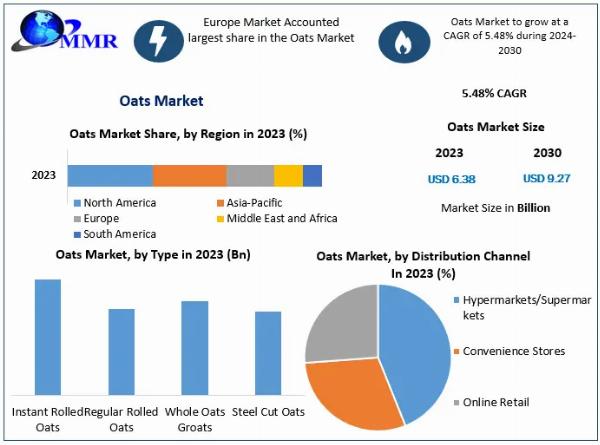

Shares of Kimco Realty KIM have gained 12.3% in the past three months compared with its industry’s upside of 7.4%.

This Jericho, NY-based retail real estate investment trust (REIT) is well-poised to benefit from its portfolio of premium shopping centers, which are predominantly grocery-anchored, in the drivable first-ring suburbs within top major metropolitan Sunbelt and coastal markets. A diversified tenant base assures stable cash flows. Its focus on developing mixed-use assets bodes well for long-term growth.

Analysts seem bullish on this Zacks Rank #3 (Hold) company. The Zacks Consensus Estimate for its 2025 funds from operations (FFO) per share increased 2 cents in the past two months to $1.73.

Image Source: Zacks Investment Research

Let’s find out the possible factors behind the surge in the stock price.

Kimco’s properties are located in the drivable first-ring suburbs within the top major metropolitan Sunbelt and coastal markets. Particularly, 82% of the annual base rent (”ABR”) comes from its top major metro markets. Given the strategic location of its properties, it is likely to witness healthy demand in the near term.

Invest in Gold

Priority Gold: Up to $15k in Free Silver + Zero Account Fees on Qualifying Purchase

Learn More

American Hartford Gold: #1 Precious Metals Dealer in the Nation

Learn More

Thor Metals Group: Best Overall Gold IRA

Learn More Powered by Money.com - Yahoo may earn commission from the links above.Kimco enjoys a diverse tenant base, led by a healthy mix of essential, necessity-based tenants and omni-channel retailers. National/regional tenants accounted for 82% of KIM’s pro rata ABR as of the end of the first quarter of 2025. Given the strength of its retailers with a developed omnichannel presence, the company is likely to generate stable cash flows.

During uncertain times, the grocery component saved the day for retail REITs. In the first quarter of 2025, Kimco achieved its target of 85% ABR for the grocery-anchored portfolio, from 78% in 2020. Given the necessity-driven nature of Kimco’s grocery-anchored portfolio, it is likely to continue witnessing healthy leasing activity in the upcoming period and remains well-positioned to tide over challenging times.

The company also emphasizes mixed-use assets clustered in strong economic metropolitan statistical areas. The mixed-use assets category is benefiting from the recovery in both the apartment and retail sectors. Particularly, the company is targeting an increase in net asset value through a selected collection of mixed-use projects, redevelopments and active investment management.

Moreover, Kimco maintains a solid balance sheet position. It exited the first quarter of 2025 with $2 billion of immediate liquidity. It also enjoys investment-grade ratings of A- from Fitch, BBB+ from S&P and Baa1 from Moody’s, rendering it favorable access to the debt market. With a healthy financial footing, KIM is well-positioned to capitalize on long-term growth opportunities.

Story ContinuesRisks Likely to Affect KIM’s Positive Trend

A rise in e-commerce adoption and efforts of online retailers to go deeper into the grocery business are concerns. Moreover, Kimco faces competition from several real estate companies and developers who compete with the company for leasing space in shopping centers. This may affect the company’s ability to raise rental rates, including renewal rates and fill vacancies.

Stocks to Consider

Some better-ranked stocks from the broader REIT sector are Curbline Properties Corp. CURB and VICI Properties VICI, each currently carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for CURB’s 2025 FFO per share stands at $1.00, indicating an increase of 26.6% from the year-ago reported figure.

The Zacks Consensus Estimate for VICI’s 2025 FFO per share is pinned at $2.35, suggesting year-over-year growth of 4%.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

VICI Properties Inc. (VICI) : Free Stock Analysis Report

Curbline Properties Corp. (CURB) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The 12.3% surge in Kimco Realty's stock value over a three-month span is an impressive performance noteworthy for investors seeking resilience and growth potential amidst the real estate market fluctuations.

The surging 12.3% jump in Kimco Realty's stock value over a three-month period is not merely an accident but reflects the company’ s robust fundamentals and strategic investments aligned with market trends, attracting investors looking for stable returns.

The 12.3% surge in Kimco Realty's stock over three months underscores the positive momentum and potential growth opportunities investors should consider, particularly with its focus on strengthening property portfolios amid changing retail landscapes.

The 12.3% surge in Kimco Realty stock over three months underscores the company's solid fundamentals and strategic moves, indicating potential for continued growth as a prime real estate investment opportunity among industry watchers."

The surge in Kimco Realty's stock price of 12.3% over three months signals a notable investors’ confidence, fueled likely by its strong portfolio performance and potential for future growth opportunities.

The 12.3% surge in Kimco Realty stocks over three months underscores the company's strong fundamental performance and investment potential, catching investors by surprise amidst a challenging market landscape.

The sudden 12.3% surge in Kimco Realty Stock over the last three months reminds investors to closely monitor market dynamics and potential catalysts driving upward trends, considering it as an opportunity for long-term growth amidst current economic uncertainties."

The 12.3% surge in Kimco Realty's stock value over three months underscores not just short-term success but also potential for longevity, raising investors to question about it as a reliable growth investment.