Shopify SHOP is growing its presence in the e-commerce domain by offering user-friendly tools and an extensive app marketplace.

According to the Morder Intelligence report, the e-commerce market is projected to be worth $10.19 trillion in 2025. It is expected to reach $21.22 trillion by 2030, with a compound annual growth rate of 15.8% over the 2025-2030 period. Shopify is likely to gain from the massive growth opportunity.

Shopify’s robust growth in its merchant base is driven by its merchant-friendly tools, including Shop Pay, Shopify Pay Instalments, Sign in with Shop and the Shop App. The strong adoption of these solutions holds promise for Shopify’s prospects.

SHOP’s expanding portfolio has been a major growth driver for its success. Its merchant-friendly tool Shop Pay stands out as a key driver. The app processed $22 billion in Gross Merchandise Value in the first quarter of 2025, up 57% year over year. Large brands like Birkenstock, Lilly Pulitzer, and Johnny adopted Shop Pay, enhancing Shopify’s portfolio.

Further expanding its portfolio, Shopify recently partnered with Coinbase and Stripe to enable merchants worldwide to accept USDC stablecoin payments through Shopify Payments. This integration offers fast, borderless transactions on the Base network, with no added fees and seamless checkout experiences.

SHOP Faces Stiff Competition

Shopify is facing stiff competition in the e-commerce marketplace against the likes of Etsy ETSY and BigCommerce BIGC.

BigCommerce is benefiting from its expanding portfolio, particularly with the introduction of Catalyst, enabling businesses to create unique and efficient B2B and B2C e-commerce experiences. BigCommerce also benefits from its AI-powered tools and integrations.

Etsy is benefiting from enhanced personalization through AI, strong mobile app performance, and continued growth in gifting, as well as Depop’s impressive performance.

Etsy is also improving its customer experience through more browsable and personalized shopping experiences, particularly on its mobile app. The app now accounts for 44.5% of total Etsy marketplace Gross Merchandise Sales in the first quarter of 2025, with better buyer conversion rates, more monthly active users, and increased app downloads.

SHOP’s Share Price Performance, Valuation and Estimates

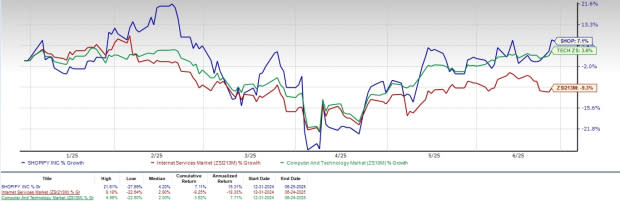

Shopify shares have surged 7.1% year to date, outperforming the broader Zacks Computer & Technology sector’s return of 3.6%. The Zacks Internet Services industry declined 9.3% in the same time frame.

Shopify Stock Performance

Image Source: Zacks Investment Research

SHOP stock is trading at a premium, with a forward 12-month Price/Sales of 12.47X compared with the industry’s 5.05X. SHOP has a Value Score of F.

Price/Sales (F12M)

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for second-quarter 2025 earnings is pegged at 28 cents per share, which has remained unchanged over the past 30 days, indicating a 7.69% increase year over year.

Shopify Inc. Price and Consensus

Shopify Inc. price-consensus-chart | Shopify Inc. Quote

The consensus mark for 2025 earnings is pegged at $1.40 per share, unchanged over the past 30 days, suggesting 7.69% year-over-year growth.

SHOP currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Etsy, Inc. (ETSY) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

BigCommerce Holdings, Inc. (BIGC) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Shopify's swift e-commerce growth demonstrates considerable potential for continued upside, underscoring its resilience and adaptability in the ever changing digital landscape.

Shopify's renewed e-commerce growth trajectory bodes well for a promising future as it solidifies its position at the forefront of driving online business expansions.

Shopify’s escalating e-commerce growth is a testament to its robust platform and innovative features, signaling even more upside potential for merchants looking to soar above competition with ease.

Shopify's escalation in e-commerce growth is not just a blip on the radar but an exhilarating indicator of lasting upward momentum, fueled by its unparalleled platform features and versatility. This trend holds tremendous promise for buyers seeking online shopping solutions worldwide.

Shopify's rising e-commerce growth trajectory, fueled by a strong suite of tools and services catered to small businesses worldwide amidst the pandemic era’th rally in online shopping habits—underscores its promise for continued expansion as this trend remains firmly intact.

With Shopify's e-commerce growth acceleration, it signals a promising journey upwards as the platform continues to innovate and attract more merchants due its scalability for international expansion.

Shopify's continued e-commerce growth momentum suggests a strong foundation for further expansion, fueled by its innovative platform and unwavering commitment to supporting small businesses globally. This development is indeed an encouraging sign of future upside potential.

With Shopify's e-commerce growth picking up pace, it looks like there could be even more potential for upside as the platform continues to evolve and attract a wider range of merchants worldwide.

Shopify's continued e-commerce growth momentum is a clear indication of its enduring appeal and adaptability in the ever evolving digital landscape, signaling an optimistic outlook for future expansion beyond current market boundaries.

Shopify's continued acceleration in e-commerce growth underscores its resilience and potential for further expansion as the digital divide widens. This trend is a clear sign of upside momentum, with innovative solutions tailored to中小型企业需求 fueling ongoing success.

![Isothermal Bags Containers Market [2028]: Top Trends, Size, and Competitive Intelligence - TechSci Research](https://antiochtenn.com/zb_users/upload/2025/07/20250719012446175285948669203.jpg)