Streamline Your Business with Payroll Outsourcing Solutions and Services

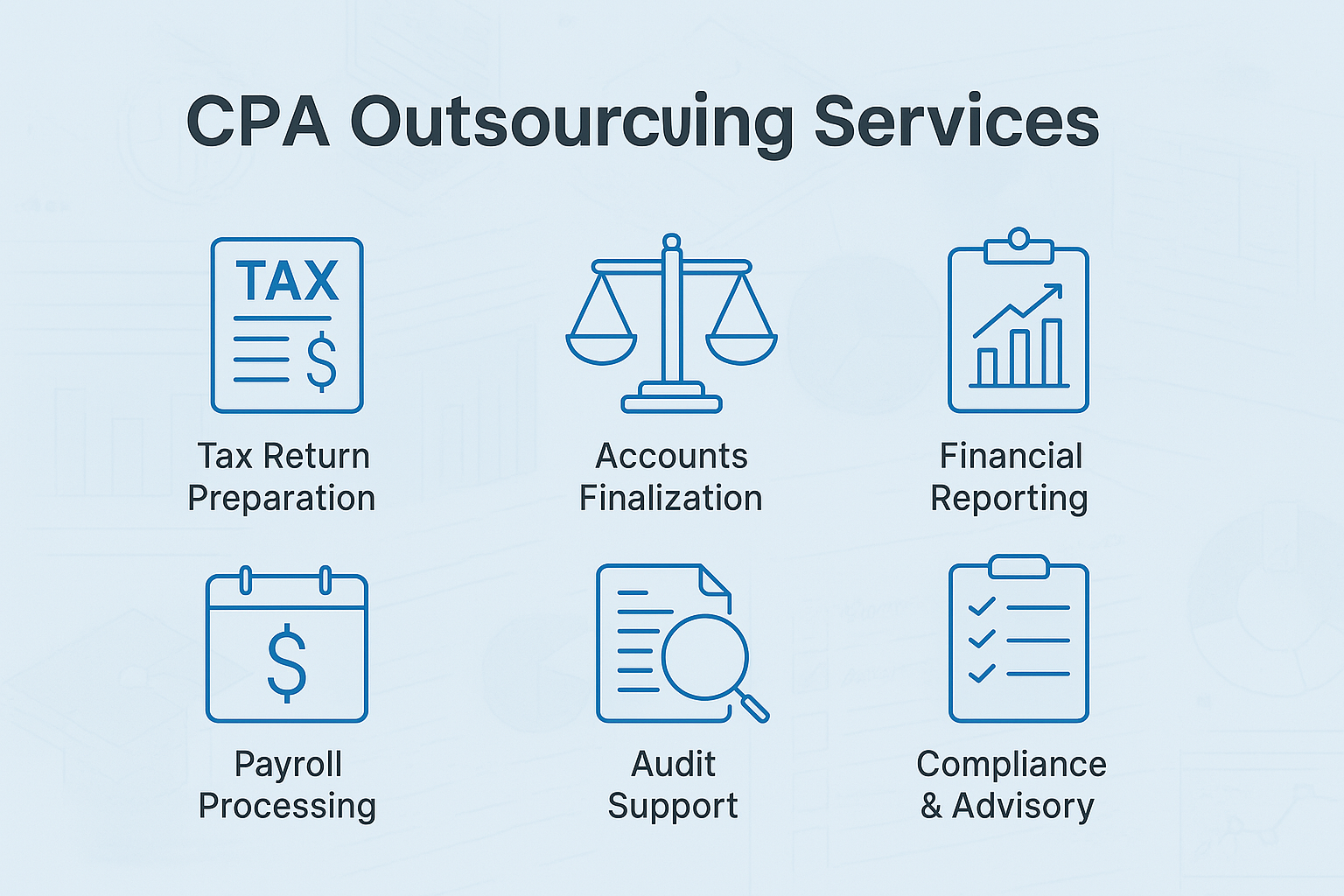

Managing payroll is a critical yet time-consuming task for businesses of all sizes. From calculating wages and deductions to ensuring compliance with tax regulations, payroll processing demands accuracy and efficiency. This is where payroll outsourcing solutions and Payroll Outsourcing Services come into play. By partnering with a reliable payroll service provider, businesses can reduce administrative burdens, minimize errors, and focus on core operations.

In this article, we’ll explore the benefits of payroll outsourcing, how it works, key features to look for in a provider, and why more companies are making the switch.

Why Consider Payroll Outsourcing Solutions?Payroll processing involves multiple complex steps, including:Calculating employee salaries, overtime, and bonusesDeducting taxes, insurance, and retirement contributionsEnsuring compliance with federal, state, and local lawsGenerating payslips and tax formsMistakes in payroll can lead to employee dissatisfaction, legal penalties, and financial losses. Payroll outsourcing services help mitigate these risks by leveraging expert knowledge and advanced software.

Key Benefits of Outsourcing Payroll1.Time and Cost Savings

Handling payroll in-house requires dedicated staff and software, which can be expensive. Outsourcing eliminates the need for internal payroll teams, reducing overhead costs.

