The Progressive Corporation: A Growth Driver in Personal Property Insurance with Sustainable Momentum

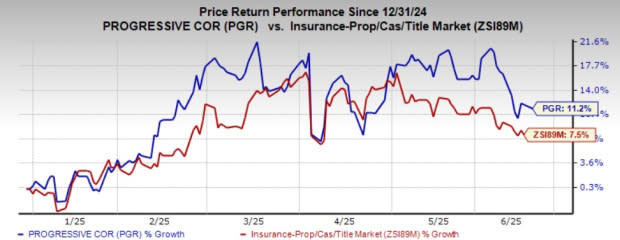

The Progressive Corporation (PGR) is a leading provider of personal property insurance, offering coverage to homeowners, renters, and other property owners. The company has been consistently working to expand its customer base through cross-selling auto policies and Progressive Home Advantage (PHA), which enhances revenue diversification and strengthens customer retention and lifetime value by bundling policies. Bundling policies enables PGR to deepen customer engagement and reduce acquisition costs, providing a competitive advantage by leveraging its extensive auto insurance customer base for cross-selling opportunities. The buyout of American Strategic Insurance and investments in multi-product capabilities further support PGR's expansion into personal lines insurance. PGR's disciplined underwriting approach, conservative reserving, and strong reinsurance protection help manage property loss volatility. Geographic diversification helps mitigate exposure to high-catastrophe regions. The insurer is extending its data-driven underwriting and advanced telematics—initially developed for auto insurance—into the property segment to refine risk assessment and streamline claims processing. With rising consumer demand for integrated insurance solutions, PGR is well-positioned as a one-stop provider for personal insurance needs. Its ability to bundle property and auto coverage reinforces its market positioning. Supported by a strong brand reputation, scalable infrastructure, and innovative pricing technologies, PGR is poised to capture a greater share in the expanding personal property market. While the property segment remains smaller than auto, it holds significant potential to drive future earnings growth and valuation upside. PGR's competitors, such as The Allstate Corporation (ALL) and The Travelers Companies Inc. (TRV), have also been experiencing growth in their personal property insurance businesses, driven by strategic pricing actions, broader distribution reach, and stronger customer retention through bundling. This has led to higher premium growth and improved profitability at both companies. PGR's shares have gained 10.9% year to date, outperforming the industry. However, PGR trades at a price-to-book value ratio of 5.39, above the industry average of 1.56. Despite this, the Zacks Consensus Estimate for PGR's second-quarter and third-quarter 2025 EPS has moved up 11.6% and 1.4%, respectively, over the past 30 days. The same for full-year 2025 and 2026 has increased 2.3% and 0.7%, respectively. Overall, PGR is poised to continue its growth trajectory in the personal property insurance market, supported by its strong brand reputation, innovative pricing technologies, and disciplined underwriting approach. With a focus on expanding its customer base through cross-selling opportunities and leveraging its extensive auto insurance customer base, PGR is well-positioned to capture a larger share of the expanding personal property market in the years ahead.

The progressive Corporation, anchored by its innovative approach and commitment to sustainability in personal property insurance markets through strategic growth drives such as smart technology integration for claims processing efficiency ensures long-term success with steady upward momentum.

The Progressive Corporation has emerged as a dominant force in personal property insurance, consistently driving growth with an unwavering commitment to sustainability and customer-centric innovation.

The progressive steps taken by The Progressive Corporation in personal property insurance with a focus on sustainable growth momentum demonstrate an impressive commitment to forging ahead while ensuring the future of its clients' financial security is protected.