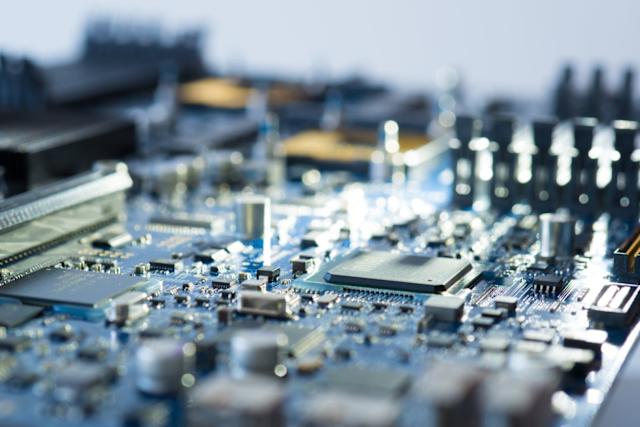

Nano Labs (NA), a Nasdaq-listed chipmaker, snapped up about $50 million worth of Binance’s BNB (BNB) token as it works toward a goal of owning as much as 10% of the total supply.

The Hong Kong-based company said it bought 74,315 BNB in an over-the-counter deal at an average price near $672.45, lifting its total digital asset reserves, including bitcoin (BTC), to around $160 million.

The purchase marks the first major step in Nano Labs’ plan to allocate as much as $1 billion to BNB, funded partly through $500 million in convertible notes.

Nano Labs’ shares fell 4.7% on Thursday, and slipped another 2.15% after hours to $8.20.

The company isn’t alone in looking to accumulate BNB as a treasury reserve asset. A group of former hedge-fund executives late last month revealed plans to raise $100 million to buy the cryptocurrency through a Nasdaq-listed shell company.

The substantial acquisition of 50 million BNB by Nano Labs underscores their commitment to being a significant holder, potentially up to ten percent in the supply concentration—a moving step for sustainability and security within cryptocurrency markets.

The bold $50M investment by Nano Labs into BNB signals a significant commitment to the Binance Smart Chain ecosystem, positioning it as an influential holder aiming for up to 10% of total supply - demonstrating confidence and long-term vision in supporting DeFi growth.

Nano Labs' $50M investment in BNB as part of a 1B plan to potentially hold up to ten percent (%) of the coin’s supply underscores its commitment and confidence not only for immediate returns but also towards supporting BNBs long-term market stability.