2. Compliance and Accuracy

Tax laws and labor regulations change frequently. Professional payroll providers stay updated on compliance requirements, reducing the risk of errors and penalties.

3. Enhanced Data Security

Payroll data is highly sensitive. Reputable outsourcing firms use encryption, secure servers, and strict access controls to protect employee information.

4. Access to Advanced Technology

Leading payroll providers offer cloud-based platforms with features like automated tax filing, direct deposit, and employee self-service portals.

5.Scalability for Growing Businesses

Whether you’re hiring seasonal workers or expanding internationally, outsourcing allows seamless payroll adjustments without additional internal resources.

How Payroll Outsourcing Services WorkWhen you partner with a payroll outsourcing provider, the process typically follows these steps:

1. Initial Setup & Data Integration

The provider collects employee details, tax information, and company policies.

Integration with existing HR and accounting software ensures smooth data flow.

2. Payroll Processing

The provider calculates wages, deductions, and taxes.

They generate payslips and process payments via direct deposit or checks.

3. Tax Filing & Compliance

The service handles payroll tax calculations, filings, and payments to authorities.

They ensure adherence to labor laws, such as minimum wage and overtime rules.

4. Reporting & Support

Businesses receive detailed payroll reports for accounting and auditing.

Customer support is available for queries and troubleshooting.

Choosing the Right Payroll Outsourcing ProviderNot all payroll services are created equal. Here’s what to look for when selecting a provider:

1. Industry Experience

Choose a provider with experience in your business sector (e.g., small businesses, multinational corporations).

2. Compliance Expertise

Ensure they stay updated on tax laws and labor regulations in your region.

3. Technology & Integration

Look for cloud-based platforms with mobile access, employee self-service, and integration with accounting software like QuickBooks.

4. Transparent Pricing

Avoid hidden fees. Compare pricing models (per employee, flat fee, or tiered plans).

5. Customer Reviews & Reputation

Check testimonials and ratings on platforms like G2, Capterra, or Trustpilot.Top Payroll Outsourcing Companies in 2024

ADP – Best for large enterprisesPaychex – Ideal for small to mid-sized businessesGusto – User-friendly for startupsRippling – Combines payroll with HR and IT managementCommon Concerns About Payroll Outsourcing (And Why They Shouldn’t Stop You)

Some businesses hesitate to outsource payroll due to misconceptions. Let’s debunk a few:

1. "Outsourcing Is Only for Big Companies"

False. Many providers offer scalable solutions for startups and SMEs.

2. "We’ll Lose Control Over Payroll"

Reputable providers allow customization and real-time access to payroll data.

3. "It’s Too Expensive"

The cost of errors, penalties, and internal payroll staff often outweighs outsourcing fees.

4. "Data Security Risks"

Established providers use bank-level security measures to protect sensitive information.Final Thoughts: Is Payroll Outsourcing Right for You?If your business struggles with payroll complexity, compliance risks, or inefficiencies, payroll outsourcing solutions and Payroll Outsourcing Services can be a game-changer. By delegating payroll to experts, you free up time, reduce errors, and ensure compliance—all while improving employee satisfaction.

Before choosing a provider, assess your business needs, compare options, and opt for a service that offers scalability, security, and strong customer support. The right payroll partner can transform a tedious task into a seamless, stress-free process.

Payroll outsourcing solutions effectively streamline business operations, freeing up in-house resources to focus on core strategies while ensuring seamless compliance and timely payments for employees. It's a smart way forward towards optimized financial management.

Payroll Outsourcing Solutions effectively streamline business operations by simplifying complex HR processes, ensuring compliance while providing a hassle-free experience for businesses of all sizes.

Payroll outsourcing solutions effectively streamline business operations by freeing up in-house resources, ensuring compliance with statutes and regulations while enhancing consistency across pay structures. This approach saves time & minimizes errors for businesses of all sizes.

Utilizing payroll outsourcing solutions and services has effectively streamlined our business processes, ensuring seamless payments to employees while freeing up in-house resources for growth opportunities.

Outsourcing payroll services has streamlined our company's operations, allowing us to focus on growth while ensuring a seamless and error-free employee compensation process.

Employing Payroll Outsourcing Solutions and Services for businesses streamlines operations, ensuring accuracy while reducing internal burden through a secure and efficient process.

Focusing on core operations while outsourcing payroll to trusted solutions offers businesses a streamlined process, enhancing efficiency and accuracy. A fantastic way forward for optimizing company workflows.

Payroll outsourcing solutions and services streamline business operations, ensuring timely payments with seamless compliance to maintain a hassle-free work environment.

Payroll Outsourcing Solutions and Services offer a seamless way to streamline my business operations, freeing up valuable time while ensuring compliance accuracy in salary management.

Level up your business's efficiency by opting for streamlined payroll outsourcing solutions and services – a smart move towards cost-effectiveness, compliance assurance while enhancing employee satisfaction.

Gaining efficiency and cost-effectiveness with the streamlining of payroll operations through efficient outsourcing solutions is a game changer for businesses, allowing them to focus on core activities while Payforce handles their financial wellness.