United Parcel Service, Inc. (UPS) is Attracting Investor Attention: Here is What You Should Know

United Parcel Service (UPS) has been one of the most searched-for stocks on Zacks.com lately. So, you might want to look at some of the facts that could shape the stock's performance in the near term.

Over the past month, shares of this package delivery service have returned +7.5%, compared to the Zacks S&P 500 composite's +5.2% change. During this period, the Zacks Transportation - Air Freight and Cargo industry, which UPS falls in, has gained 8.1%. The key question now is: What could be the stock's future direction?

While media releases or rumors about a substantial change in a company's business prospects usually make its stock 'trending' and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making.

Earnings Estimate Revisions

Rather than focusing on anything else, we at Zacks prioritize evaluating the change in a company's earnings projection. This is because we believe the fair value for its stock is determined by the present value of its future stream of earnings.

We essentially look at how sell-side analysts covering the stock are revising their earnings estimates to reflect the impact of the latest business trends. And if earnings estimates go up for a company, the fair value for its stock goes up. A higher fair value than the current market price drives investors' interest in buying the stock, leading to its price moving higher. This is why empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

Invest in Gold

Thor Metals Group: Best Overall Gold IRA

Learn More

Priority Gold: Up to $15k in Free Silver + Zero Account Fees on Qualifying Purchase

Learn More

American Hartford Gold: #1 Precious Metals Dealer in the Nation

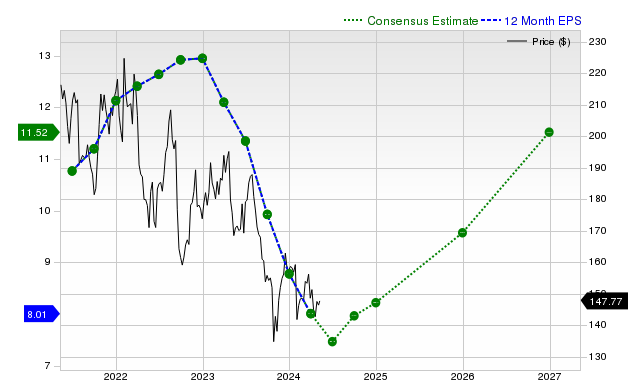

Learn More Powered by Money.com - Yahoo may earn commission from the links above.For the current quarter, UPS is expected to post earnings of $1.56 per share, indicating a change of -12.9% from the year-ago quarter. The Zacks Consensus Estimate has changed -2.2% over the last 30 days.

The consensus earnings estimate of $7.02 for the current fiscal year indicates a year-over-year change of -9.1%. This estimate has changed -0.9% over the last 30 days.

For the next fiscal year, the consensus earnings estimate of $7.93 indicates a change of +13% from what UPS is expected to report a year ago. Over the past month, the estimate has changed -1.6%.

Having a strong externally audited track record, our proprietary stock rating tool, the Zacks Rank, offers a more conclusive picture of a stock's price direction in the near term, since it effectively harnesses the power of earnings estimate revisions. Due to the size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, UPS is rated Zacks Rank #4 (Sell).

Story ContinuesThe chart below shows the evolution of the company's forward 12-month consensus EPS estimate:

12 Month EPS

Projected Revenue Growth

Even though a company's earnings growth is arguably the best indicator of its financial health, nothing much happens if it cannot raise its revenues. It's almost impossible for a company to grow its earnings without growing its revenue for long periods. Therefore, knowing a company's potential revenue growth is crucial.

In the case of UPS, the consensus sales estimate of $20.82 billion for the current quarter points to a year-over-year change of -4.6%. The $87.21 billion and $87.75 billion estimates for the current and next fiscal years indicate changes of -4.2% and +0.6%, respectively.

Last Reported Results and Surprise History

UPS reported revenues of $21.55 billion in the last reported quarter, representing a year-over-year change of -0.7%. EPS of $1.49 for the same period compares with $1.43 a year ago.

Compared to the Zacks Consensus Estimate of $21.06 billion, the reported revenues represent a surprise of +2.3%. The EPS surprise was +3.47%.

Over the last four quarters, UPS surpassed consensus EPS estimates three times. The company topped consensus revenue estimates just once over this period.

Valuation

No investment decision can be efficient without considering a stock's valuation. Whether a stock's current price rightly reflects the intrinsic value of the underlying business and the company's growth prospects is an essential determinant of its future price performance.

While comparing the current values of a company's valuation multiples, such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF), with its own historical values helps determine whether its stock is fairly valued, overvalued, or undervalued, comparing the company relative to its peers on these parameters gives a good sense of the reasonability of the stock's price.

The Zacks Value Style Score (part of the Zacks Style Scores system), which pays close attention to both traditional and unconventional valuation metrics to grade stocks from A to F (an A is better than a B; a B is better than a C; and so on), is pretty helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

UPS is graded B on this front, indicating that it is trading at a discount to its peers. Click here to see the values of some of the valuation metrics that have driven this grade.

Bottom Line

The facts discussed here and much other information on Zacks.com might help determine whether or not it's worthwhile paying attention to the market buzz about UPS. However, its Zacks Rank #4 does suggest that it may underperform the broader market in the near term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The growth potential, strong financial standing and near-unrivalled worldwide delivery network of United Parcel Service (UPS) Inc. are major factors attracting considerable investor attention amidst a sea of increasingly competitive logistics providers.'

UPS's continuous innovation, strong global presence coupled with resilience during the pandemic era has indeed captured investor interest; its figureheads embody a commitment to service excellence that resonates in today’s fintech landscape.

UPS' consistent focus on innovation, DNA of excellence and commitment towards sustainable delivery models is capturing the attention of investors hungry for growth potential in a challenging industry landscape.

The steady growth trajectory and resilient business model of United Parcel Service, Inc. (UPS) are firmly capturing investor interest amidst global uncertainties – a clear indication that its innovative supply chain solutions remain in high demand.

With its strong delivery network, innovative 3PL solutions and steadfast commitment to sustainability initiatives like carbon neutral goals by the year of their emissions peak UPS is creating unparalleled investor interest focusing on long-term growth potential.

The solid financial standing and innovative business strategies of United Parcel Service, Inc. (UPS) capture the attention even further amidst its diverse portfolio growth that prioritizes sustainability efforts; making it a reliable choice for investors seeking stability with potential returns.