Oktas Cross App Access Expands Security Portfolio: Should You Invest in OKTA Stock?

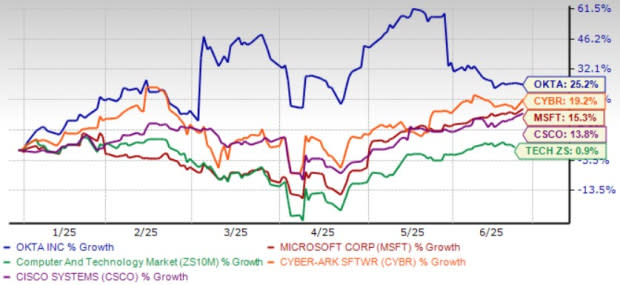

Okta (OKTA) is expanding its security portfolio with the launch of a new protocol, Cross App Access, which helps in securing AI agents. The company is working with ISVs to enable their enterprise customers to better connect their AI tools to other apps and data. This latest protocol removes repetitive authorization consent screens and manages agent access for better security and compliance. The new protocol reflects Okta's commitment to protecting its customers deploying AI. The company's focus on protecting non-human identities (NHIs) and developers building secure agents is noteworthy. NHIs include service accounts, shared accounts, machines, and tokens, and often operate outside traditional identity governance frameworks, leaving organizations vulnerable to security risks. Identity Security Posture Management and Okta Privileged Access help in solving the vulnerabilities related to NHIs. Moreover, for developers, Okta is gaining from the rapid adoption of the Auth0 platform. Auth for generative AI addresses the problem of AI agents creating unsecured NHIs by enabling developers to integrate secure identity into their GenAI applications. Okta's offerings include Okta AI, a suite of AI-powered capabilities embedded across several products, which empowers organizations to harness AI to build better experiences and protect against cyberattacks. The company benefits from strong demand for its new products, including Identity Governance, Privileged Access, Device Access, Fine Grained Authorization, Identity Security Posture Management, and Identity Threat Protection with Okta AI. OKTA's innovative portfolio is helping the company win clients, driving top-line growth. It exited first-quarter fiscal 2026 with roughly 20,000 customers and $4.084 billion in RPOs, reflecting strong growth prospects for subscription revenues. Customers with more than $100 thousand in Annual Contract Value increased by 70 sequentially to 4,870. The combined governance portfolio of Okta Identity Governance, Lifecycle Management, and Workflows has surged 400% over the past three years to nearly $40 billion at the end of the fiscal first quarter. Okta is benefiting from a rich partner base that includes the likes of Amazon Web Services, CrowdStrike, Google, LexisNexis Risk Solutions, Microsoft, Netskope, Palo Alto Networks, Plaid, Proofpoint, Salesforce, ServiceNow, VMware, Workday, Yubico, and Zscaler. The company has more than 7,000 integrations with cloud, mobile, and web applications and IT infrastructure providers as of April 30, 2025. An innovative portfolio and rich partner base have helped Okta shares jump 25.2% year to date, outperforming the Zacks Computer and Technology sector, as well as peers CyberArk, Cisco Systems (CSCO), and Microsoft. While the sector has returned 0.9%, CyberArk, Cisco, and Microsoft shares have appreciated 19.2%, 13.8%, and 15.3%, respectively, over the same timeframe. The stock is currently trading above the 200-day moving average, indicating a bullish trend. For fiscal 2026, OKTA still expects revenues between $2.85 billion and $2.86 billion, indicating 9-10% growth from the figure reported in fiscal 2025. Uncertainty in the federal business, along with challenging macroeconomic conditions, are headwinds for the company. However, Okta expects fiscal 2026 non-GAAP earnings between $3.23 and $3.28 per share, up from previous guidance between $3.15 and $3.20 per share. The Zacks Consensus Estimate for Okta's earnings has increased 9 cents over the past 30 days to $3.28 per share. The earnings figure suggests 16.73% growth over the figure reported in fiscal 2025.