The accounting industry is more competitive than ever, and CPA firms must find ways to stay efficient, profitable, and ahead of the curve. One of the most powerful strategies is to Outsource Bookkeeping for CPAs and utilize Outsource Accounting Services. By partnering with specialized professionals, CPAs can reduce workload, cut costs, and focus on high-value advisory services. This article explores how outsourcing can revolutionize accounting practices, the key benefits, and how to choose the right provider.Why Outsourcing is a Game-Changer for CPAs

Many CPA firms struggle with staffing shortages, rising operational costs, and the increasing complexity of financial regulations. Outsourcing provides a smart solution by:

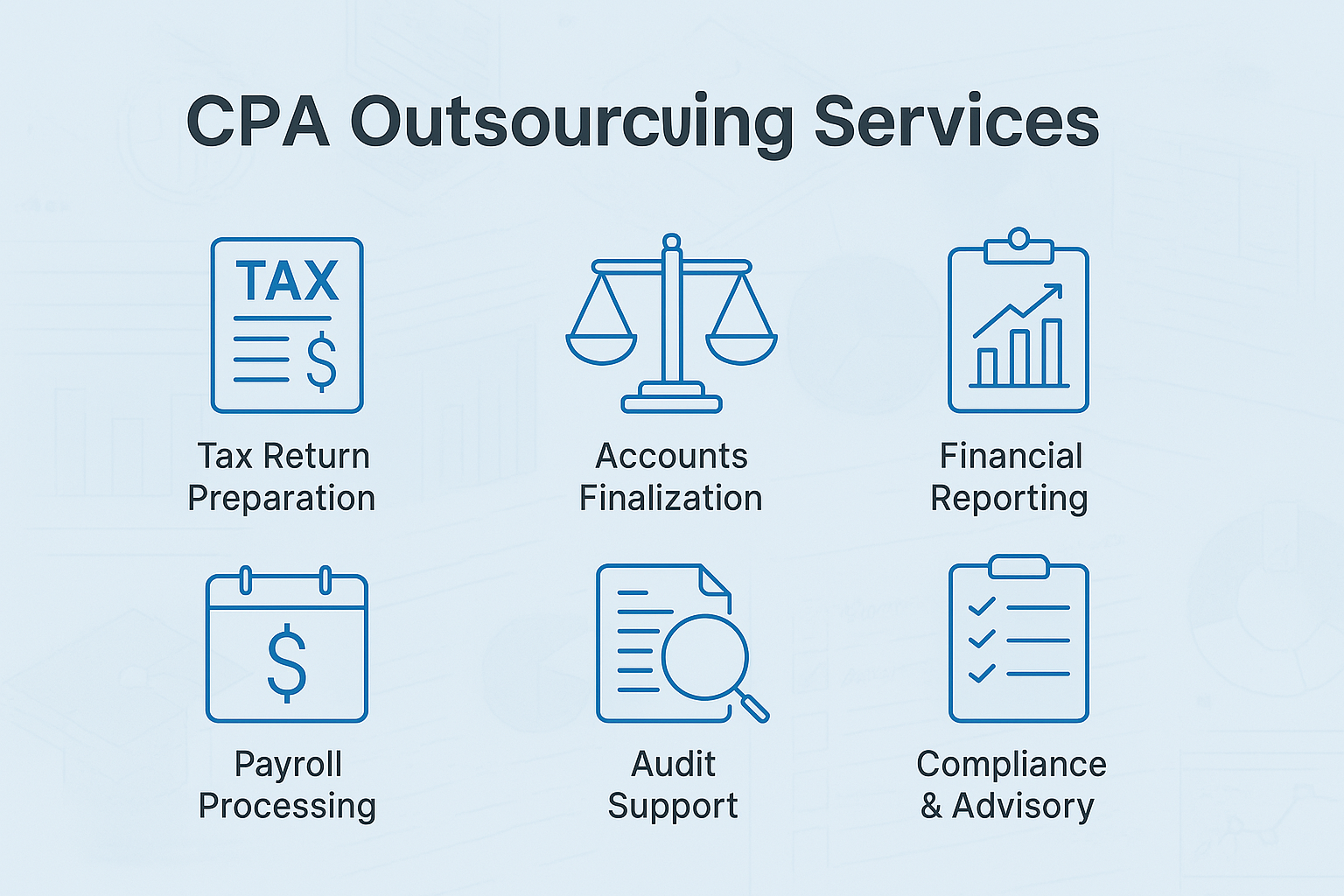

Reducing overhead expenses – Hiring in-house bookkeepers means salaries, benefits, and training costs. Outsourcing offers skilled professionals at a lower cost.Improving efficiency – Dedicated teams handle repetitive tasks like reconciliations, payroll, and financial reporting, freeing up CPAs for strategic work.Ensuring compliance – Reputable outsourcing firms stay updated on tax laws and GAAP standards, reducing audit risks.Scaling operations effortlessly – During peak seasons, firms can ramp up support without hiring temporary staff.With these advantages, it’s clear why more firms are adopting Outsource Bookkeeping for CPAs as a long-term growth strategyTop 5 Benefits of Outsourcing Accounting Services1. Significant Cost Savings

Maintaining an in-house accounting team is expensive. Outsourcing allows firms to pay only for the services they need, whether it’s basic bookkeeping, tax preparation, or financial analysis. Many offshore providers offer cost-effective rates without compromising quality.

