Plymouth Industrial REIT Expands Ohio Footprint with $193M Acquisition of 21 Industrial Properties

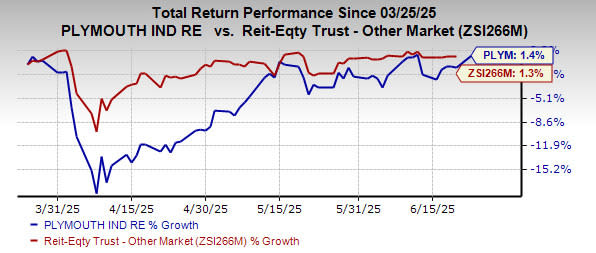

Plymouth Industrial REIT (PLYM) recently announced the acquisition of a portfolio of industrial properties across Columbus, Cincinnati, and Cleveland, OH for $193 million. The portfolio comprises 21 buildings and totals 1.95 million square feet of space, further strengthening Plymouth’s regional presence and aligning with its strategy of acquiring well-positioned, income-generating industrial assets with embedded growth potential. The portfolio includes highly functional industrial assets located in a strong infill location, boasting attractive features such as high clear heights, sufficient truck loading facilities, updated lighting, and modern office finishes. Currently, the portfolio is 97% leased to 75 tenants with a weighted average remaining lease term of 2.47 years. The in-place rents are roughly 22% lower than current market rates, providing significant upside potential at the time of lease rollover. The purchase price represents a discount of more than 25% compared to the current replacement cost. As a result of this acquisition, Plymouth now possesses over 12 million square feet of industrial space within Ohio. The portfolio will be managed by the company’s Columbus office, which employs a team of nine experienced property management professionals. Anthony Saladino, president and CFO of Plymouth, commented on the transaction, stating, “This transaction reflects our continued success in deploying strategic capital into high-quality, functional industrial real estate at compelling economics. By adding scale in our core markets and leveraging our vertically integrated platform, we believe we are well-positioned to drive long-term value creation and deliver strong leasing outcomes across the portfolio.” Shares of Plymouth Industrial REIT have gained 1.4% in the past three months compared with the industry’s growth of 1.3%. The company is a Zacks Rank #3 (Hold) stock. In addition to Plymouth Industrial REIT, two other better-ranked stocks from the broader REIT sector are VICI Properties (VICI) and Medical Properties Trust (MPW), each currently carrying a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for VICI’s 2025 FFO per share has moved one cent northward to $2.35 over the past week. Meanwhile, the Zacks Consensus Estimate for MPW’s 2025 FFO per share has moved one cent northward to 57 cents over the past month. In conclusion, Plymouth Industrial REIT’s strategic acquisition aligns with its long-term growth strategy and positions it well for future success. However, macroeconomic uncertainties and tariff issues remain a concern in the near term. Investors should consider the broader REIT sector for potential opportunities, including VICI Properties and Medical Properties Trust.

For more information on today’s top-performing stocks and insights from Zacks Investment Research, download 7 Best Stocks for the Next 30 Days for free. Click here to get your report now!

Medical Properties Trust, Inc. (MPW) : Free Stock Analysis Report Plymouth Industrial REIT (PLYM) : Free Stock Analysis Report VICI Properties Inc. (VICI) : Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com). For more information on Zacks Investment Research and its recommendations, visit their website today!

The $193M acquisition of 24 industrial properties by Plymouth Industrial REIT expands its Ohio presence, further solidifying the company's position in one of America’swidely used logistics regions.

The strategic $193M acquisition of 21 industrial properties by Plymouth Industrial REIT underscores its commitment to expanding and strengthening the company's footing in Ohio, further solidifying their position as a leading player within US commercial real estate markets.

This bold $193 million acquisition by Plymouth Industrial REIT further consolidates its position in the Ohio market, solidifying it as a leading player within the industrial real estate space with strategic expansions.

The strategic $193M acquisition by Plymouth Industrial REIT further consolidates its position in Ohio's thriving industrial market, demonstrating the fund’sbias for reinforcing long-term stability and growth through sound real estate investments.

The bold $193M acquisition of 20+ industrial properties by Plymouth Industrial REIT bolsters its presence in Ohio, signifying a strategic commitment to the region's growing logistics and manufacturing sectors.

Plymouth Industrial REIT's strategic Ohio expansion marks a significant milestone in solidifying their Midwest industrial portfolio, demonstrating both financial acumen and commitment to long-term growth potential."

The $193 million acquisition of 21 industrial properties by Plymouth Industrial REIT reinforces its commitment to expanding in Ohio, marked a strategic move that illustrates the company's continued growth potential and investment confidence within regional logistics realms.

This bold move by Plymouth Industrial REIT to acquire 21 industrial properties in Ohio for $193M underscores its commitment and strategic expansion plans, embodying a solid growth strategy amid the ever-evolving commercial real estate landscape.