Mastercards Adaptation to Stablecoins: Navigating the Digital Payment Landscape and Staying Competitive

Mastercard Incorporated (MA) appears well-equipped to navigate the potential disruption posed by stablecoins. Despite major retailers such as Walmart and Amazon considering launching their own stablecoins to reduce dependence on traditional payment networks and avoid interchange fees, the immediate threat to Mastercard’s core business remains limited.

High Yield Savings Offers

Earn 4.10% APY on balances of $5,000 or more with Cit Bank. View Offer.

Earn up to 4.00% APY with Savings Pods at Current Bank. View Offer.

Earn up to 3.80% APY & up to $300 Cash Bonus with Direct Deposit at SoFi Bank. View Offer.

Powered by Money.com - Yahoo may earn commission from the links above.

While stablecoins offer advantages like faster settlement and lower transaction costs, particularly in cross-border payments, they lack essential consumer benefits such as credit access, fraud protection, and reward programs, areas where Mastercard holds a distinct competitive edge. In addition, widespread adoption of stablecoin-based payment systems faces considerable barriers, including trust deficits, infrastructure gaps, and regulatory uncertainty.

Mastercard is not standing idle amid these changes. The company has already introduced initiatives like its Multi-Token Network and has piloted USDC settlements to integrate blockchain technology into its payment infrastructure. These efforts indicate that Mastercard aims to evolve its business model to incorporate stablecoin transactions rather than be displaced by them.

Past technological shifts, such as the rise of mobile wallets, ultimately complemented rather than replaced traditional card networks, and a similar outcome may occur with stablecoins. Nevertheless, there are potential revenue risks if merchant-led stablecoin platforms gain faster traction than anticipated, especially in high-fee or cross-border segments.

Overall, while stablecoins introduce new pricing pressures, Mastercard’s proactive innovation strategy and well-established consumer advantages suggest that the company is more likely to adapt and thrive alongside this emerging technology than face existential decline.

How Visa and PayPal are Integrating Stablecoins

Visa Inc. (V) and PayPal Holdings, Inc. (PYPL) are actively incorporating stablecoins into their operations to stay competitive in the evolving digital payment landscape. In 2020, Visa launched pilots using USDC for settling transactions on its network, enhancing cross-border payment efficiency by reducing costs and processing times. Visa is partnering with crypto wallets to enable stablecoin payments across its merchant network. Similarly, PayPal has launched its own stablecoin, PYUSD, built on the Ethereum blockchain, enabling users to buy, sell, and transfer the token directly within its platform and on some external wallets. This move enhances transaction speed and reduces costs while strengthening PayPal’s presence in the blockchain and digital asset ecosystem.

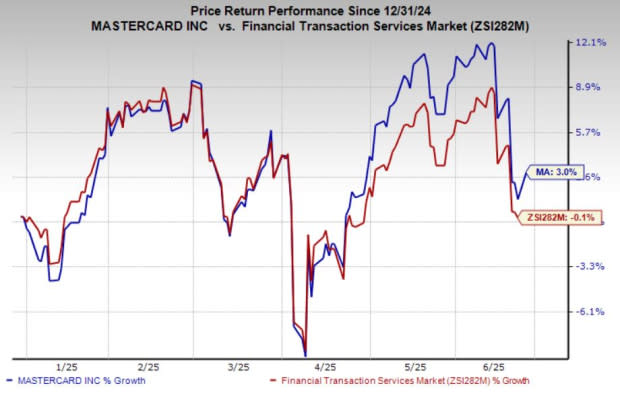

Mastercard’s Price Performance, Valuation, and Estimates

Shares of Mastercard have gained 3% year to date, outperforming the broader industry’s decline of 0.1%. From a valuation standpoint, Mastercard trades at a forward price-to-earnings ratio of 31.42X, higher than the industry average. Mastercard carries a Value Score of D. The Zacks Consensus Estimate for Mastercard’s fiscal 2025 earnings implies a 9.5% rise year over year, followed by 16.7% growth next year. The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report: Mastercard Incorporated (MA) : Free Stock Analysis Report | Visa Inc. (V) : Free Stock Analysis Report | PayPal Holdings, Inc

In the shift towardsStablecoin integration, Mastercard's adaptability and strategic moves set a benchmark for maintaining competitive edges in navigating digital payment landscapes.

Mastercard's continuous adaptation to stablecoins holds the key for navigating through today’ Increasingly Digital Payment Landscape, ensuring a stay ahead of competition with seamless integration into modern payment systems.

In the era of digital payment acceleration, Mastercard's adaption to stablecoins not only paves a path for it in navigating through this novel landscape but also reinforces its standing as an influential player that is fiercely competitive and agile towards changes.

Mastercards adaptation to stablecoins represents a strategic pivot towards the future of digital payments, demonstrating their commitment and resilience in navigating one of today's most dynamic payment landscapes while remaining competitive.

The adaption of Mastercards into the stablecoin realm is a strategic move to navigate both traditional and emerging digital payment landscapes, ensuring its competitive edge amidst ongoing innovations in cryptocurrency.

As digital payment amalgamates with stablecoins, Mastercards adaptation to this paradigm shift warrants a strategic approach of staying not just ahead but fundamentally relevant in maintaining competitive edge while navigating the intricate landscape.

Mastercards' accommodating stance towards stablecoins holds the key to navigating a smoothly integrating digital payment landscape, where remaining competitive is hinged on adaptability and embracing emerging trends.