Fragile Middle East Truce Heightens Geo-political, Macroeconomic Risks, Including for Europe

Israel and Iran have agreed on a tenuous truce this week following the recent hostilities. Nevertheless, the risk of further regional escalation – and the possible effect on oil markets and international trade – remains given the lack of international consequences for Israel and the United States from their attacks on Iran and uncertainty over what impact the joint military action has had in curtailing Iran’s nuclear activities.

In addition, the shift by the US away from a traditional role as the post-war guarantor of international norms raises the risks of broader conflicts elsewhere. The issue is particularly acute for Europe considering the ongoing war in Ukraine where there are limited signs the Kremlin is interested in pursuing a full ceasefire or longer-lasting truce.

In the longer run, the Iran-Israel crisis may raise the risk of nuclear proliferation in the Middle East and beyond. The crisis may furthermore accelerate increases in regional military expenditure just as NATO members themselves have agreed to increase defence spending to 5% of GDP – more than double a former target of 2%.

Such heightened geo-political risk is a core downside risk highlighted by Scope Ratings (Scope)’s latest global macro and credit outlook, not least for Europe. Growth in the region remains more moderate than that of the United States and China while increasing defence budgets risk creating extra fiscal strain for sovereigns already struggling to cut budget deficits and reverse increasing public debt.

Germany’s stagnant performance this year should drag euro-area growth to a less-than-expected 1.1%, 0.5pps below Scope Ratings’ October-2024 forecasts, before a slight rebound in 2026 to 1.5%. By contrast, US growth remains comparatively resilient even though Scope has nevertheless lowered its projections to 1.8% for 2025 from a previous projection of 2.7%. China’s economic growth is forecast at a better-than-anticipated 4.8% this year, supported by the ambitious government target for this year of “around 5%” economic growth and the recent temporary easing of US-China trade tensions.

Energy Prices to Stay Volatile; Crisis Presents a Risk to Inflation Outlooks

Inflation remains another potential source of economic weakness, including for Europe, given Scope Ratings’ consistent view that borrowing rates are likely to stay relatively higher for longer, given the higher structural price pressures than before the pandemic.

Here, Europe’s dependence on energy imports continues to be a vulnerability, not least if oil prices stay volatile amid the heightened and unresolved tensions within the Middle East region. This means continued risks for inflation and external-sector balances globally – especially for significant energy importers, which, inside the EU, include economies such as Malta, Cyprus, Luxembourg, Belgium and Greece.

Story ContinuesAs things stand, Brent futures (for August delivery) have dropped to under USD 70 a barrel at the time of writing, from the highs last week at nearly USD 79 a barrel. Oil is today below the levels when Israel began the attacks recently on 13 June. But the uncertainties within the region ensure the volatility in crude prices stays elevated.

Longer-run risks for energy prices remain twofold. Firstly, Iranian crude exports, which have already been declining, could fall further, which would tighten oil markets. The much more significant but less probable scenario involves a closure of the Strait of Hormuz through which 20% of global oil alongside Qatari exports of liquefied natural gas are transported by ship. That said, despite multiple conflicts involving Iran over the years, authorities have never closed the Strait partly because of the economy’s reliance on sea-borne trade with China.

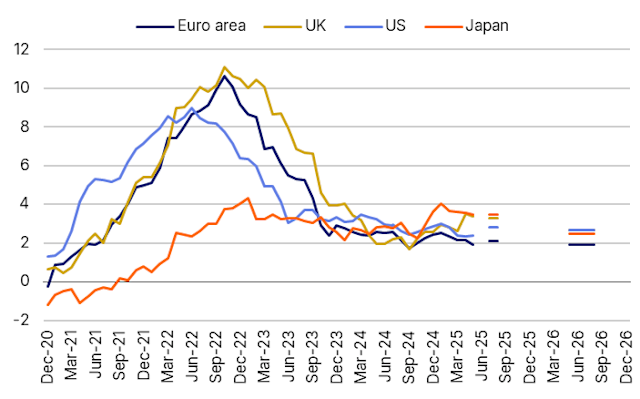

As things stand, Scope projects euro-area inflation staying moderate at 2.1% in 2025 before 1.9% in 2026, but inflation risks remaining more significant for the United States, United Kingdom and Japan (Figure 1).

Figure 1: Disinflation trend continues across many economies but meets road bumps in many others

Headline inflation, with Scope forecasting, % year-over-year

Middle East Conflict Comes as Trade Disruptions Hold Back Global Growth

Regional instability also increases a risk of trade disruptions and the associated effects for consumer and business sentiment in the Middle East, Europe and beyond.

Global growth is forecast to slow to 3.0% in 2025 (cut 0.4pps from Scope’s October forecasts) from 3.3% in 2024 before continuing at a moderate 3.1% next year.

Related material:

Report: Scope’s 2025 mid-year global economic outlook

Slides: Scope Ratings’ 2025 mid-year economic and credit outlook

For a look at all of today’s economic events, check out our economic calendar.

Dennis Shen is the Chair of the Macro Economic Council and Lead Global Economist of Scope Group. The rating agency’s Macroeconomic Council brings together the company’s credit opinions from multiple issuer classes: sovereign and public sector, financial institutions, corporates, structured finance and project finance.

This article was originally posted on FX Empire

More From FXEMPIRE:

-

Bullish Big Money Buying Axon

-

Big Money Lifts Disney 1,427% Since First Outlier Buy

-

Core & Main Flashes Bullish Outlier Signals

-

Veeva Sees Inflows after Earnings Beat

-

Bulgaria Poised to Join the Euro: An Interview with Scope Ratings’ Dennis Shen

-

Strong Inflows Make Catalyst Stock an Outlier

East's delicate balance could unravel due to the newly fortified geopolitical and macroeconomic risks in a fragile Middle East, threatening not just regional stability but also extending its ramifications across Europe with broader implications for global economics.

This fragile truce in the Middle East underscores its pivotal pivot point role, elevating geopolitical volatility and macroeconomic risks that resonate throughout Europe as well.

This recent fragile middle east truce, marked by constant jitters and unexpected twists in the region's geopolitical landscape coupled with potential macroeconomic spillovers for Europe due to energy price fluctuations says little about sustainable peace amidst escalating risks.

The ongoing fragile truce in the Middle East underscores not only regional geopolitical tensions but also heightens macroeconomic risks that could have ripple effects felt across Europe and beyond.

The delicate equilibrium established by the recent Middle Eastern truce underscores a need for heightened strategic vigilance on both regional and international fronts, posing enhanced geopolitical as well macroeconomic risks that might reverberate beyond Europe'd shores.

The delicate truce in the Middle East could inadvertently amplify geopolitical tensions and macroeconomic risks, painting a troubled landscape for European interests conditioned by heightened volatility across commodities markets.

The latest fragile Middle Eastern truce promises to further complicate the region's already volatile geopolitical landscape and intricate macroeconomic interconnections, creating new opportunities for unpredictable spills into Europe’sin overarching security structure.

The fragile truce in the Middle East exacerbates geopolitical uncertainties and macroeconomic risks, posing a significant challenge for Europe's security posture as well its economic stability.

Commenting on the precarious Middle Eastern lull in tensions, which magnifies geopolitical and macroeconomic risks globally—especially for Europe due to its economic interdependence with region’s major players.

该文强调了脆弱的中东停火如何加剧地缘政治与宏观经济风险,尤其在欧洲面临更为复杂的外部环境挑战的当下。

The fragile nature of the Middle East truce underscores its precarious impact, exacerbating geopolitical tensions and macroeconomic volatility that further exposes Europe to unforeseen risks.