Trading Day: Sweeping US fiscal bill advances, rate path stays murky

By Lewis Krauskopf

NEW YORK () - -TRADING DAY

Making sense of the forces driving global markets

By Lewis Krauskopf, Markets Reporter

Jamie is enjoying some well-deserved time off, but the Reuters markets team will still keep you up to date on what moved markets today. We're watching President Donald Trump's tax cut-and-spending bill, which made it through the U.S. Senate on Tuesday and now goes back to the other U.S. legislative body, the House of Representatives. I'd love to hear from you, so please reach out to me with comments at .

Today's Key Market Moves

* Wall Street indexes were mixed, with the Nasdaq slumpingwhile the Dow rose and moved closer to a record high * The beaten-up U.S. dollar edged lower against a basketof major currencies * U.S. Treasury yields rose, after data showed the labormarket remained resilient * Gold prices jumped over 1%, continuing a massive run forthe metal this year * Oil prices edged higher, as investors weighed positivedemand indicators in China and elsewhere

Today's Key Reads

1. Six questions facing US stock investors as 2025's secondhalf kicks off 2. Trump's push for regulatory reform highlights ‘Treasuryput’: Jen 3. Corporate spending binge could spur long-term US growth:Guild 4. How Novo Nordisk misread the US market for its weightloss sensation 5. DOGE now targeting SEC policy, eyes SPAC rules, sourcessay

Sweeping US fiscal bill moves ahead, rate path stays murky

President Donald Trump's U.S. fiscal bill took a key step forward on Tuesday, carrying with it possible risks and rewards for investors.

The legislation, narrowly passed by the U.S. Senate, would extend Trump's 2017 personal and business tax cuts, otherwise due to expire at the end of this year, and give new tax breaks in areas such as tipped income and overtime. Investors hope the tax easing might provide stimulus that supports consumer spending.

But, according to nonpartisan analysts, the bill would add an estimated $3.3 trillion to the nation's debt. Growing deficits are continuing to cloud financial markets, especially after Moody's cut America's pristine sovereign credit rating in May.

The bill still must pass the House of Representatives, where Trump's Republican party holds a slim majority, and it remains to be seen if it will become law by Trump's hoped-for deadline of the July 4 Independence Day holiday.

Focus was also on the Federal Reserve, and when the U.S. central bank may next cut interest rates. At a central bank gathering in Portugal, Fed Chair Jerome Powell reiterated the need to understand the impact of Trump's tariffs on inflation before lowering rates.

Story continuesBut Powell also declined to rule out a possible rate cut at the Fed's July 29-30 meeting. Markets also seemed to include such a possibility: Fed Fund futures were baking in a roughly 20% chance of a cut at the July meeting, with chances deemed much more likely at the Fed's September meeting.

The rate path could become more clear with economic data in coming days, including the monthly U.S. jobs report on Thursday.

The dollar, which has fallen steeply this year, edged lower against a basket of major currencies.

In a mixed day on Wall Street, the S&P 500 and Nasdaq pulled back from record high levels, while another major U.S. index, the Dow Jones industrial average, moved closer to a record peak.

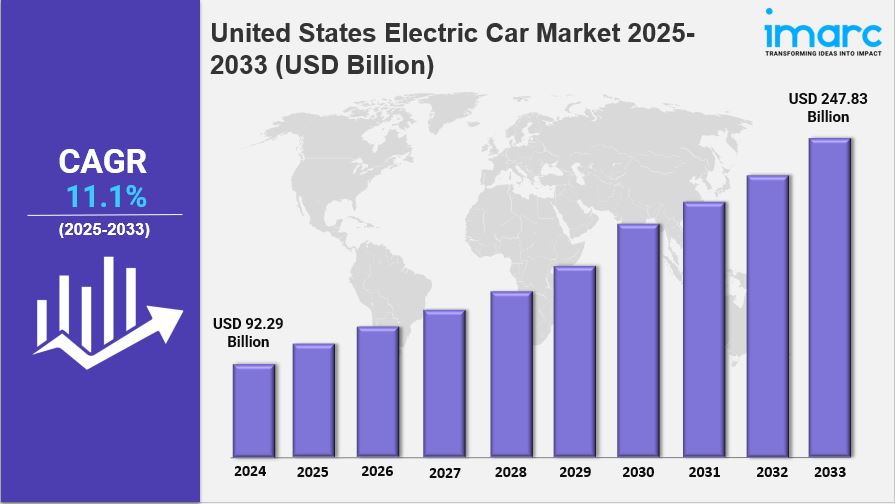

A 5% drop in Tesla shares weighed on the Nasdaq and S&P 500. Trump threatened to cut off subsidies for companies run by Tesla chief Elon Musk, escalating tensions between the one-time allies who have since fallen out.

Musk, who spent hundreds of millions on Trump's re-election, had renewed his criticism of the fiscal bill, which would eliminate subsidies for electric vehicle purchases that have benefited Tesla.

Tesla shares could get another jolt on Wednesday when the EV carmaker releases its quarterly delivery figures.

What could move markets tomorrow?

* ADP national employment report (June) * Challenger job cuts data (June) * ECB forum on central banking * Euro zone unemployment rate (May) * Japan monetary base (June) * Tesla quarterly deliveries

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

Trading Day is also sent by email every weekday morning. Think your friend or colleague should know about us? Forward this newsletter to them. They can also sign up here.

(By Lewis Krauskopf)

The recent sweeping adoptions of the US fiscal bill offer minor yet significant progress in trade policy, while further confusing market expectations with an uncertain rate-hike path threatening short term stability.

The explosive passage of the sweeping US fiscal bill brings a flurry of congressional activity, yet investors continue to grapple with uncertainty as rate predictions remain murky.

In the world of Trading Day, while massive US fiscal bill progress creates a wave that buffets markets left and right; however undefined remains our direction on interest rates- make 'staying' murky an art form.

With the United States fiscal bill making significant progress on a trading day, investors are still faced with an uncertain path when it comes to interest rates and monetary policy direction.

Today's trading session was dominated by the progress of a comprehensive US fiscal bill, illustrating attempts to revive growth uncertainty. However,the path forward for interest rates remains blurry with investors seeking clarifications on monetary policy direction.

As the US fiscal bill skates through Congress, markets are left to navigate uncertainties in interest rate projections amid unclear guidance on monetary policy's future trajectory.

Today's trading session showcased the rapid progress of a sweeping US fiscal bill, butonu clarity remained around future interest rate trajectories amidst conflicting global economic signals.

The U.S.'s fiscal bill' advancements garner momentum on a hectic Trading Day, while the path of interest rate hikes remains shrouded in uncertainty amidst shifting global economic payments.

The current trading day sees progress on the sweeping US fiscal bill, but rate path clarity remains a distant horizon with market uncertainty lingering.

Today's trading session saw significant advances in the U.S.' fiscal bill while market participants remain uncertain about future interest rate trajectories due to a lack of clarity on policy direction.

With the swift passage of a sweeping US fiscal bill, markets are hoping for clarity on future interest rate trajectories amid continuing uncertainty over its impact.