Renting vs. Buying: A Comprehensive Analysis of Housing Costs in 342 U.S. Cities

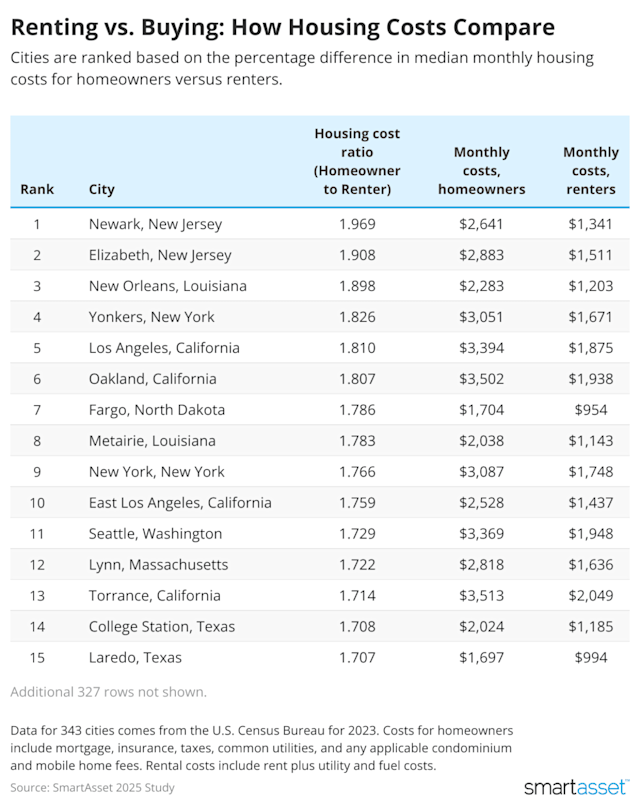

The cost of housing in the United States is a multifaceted issue that goes beyond a simple comparison of monthly rent and mortgage payments. It encompasses additional expenses such as utilities, insurance, maintenance, and taxes. To help individuals make informed decisions about whether to rent or buy, SmartAsset conducted a study ranking 342 of the largest U.S. cities based on the median gross rental and housing costs residents face on a monthly basis.

Key Findings

- Newark, New Jersey: It costs twice as much to be a homeowner than a renter in Newark. Homeowners face median monthly costs of $2,641, or 1.97 times as much as the median monthly costs of $1,341 for renters. The median home value here is $403,500.

- Oakland, California: Homeowners pay $1,564 more per month than renters in Oakland, the greatest dollar premium on homeownership in the study. Homeowners face a median $3,502 in housing bills per month, compared to $1,938 for renters.

- Surprise, Arizona: Renters have the biggest advantage in Surprise, where renting offers a roughly 15% discount—or savings of $321 per month—compared to homeownership. Homeowners pay an average of $1,789, compared to $2,110 for renters.

- In 17 cities, it is cheaper to own your home rather than rent. Most of these cities are in Arizona and Florida.

- South Bend, Indiana: Renters and homeowners are at a dead tie in terms of costs in South Bend, with both coming in at a median of $1,062 per month.

Top 10 Cities Where Homeownership is More Expensive Than Renting

- Newark, New Jersey: Housing cost ratio (Homeowner:Renter) = 1.969; Difference = $1,300; Median monthly costs while renting = $1,341; Median monthly housing costs for homeowners = $2,641; Median home value = $403,500

- Elizabeth, New Jersey: Housing cost ratio = 1.908; Difference = $1,372; Median monthly costs while renting = $1,511; Median monthly housing costs for homeowners = $2,883; Median home value = $468,200

- New Orleans: Housing cost ratio = 1.898; Difference = $1,080; Median monthly costs while renting = $1,203; Median monthly housing costs for homeowners = $2,283; Median home value = $306,400

Top 10 Cities Where Renting is More Expensive Than Homeownership

- Surprise, Arizona: Housing cost ratio (Homeowner:Renter) = 0.848; Difference = -$321; Median monthly costs while renting = $2,110; Median monthly housing costs for homeowners = $1,789; Median home value = $443,500

- San Tan Valley, Arizona: Housing cost ratio = 0.857; Difference = -$300; Median monthly costs while renting = $2,091; Median monthly housing costs for homeowners = $1,791; Median home value = $433,500

Data and Methodology

To determine the net difference in monthly costs for homeowners versus renters, SmartAsset compared the following variables from 342 cities with populations over 100,000 people for which data was available. All data comes from the U.S. Census Bureau’s 2023 American Community Survey:

- Mortgage cost: The median monthly housing costs for owner-occupied housing units with a mortgage. This includes the cost of mortgage, insurance

This comprehensive study, 'Renting vs. Buying: A Comprehensive Analysis of Housing Costs in 342 US Cities,' offers valuable insight into the economic trade-offs between leasing and owning a home across various American metros.

This comprehensive analysis, 'Renting vs. Buying: A Comprehensive Analysis of Housing Costs in 342 U .S Cities,' provides a nuanced view on housing choices by digging deep into the finer details and long-term implications for individuals' financial health across diverse locations.