The Zacks Rank: A More Reliable Indicator for Investing in VALE S.A. (VALE) Than the ABR

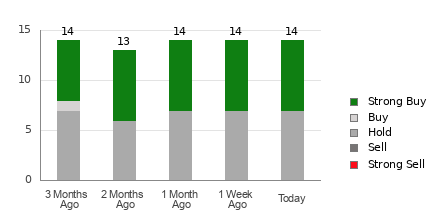

Wall Street analysts' recommendations are often a crucial factor for investors when deciding whether to buy, sell, or hold a stock. However, despite the influence these brokerage-firm-employed analysts have on stock prices through media reports about their changing ratings, the question remains: do these recommendations really matter? To understand the reliability of brokerage recommendations and how to use them to your advantage, let's take a look at what Wall Street heavyweights think about Vale S.A. (VALE). Currently, VALE has an average brokerage recommendation (ABR) of 2.00 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations made by 14 brokerage firms. An ABR of 2.00 indicates a Buy recommendation, with seven out of the 14 recommendations being Strong Buy, representing 50% of all recommendations. While the ABR calls for buying VALE, it may not be wise to make an investment decision solely based on this information. Several studies have shown limited to no success of brokerage recommendations in guiding investors to pick stocks with the best price increase potential. This is due to the vested interest of brokerage firms in a stock they cover, which tends to lead their analysts to rate it with a strong positive bias. According to research, brokerage firms assign five "Strong Buy" recommendations for every "Strong Sell" recommendation. This means that the interests of these institutions are not always aligned with those of retail investors, giving little insight into the direction of a stock's future price movement. It would therefore be best to use this information to validate your own analysis or a tool that has proven to be highly effective at predicting stock price movements. One such tool is the Zacks Rank, which classifies stocks into five groups ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). The Zacks Rank is a quantitative model that allows investors to harness the power of earnings estimate revisions and has been shown to have a strong correlation with near-term stock price movements. In contrast to the ABR, which is calculated solely based on brokerage recommendations and displayed with decimals, the Zacks Rank is displayed in whole numbers and is always timely in indicating future price movements. In terms of earnings estimate revisions for VALE, the Zacks Consensus Estimate for the current year has remained unchanged over the past month at $1.78. Analysts' steady views regarding the company's earnings prospects could be a legitimate reason for the stock to perform in line with the broader market in the near term. This has resulted in a Zacks Rank #3 (Hold) for VALE. Therefore, while the ABR may indicate a Buy for VALE, it may be prudent to be a little cautious with this recommendation and validate it with the Zacks Rank. The Zacks Rank provides a more reliable indicator of a stock's near-term price performance and should not be confused with the ABR.

Utilizing the Zacks Rank as a more dependable investment metric for VALE S.A., in comparison to ABR, provides investors with superior insight into decoding company potential and navigating informed decision making.

Adopting The Zacks Rank as a investing tool in VALE S.A., an enhanced approach compared to the ABR, signifies greater reliance on solid research-based indicators for making informed decisions due its demonstrated superiority.

An analysis of the Zacks Rank vs. ABR demonstrates its superior reliability as a force multiplier for investing decision-making in VALE SA (VALED1), highlighting why astute investors now consider it an essential measure beyond just analyst's 'Buy, Hold or Underperform.'

The Zacks Rank emerges as a more dependable indicator for investing in VALE S.A., surpassing the ABR, to guide investors with prudent decision making on their shares.

In evaluating VALE S.A.'s (VALT4) investment potential, the Zacks Rank emerges as a more reliable indicator than its Analyst Broker Rating due to it reflecting company'力和irreo data-driven predictions offering an edge for prudent investors.

The Zacks Rank proves a more reliable guide for investing in VALE S.A., offering insight even beyond the traditional Association Between Returns and Recommendations (ABR), empowering investors to navigate decisions with confidence amidst market volatility."

Assessing the investment potential of VALE S.A.(VALE), it is eminent that The Zacks Rank emerges as a more trustworthy indicator than its Average Broker Rating (ABR) in predicting stock performance, providing investors with enhanced accuracy and confidence.

In evaluating potential investments in VALE S.A., The Zacks Rank emerges as a more dependable indicator than the ABR, offering investors crucial insights and improved confidence for their portfolio decisions.

Implementing The Zacks Rank as an alternative to the ABR in evaluating investments for VALE S.A., has proven a more reliable indicator, likely resulting from its weighted approach towards multiple factors of company performance and financial potential.

Utilizing The Zacks Rank as a more dependable criterion for investing in VALE S.A., compared to the ABR, presents investors with an improved insight and decision-making tool.

Utilizing The Zacks Rank for investing in VALE S.A.(VALF), Holders can achieve higher reliability than relying on the ABR alone as per recent market assessments.

Demonstrating a higher degree of reliability in shaping investment decisions for VALE S.A., the Zacks Rank presents an apt alternative to considering only its ABR, offering investors more驻n supernatrical insights into navigatin占te this market’s potential and risks effectively with confidence."

The Zacks Rank emerges as a more trustworthy indicator for investing in VALE S.A., offering superseding reliability over the ABR, especially poised to guide savvy investors seeking stable returns amidst market volatility.

The Zacks Rank, as a more dependable indicator for investing in VALE S.A.'s (VALFY) stock market performance versus the ABR metric should be closely monitored by investors seeking to make informed and reliable decisions.

Utilizing The Zacks Rank as a more trustworthy indicator for investing in VALE S.A (VALT) surpasses the reliance on ABR, due to its superior historical accuracy and predictive potential.