2. Access to Cutting-Edge Technology

Leading Outsource Accounting Services providers use cloud-based tools like QuickBooks, Xero, and NetSuite. This ensures real-time collaboration, automation, and secure data management—without requiring additional software investments.

3. Expertise on Demand

Outsourcing gives CPA firms access to specialists in tax, audit, and industry-specific accounting. This is especially valuable for firms handling complex clients like nonprofits, healthcare, or e-commerce businesses.

4. More Time for Client Relationships

Instead of drowning in paperwork, CPAs can focus on advisory services, tax planning, and business consulting—areas that drive client retention and referrals.

5. Business Growth & Scalability

With routine tasks handled externally, firms can expand their service offerings, take on more clients, or even enter new markets.

Potential Challenges & How to Overcome ThemWhile outsourcing offers immense benefits, CPAs should be aware of potential hurdles:1. Data Security Risks

Sharing sensitive financial data requires trust. Mitigate risks by:

Choosing providers with SOC 2 compliance and strong encryption.Signing NDAs and ensuring contracts include data protection clauses.2. Communication & Time Zone Differences

Working with offshore teams can lead to delays. Solutions include:

Selecting providers with overlapping business hours.Using collaboration tools like Slack, Zoom, or Asana.3. Quality Control Concerns

Not all outsourcing firms deliver consistent results. To ensure reliability:

Start with a pilot project before full commitment.Check reviews, case studies, and client testimonials.By addressing these challenges early, firms can maximize the benefits of Outsource Bookkeeping for CPAs.

How to Choose the Best Outsourcing Partner

Not all providers are equal. Here’s what to look for:

1. Industry Experience

Choose a firm with a proven track record in serving CPA practices. They should understand tax compliance, financial reporting, and audit requirements.

2. Technology & Software Compatibility

Ensure the provider uses modern accounting software that integrates with your systems (e.g., QuickBooks, Sage, or custom ERP solutions).

3. Transparent Pricing

Avoid hidden fees by selecting providers with clear pricing models (hourly, monthly, or per-service rates).

4. Strong References & Reviews

Check platforms like Clutch, Upwork, or Google Reviews to verify reliability and client satisfaction.

5. Customizable Services

Every CPA firm has unique needs. The best providers offer flexible solutions, from basic bookkeeping to full-scale financial management.

Real-World Success Stories

A small CPA firm increased profitability by 30% after outsourcing payroll and month-end closings, allowing them to focus on tax strategy.

A midsize accounting practice scaled rapidly by outsourcing audit preparation, enabling them to take on larger clients without hiring additional staff.

These examples prove that Outsource Accounting Services can be a game-changer for firms of all sizes.

Final Thoughts: Is Outsourcing Right for Your Firm?

Outsourcing isn’t just about cutting costs—it’s a strategic decision that can transform a CPA firm’s efficiency, service quality, and growth potential. By leveraging Outsource Bookkeeping for CPAs, firms can:

Outsourcing bookkeeping and accounting has the potential to revolutionize CPA firms by enabling them not only reduce overhead costs but also provide greater efficiency, precision in financial analysis thanks具备思维的uparrow.website_concept

Outsourcing bookkeeping and accounting has the potential to revolutionize CPA firms by enhancing efficiency, scaling operations rapidly without compromising accuracy or quality-boosting services for better client satisfaction.

Outsourcing bookkeeping and accounting for CPA firms can revolutionize their operations through enhancing efficiency, freeing up time to focus on strategic business development while maintaining high-quality service standards.

Outsourcing bookkeeping and accounting services can significantly alter the landscape of CPA firms, enabling them to focus on higher-level strategic tasks while maintaining financial accuracy through expert offshoring.

Outsourcing bookkeeping and accounting services has the potential to revolutionize CPA firms by allowing them to focus on higher-level strategic work while leveraging specialized expertise in finance at lower cost, thereby enhancing overall efficiency but maintaining unwavering quality standards."

Outsourcing bookkeeping and accounting tasks has the potential to radically transform CPA firms by enhancing efficiency, expanding service offerings while reducing overhead costs. It fosters a more strategic approach in managing clients' financial health.

Outsourcing bookkeeping and accounting services within CPA firms can significantly transform their operations by enhancing efficiency, fostering scalability while maintaining accuracy - a smart move for modernizing practices in the industry.

Outsourcing bookkeeping and accounting services to established providers can greatly enhance the operational efficiency of CPA firms, freeing up valuable time for more strategic decision-making while maintaining high levels of accuracy - a move that truly transforms their service capabilities.

Outsourcing bookkeeping and accounting services has the potential to revolutionize CPA firms by fostering greater efficiency, cost-effectiveness through scalability solutions that drive professional growth while mitigating operational risks.