Trump Signs GENIUS Act Into Law, Elevating First Major Crypto Effort to Become Policy

WASHINGTON, D.C. — President Donald Trump fulfilled part of his vow to establish U.S. crypto regulations on Friday, signing legislation into law that formally established rules for stablecoin issuers — marking a first step that the digital assets industry hopes will end with the more important regulatory regime governing the wider crypto markets.

Before a crowd of crypto executives in the East Room of the White House, a jubilant Trump signed the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, which registered a massive 308-122 bipartisan vote in the House of Representatives on Thursday and an earlier 68-30 vote in the Senate — demonstrating a huge margin of support from Democrats.

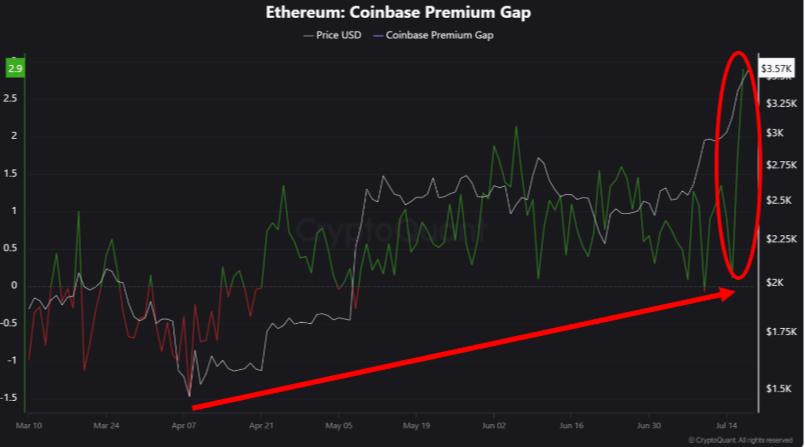

Trump walked into a packed East Room filled with applauding lawmakers and industry leaders, including Coinbase's Brian Armstrong, Tether's Paolo Ardoino, Circle's Jeremy Allaire, Gemini's Cameron and Tyler Winklevoss, Kraken's Dave Ripley, Chainlink's Sergey Nazarov and others.

"So congratulations, you've come a long way since the Biden administration, when they had no idea what you were all talking about, and half of you are under arrest," he joked at the outset.

Trump called out various members of Congress by name, alongside members of his Cabinet, saying they were instrumental in moving the legislation, as well as various industry leaders attending the ceremony.

"Let me say, the entire crypto community, for years, you were mocked and dismissed and counted out," he said. "You were counted out as little as a year and a half ago, but this signing is a massive validation."

The GENIUS Act will now be forwarded to the federal financial and banking agencies that must implement its various provisions. That will include formalizing the definitions for what kind of firms make acceptable issuers of stablecoins, which is a field currently dominated by Tether's USDT and Circle's USDC, though Wall Street institutions have been jumping into the space at a rapid pace.

Implementation of a law by federal regulators can be a drawn-out process, but GENIUS at least gives the industry a broad roadmap for how its U.S. interactions will look in the future. So pressure now shifts from lobbying to execution for stablecoin companies.

"The act sets a necessarily compliance baseline, but whether stablecoins can deliver their promise will depend on how effectively stablecoin issuers disclose reserves, implement operational safeguards, maintain robust governance practices and ensure structural alignment between issuers interests and consumer protection," noted Rajeev Bamra, an associate managing director for digital economy at Moody's Ratings, in a statement. "With broader adoption comes greater systemic responsibility of market participants."

繼續閱讀The industry has come a long way in Washington since its tumultuous 2022 in which several major businesses failed spectacularly, and crypto-supporting lawmakers were burned by the fall of global exchange FTX and its former CEO, Sam Bankman-Fried, who was a fixture in congressional meetings and the industry's D.C. events. But aggressive lobbying and a major campaign-finance push from the industry's Fairshake political action committee during last year's congressional elections elevated the sector into the good graces of the White House and Congress.

Trump has declared himself the crypto president, and his administration has routinely called for a "golden age" for the industry to begin. Now that GENIUS is law, the focus shifts toward the bigger task of passing legislation that defines the proper oversight of different forms of cryptocurrency, trading platforms and projects and assigns federal agencies to new roles as watchdogs over these markets.

White House Crypto and AI Czar David Sacks took the podium briefly to praise Trump and the legislation, saying that while he's used to the tech world moving quickly, the speed at which GENIUS became law "this was fast for us in Silicon Valley."

"This GENIUS Act will unlock American dominance in the crypto industry by creating clear rules of the road," he said. "It will update archaic payment rails with a revolutionary new payment system, and it will extend U.S. dollar dominance, like [Trump] said, globally by creating a digital dollar that people all over the world can use. And for every digital dollar in a crypto wallet, there'll be a traditional dollar in a U.S. bank account, which will create trillions of dollars demand for U.S Treasuries."

The Digital Asset Market Clarity Act that also swept through the House with a 294-134 vote on Thursday, at the peak of what lawmakers were calling "Crypto Week," has delivered momentum and a message to the Senate in its ongoing writing of its own market structure bill. Representative French Hill, the chairman of the House Financial Services Committee, urged in a press conference following Thursday's win for the Clarity Act that senators should just take up his bill and amend it rather than embark on their own legislation.

"Put it through your process," Hill advised the Senate — specifically Senator Tim Scott, the chairman of the Senate Banking Committee. "Obviously, it's open to amendment. It's a collaborative process."

The Senate hasn't yet released a draft of its bill, only a series of principles it intends to follow. So it remains unclear when the crypto advocates may again return to witness Trump signing a market structure bill, though Senator Scott assured the White House he's set a Sept. 30 deadline for Senate action.

Read More: Can Tether's Dominance Survive the U.S. Stablecoin Bill?