Copa Holdings CPA is benefiting from its robust expansion and modernization efforts, boosting the company’s operational efficiency. The shareholder-friendly initiatives are also encouraging. Owing to these tailwinds, CPA shares have performed impressively on the bourse. If you have not taken advantage of its share price appreciation yet, it’s time to do so.

Upsides for CPA

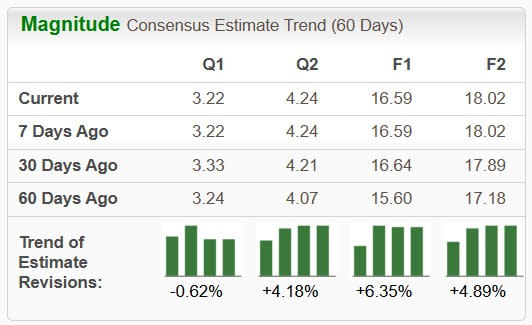

CPA’s Northward Earnings Estimate Revision: The Zacks Consensus Estimate for earnings per share has been revised upward by 6.4% over the past 60 days for the current year. For 2026, the consensus mark for earnings per share has moved 4.9% north in the same time frame. The favorable estimate revisions indicate brokers’ confidence in the stock.

Image Source: Zacks Investment Research

Robust Price Performance: A look at the company’s price trend reveals that its shares have risen 19.9% year to date, surpassing the Zacks Transportation – Airline industry’s 7.1% fall.

Image Source: Zacks Investment Research

Positive Earnings Surprise History: Copa Holdings has an encouraging earnings surprise history. The company's earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 5.5%.

Solid Zacks Rank: CPA currently sports a Zacks Rank #1 (Strong Buy).

High Yield Savings Offers

Earn 4.10% APY** on balances of $5,000 or more

View Offer

Earn up to 4.00% APY with Savings Pods

View Offer

Earn up to 3.80% APY¹ & up to $300 Cash Bonus with Direct Deposit

View Offer Powered by Money.com - Yahoo may earn commission from the links above.Bullish Industry Rank: The industry to which CPA belongs currently has a Zacks Industry Rank of 48 (out of 244). Such a favorable rank places it in the top 20% of Zacks Industries.Studies show that 50% of a stock price movement is directly related to the performance of the industry group to which it belongs.

A mediocre stock within a strong group is likely to outperform a robust stock in a weak industry. Reckoning the industry’s performance becomes imperative.

Growth Factors: Copa Holdings continues to drive long-term growth and modernization, ending the first quarter of 2025 with a streamlined fleet of 112 Boeing 737 aircraft. This uniform fleet supports cost-efficient operations and simplified maintenance. Strengthening its future plans, Copa exercised options for six additional 737 MAX-8s for delivery in 2028, raising its firm order book to 57. Operationally, the airline led the industry with a 90.8% on-time performance and a 99.9% flight completion rate, underscoring its focus on efficiency and reliability.

Copa’s commitment to delivering shareholder value remains strong. In 2024, the company repurchased $87 million in shares under its $200 million share buyback program, representing approximately 2% of total outstanding shares at year-end. In addition, Copa’s board approved a quarterly dividend of $1.61 per share for 2025, payable on June 13 to shareholders of record as of May 30. Through share repurchases and consistent dividends, Copa continues to prioritize long-term value for its investors.

Story continuesOther Stocks to Consider

Investors interested in the Transportation sector may also consider SkyWest SKYW and Air Lease AL.

SKYW currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SKYW has an expected earnings growth rate of 19.4% for the current year. The company has an impressive earnings surprise history. Its earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average beat of 17.1%. Shares of SKYW have risen 21.1% year to date.

AL currently carries a Zacks Rank #2.

The company has a mixed earnings surprise history. Its earnings outpaced the Zacks Consensus Estimate in two of the trailing four quarters and missed twice, delivering an average beat of 5.2%. Shares of AL have rallied 18.5% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Air Lease Corporation (AL) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Copa Holdings' steadfast commitment to efficiency, expanding route networks and strong financial performance make its stock an enticing investment for astute investors seeking steady growth potential.

Investing in Copa Holdings now is a prudent decision, as the company's solid financial performance and reliable operations make it an attractive option for risk-aware investors seeking long term gains.

A timely investment in Copa Holdings stock presents a strong case for returning investors, as they stand to benefit from the carrier's resilient international route network and expanding domestic operations - making it an attractive proposition now."

Investors looking for a sound investment with solid growth prospects should consider betting on Copa Holdings stock now, owing to its progressive expansion strategies and robust financial performance amidst Latin America's aviation recovery.

In investing, Copa Holdings' robust financial performance and strategic alignment with the changing travel trends make it a compelling choice for those willing to bet on accessibility-centered aviation now.

Currently, investors have sound reasons to place their bets on Copa Holdings' stock as it displays solid financial performance amidst the industry uncertainty with a strategic focus that exemplifies resilience and long-term potential.