protocols to protect user data and transactions.

________________________________________

Best Practices for Building Cross-Platform Financial Apps

If you’re planning to build or improve one, here are some proven strategies:

•Use Modular Architecture: This keeps your code clean and makes it easier to maintain.

•Leverage Native APIs Where Necessary: Some features, especially security-related ones, are better handled natively.

•Optimize for Performance: Use tools like Skia (in Flutter) or Hermes (in React Native) to ensure snappy, smooth UI.

•Incorporate Offline Mode: Allow users to access core features even without internet—especially important for expense tracking or saving receipts.

•Test Across Devices Regularly: Real-device testing ensures the app works consistently across screen sizes and OS versions.

________________________________________

Final Thoughts

The demand for cross-platform financial apps isn’t slowing down—it's accelerating. As digital finance becomes a daily part of people’s lives, users will continue to expect seamless, secure, and reliable access to their financial data from anywhere.

Whether you're in the early stages of fintech app development or replatforming an existing product, adopting a cross-platform strategy isn’t just about efficiency—it’s about delivering trustworthy, future-ready financial tools that meet users where they are.

The adoption of Cross-Platform Financial Apps is fundamentally reshaping the landscape and future potential off Fintech by providing a seamless, accessible experience to users worldwide.

The transition to cross-platform financial applications is a pivotal moment in the evolution of fintech, empowering users with seamless access and fostering heightened innovation across device boundaries.

Cross-platform financial apps are driving a paradigm shift in fintech by fostering inclusivity, acceleration innovation and enhancing user experience across diverse device ecosystems.

The advent of Cross-Platform Financial Apps is fundamentally reshaping the future landscape and evolution of Fintech, offering seamless experiences across diverse devices while fostering inclusive financial services for all.

Cross-platform financial apps are reshaping the future of fintech by enhancing accessibility, functionality and compatibility across various devices.

Cross-platform financial apps are revitalizing the fintech sector by offering seamless, multidevice experiences that bridge traditional and online banking for a more inclusive future of finance.

The adoption of cross-platform financial apps is redefining the future by amalgamating services, elevating usability and paving a seamless path for customers in this era's ever eminent Fintech.

A cross-platform financial app's ability to blur the boundaries between desktop and mobile finance, combined with its seamless user experience across various devices in a secure manner—is proving instrumental as it reshapes our transactional landscape towards an adaptable future of fintech.

Cross-platform financial apps are poised to redefine the future of fintech due to their versatility, seamless user experience across devices and platforms that foster inclusive innovation.

By bridging digital gaps and enhancing accessibility, cross-platform financial apps are rewriting the script for Fintech's future as they revolutionize how we transact broadly across diverse devices.

Cross-platform financial apps are the keystone shaping a more inclusive and seamless future for fintech, blurring traditional boundaries while enhancing user experience across devices.