雪中利机,期权获利潜力超31%

近年来,人工智能的热潮席卷全球,市场呈现出蓬勃发展的态势,Snowflake作为行业内的佼佼者,以其云端的强大平台——AI数据云,为客户提供了便捷的数据整合解决方案,助力客户洞悉业务脉络、构建相关应用、解决复杂业务问题,该股票展现出强劲的势头,屡次触及52周高位,预示着市场未来的强劲增长。

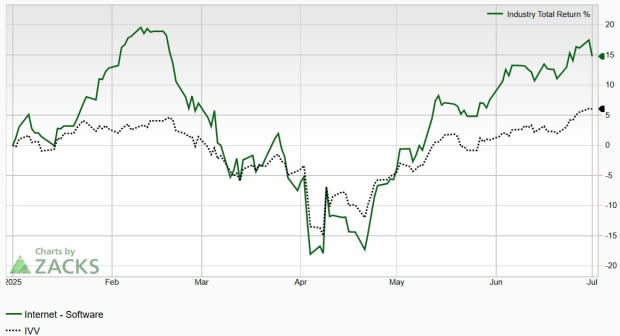

Snowflake不仅属于Zacks互联网软件行业群组,该行业群组在众多行业中排名前列,展现出强劲的发展势头,该行业群组的良好表现和领先股票的预期表现预示着它们将在未来几个月内超越市场,历史研究显示,约一半的股价涨幅是由行业分类引起的,排名前50%的Zacks排名行业远超排名后50%,这一比例超过2至1。

Snowflake的财务数据预计在财政年度2026年将迎来飞跃式增长,预计收入将飙升24.6%至452亿美元,该公司以客户为中心、以消费为基础的定价模式确保了可预测、高利润率的收入流,为未来的增长提供了坚实的基础,Snowflake的成功得益于合作伙伴关系的建立,其中包括了像NVIDIA、Amazon、Microsoft、ServiceNow和Meta Platforms等知名企业。

Snowflake提供的解决方案为利用SNOW股票的强势走势提供了灵活性,投资期权为我们提供了机会,根据当前的市场环境量身定制策略,从而在有限的风险下实现巨大的利润机会,在分析今日交易之前,让我们回顾一下期权的基本原理,尤其是在当前市场环境下,投资决策的重要性不言而喻,重要的是要记住,一个复杂策略的成功往往需要更长的时间来验证。

在探讨期权交易策略之前,让我们回顾一些基本概念,期权交易是一种投资策略,涉及购买看涨期权并出售相关看涨期权以获取更高的价格,这些合同的有效期在到期日之前确定,对于这种交易的风险与回报比率而言,前景是积极的,因为SNOW股票满足了某些启动看涨期权交易策略的启动条件,投资决策应基于自己的独立研究和考虑其他相关因素。

人工智能热潮为Snowflake带来了新的发展机遇,股票的表现和前景充满希望,期权工具为我们提供了利用潜在增长机会的绝佳工具,投资涉及风险,在做出任何决策之前,我们建议进行自己的独立研究并考虑其他可能影响投资决策的因素。

Understanding the potential 31% return outlined in this Weekly Option Windfall article on Snowflake Call Spread highlights a compelling strategy for experienced traders seeking to make targeted gains.

A Snowflake Call Spread in this week's options market presents a promising opportunity with its potential 31% profit margin, embarking on an innovative strategy to cash-in during volatile markets.

A commanding 31% profit potential, bolstered by the strategic Snowflake Call Spread in this Weekly Option Windfall strategy certainly catches my eye with its promising returns for investors who can navigate volatility.

Impressive potential profit of up to 31% for a Snowflake Call Spread in the Weekly Options column excites traders seeking highly leveraged strategies amidst low-risk intests, highlighting effective yet prudent means towards capital appreciation.

The Weekly Option Windfall's exploration into Snowflake Call Spread, promising a potential 31% profit if executed strategically within specified conditions; it further exposes the complex yet lucrative nature of leveraging call options in trading.

Snowflake Call Spread in a Weekly Option Windfall offers an enticing 31% profit potential without requiring extensive market exposure, demonstrating the strategic value of hedged trading strategies.

This engaging analysis showcases how a Snowflake Call Spread strategy could potentially deliver an impressive 31% profit within the weekly option horizon, making it both exhilarating and informative for investors seeking to capitalize on timely market movements.

Sizzling with potential profit, the snowflake call spread depicted in this 'Weekly Option Windfall' article showcases a three-digit percentage yield that promises to freeze competitors', quite remarkable given its approach.

A 31% potential profit on Snowflake Call Spread makes this weekly option windfall an attractive strategy for risk-aware investors seeking to capitalize from market growth while managing risks through call spreads.

A stunning 31% profit potential from a Snowflake Call Spread, showcasing the Weekly Option Windfall's promising approach to generating high yields with relative safety. A clever strategy indeed for investor vertical scans!

ThisWeekly Option Windfallexampledemonstratesanattractive31%profitpotentialwithSnowflakeCallSpreadstrategy,highlightingtheflexibilityandupsideofoptionstradingeveninvolatilemarkets.

Zhou Li Seizing Opportunities: A Snowflake-Like Approach for Enhancing Option Profits up to 31% over Expected.

![VMware 2V0-72.22 Practice Test - Get Excellent Scores [2024]](https://antiochtenn.com/zb_users/upload/2025/08/20250831174004175663320490757.jpg)