Terreno Realty Expands Portfolio with $16M Industrial Property Buyout in Queens: Strategic Growth and Market Outlook

Terreno Realty Corporation (TRNO) has recently announced the acquisition of an industrial property in Long Island City, Queens, NY, for $16 million. This strategic move aligns with the company's acquisition-driven growth strategy and further strengthens its presence in the New York City/Northern New Jersey market. The property, located at 11-40 Borden Avenue, comprises a single industrial distribution building spanning roughly 36,000 square feet on 1 acre. It is currently 100% leased to an insulation distributor through May 2028. The strategic location adjacent to the Queens-Midtown Tunnel and the Pulaski Bridge makes it an attractive proposition for potential tenants.

TRNO has been actively reshaping its portfolio by divesting non-core assets and acquiring value-accretive investments. These efforts are expected to drive long-term revenue growth. In the recent past, the company has made significant moves, including the acquisition of an industrial property in Los Angeles, CA, for around $10 million, and the sale of two properties for an aggregate value of around $114.5 million in May 2025. As of May 6, 2025, TRNO had acquisitions worth around $49 million under contract and nearly $75.8 million under letters of intent.

In addition, the company has five properties under development or redevelopment, which are expected to comprise eight buildings spanning approximately 0.8 million square feet, with 48% pre-leased. Terreno has dedicated around 22.4 acres of land to future developments at an estimated investment value of around $392.8 million.

With these expansion efforts, Terreno Realty is well-positioned to enhance its portfolio in six major coastal U.S. markets, including New York City/Northern New Jersey, Los Angeles, Miami, San Francisco Bay Area, Seattle, and Washington, D.C. These markets exhibit solid demographic trends and witness healthy demand for industrial real estate. However, macroeconomic uncertainty and tariff risks remain concerns.

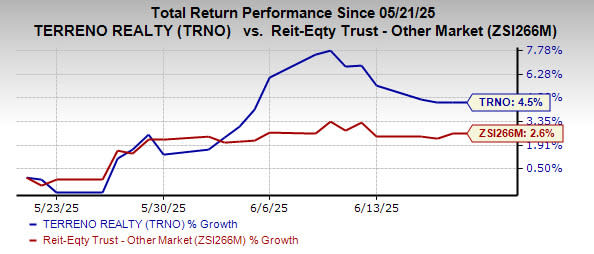

Investment Outlook and Market Performance

Shares of TRNO have gained 4.5% in the past month, outperforming the industry's rise of 2.6%. The company carries a Zacks Rank #3 (Hold) and is part of the broader REIT sector. In addition to TRNO, some other well-ranked stocks from the REIT sector include Omega Healthcare Investors (OHI) and W.P. Carey (WPC), both currently carrying a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for OHI's 2025 FFO per share has increased by one cent to $3.02 over the past two months, while the estimate for WPC's 2025 FFO per share has been raised 1% to $4.88 over the past month.

In conclusion, Terreno Realty's strategic acquisitions and expansion efforts position it well for growth in key U.S. markets. However, investors should remain cautious about macroeconomic uncertainties and tariff risks. For the latest recommendations from Zacks Investment Research, download the free report today.

The recent $16M industrial property acquisition by Terreno Realty highlights their strategic foresight for growth in the Queens market, revealing a confident outlook towardsexpanding operations amidst favourable economic conditions.

Impressive move from Terreno Realty as they solidify their industrial portfolio with a strategic $16M acquisition in Queens, paving the way for future growth and demonstrating keen market insight.

This move by Terreno Realty further solidifies its position as a leading industrial real estate player in Queens, showcasing astute strategic growth and optimism about the market's future potential with their $16M property buyout.

A strategic acquisition in Queens exemplifies Terreno Realty's commitment to diversify its industrial portfolio with a $16M investment, an important step towards their growth objectives and market expansion plans.

Impressive move by Terreno Realty expanding its industrial portfolio with a strategic $16M acquisition in Queens, demonstrating their commitment to high-growth potential markets and future market dominance.

This move by Terreno Realty to expand their portfolio with a $16M industrial property buyout in Queens displays strategic foresight and market acumen, poised for growth amidst evolving economic landscapes.

The ambitious expansion of Terreno Realty's portfolio with their strategic $16M industrial property acquisition in Queens underscores the company’smettle for calculated growth, demonstrating both a keen understanding and embraceof local market dynamics.

The acquisition by Terreno Realty marks a strategic move that underscores their commitment to the Queens market with potential for long-term growth and positive outlook, perpetuating its success in industrial property expansion.