Home Depots Growth Potential Hinges on Big-Ticket Demand Recovery: Challenges and Opportunities

The Home Depot Inc. (HD) has continued to experience strength in smaller-scale DIY and maintenance projects, such as appliances, building materials, and lumber. However, the missing catalyst for sustained top-line acceleration lies in the revival of big-ticket remodel and renovation spend. The company has seen soft engagement for big-ticket discretionary categories, such as kitchen and bath remodels, as higher interest rates have discouraged financing-dependent projects.

Big-Ticket Sales Slowdown

Big-ticket sales, often a barometer of remodeling demand, grew just 0.3% in the first quarter of fiscal 2025. This slowdown led to a decline in the company's overall comparable sales (comps) of 0.3%, with U.S. comps up just 0.2%. Given that big-ticket categories like kitchen, bath, and major exterior remodels can represent 10-15% of total ticket sales, even a modest rebound can translate into hundreds of millions in incremental revenues.

Consumer Behavior Shifts

With no major improvement expected in interest rates or housing turnover in 2025, the company anticipates continued pressure on big-ticket renovations such as kitchen and bath remodels. While Pro sales have been strong, the shift in consumer spending toward smaller-scale repairs and maintenance projects suggests that larger project demand may not rebound meaningfully in the near term, limiting growth potential in high-margin categories.

Positioning for Growth

Home Depot has been positioning itself to capture this spending surge through its SRS acquisition and trade-credit rollout, offering financing options to thousands of pros. Streamlined digital and in-store lending tools make qualifying for consumer project loans easier. With in-stock rates for building materials and fixtures at record highs, Home Depot is ensuring that when rates soften, it can fulfill large orders without delay.

Competitor Challenges

Home Depot's primary competitors, Lowe’s Companies Inc. (LOW) and Walmart Inc. (WMT), are also grappling with headwinds from muted demand in big-ticket categories. Like Home Depot, both retailers are seeing cautious consumer behavior, particularly in discretionary, high-value purchases such as appliances and home upgrades. Lowe’s big-ticket sales, those above $500, also remained soft in the first quarter of fiscal 2025, particularly in appliances and outdoor living. Walmart’s big-ticket discretionary sales have been soft, particularly in electronics, appliances, and home goods, as inflation-sensitive consumers prioritize essentials over discretionary spending.

Investment Outlook

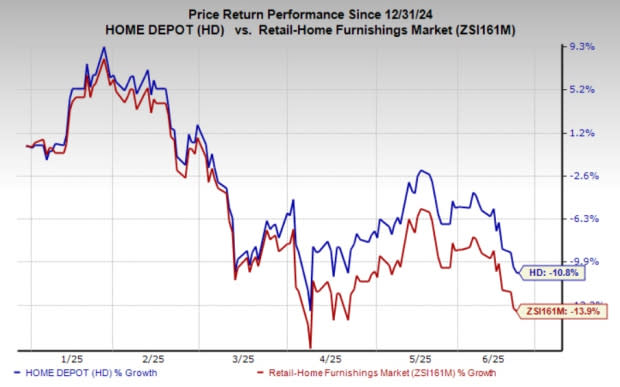

From a valuation standpoint, Home Depot trades at a forward price-to-earnings ratio of 22.31X, significantly higher than the industry’s 19.68X. It has a VGM Score of B. The Zacks Consensus Estimate for HD’s fiscal 2025 earnings implies a year-over-year decline of 1.3%, whereas its fiscal 2026 earnings estimates indicate year-over-year growth of 9.2%. Home Depot currently carries a Zacks Rank #3 (Hold).

In conclusion, while Home Depot faces challenges in the big-ticket category due to economic pressures and consumer behavior shifts, the company is positioning itself for growth through strategic moves and financial options. Investors should monitor interest-rate trends and early signs of increased financed project activity to gauge the potential for a rebound in big-ticket demand. A sustained acceleration in large-scale remodels could unlock significant growth opportunities for Home Depot and its competitors.

The growth potential of Home Depot hinges on a robust recovery in big-ticket demands, presenting both daunting challenges with initial consumer hesitancy and numerous opportunities to capitalize upon once markets rebound.

The future growth trajectory of Home Depot hinges crucially on the robust recovery in demand for big-ticket items, presenting both formidable challenges as well as untapped opportunities to adapt and thrive within an evolving retail landscape.

In the realm of Home Depot's growth potential, its vitality pivots on a robust recovery in big-ticket demand—a tale that intertwines challenges with reverberating opportunities across diverse sectors ranging from home renovations to professional construction.

The future growth trajectory of Home Depot rides a delicate balance on the rebound in demand for big-ticket items, presenting both resilient opportunities to capitalize and formidable challenges requiring strategic adaptation amidst an uncertain economic landscape.

Home Depot's future growth heavily relies on the resilience of big-ticket item demand recovery, presenting both daunting challenges in navigating an uncertain economic climate and untapped opportunities to capitalize upon increased consumer spending once market conditions stabilize.

Home Depot's continued growth potential lies in the resilience of big-ticket demand recovery—a juncture fraught with challenges but also rifewith opportunities for innovative strategies and expanded market share.