FX-hedged stocks seen outperforming as euro rises, says Morgan Stanley

Investing.com -- Morgan Stanley analysts said in a note Monday that as the U.S. dollar’s 15-year bull run appears to be ending, they see a clear opportunity for European equities with advanced foreign exchange (FX) hedging strategies to outperform.

The bank highlighted how companies that manage currency risks effectively are likely to benefit as the euro gains ground.

Invest in Gold

American Hartford Gold: #1 Precious Metals Dealer in the Nation

Learn More

Priority Gold: Up to $15k in Free Silver + Zero Account Fees on Qualifying Purchase

Learn More

Thor Metals Group: Best Overall Gold IRA

Learn More Powered by Money.com - Yahoo may earn commission from the links above.“We find companies with advanced FX hedging tend to outperform and expect material EUR strength beneficiaries to continue breaking to new highs,” Morgan Stanley analysts wrote, citing proprietary screens that identify such stocks.

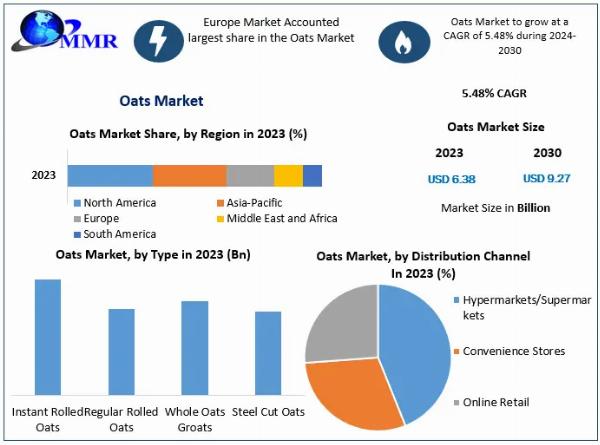

The report highlights the unique complexity of FX exposure in Europe, where only about 44% of MSCI Europe revenues are generated domestically.

“FX implications extend well below the surface of regional revenue exposures,” the analysts explained, noting the diversity of local-to-local strategies, multiple home currencies, including EUR, GBP, NOK, and CHF, and mismatches across costs, balance sheets, and cash flows.

Morgan Stanley projects a further weakening of the dollar, forecasting EUR/USD at 1.25 and GBP/USD at 1.45 by mid-2026, with bull-case scenarios of 1.30 and 1.51.

“These currency moves are likely to have implications for corporate and investor FX hedging strategies,” the bank said.

Morgan Stanley collaborated with FX strategists and sector analysts to assess FX exposure across roughly 550 European companies, aiming to reduce subjective interpretation.

“A core part of our process has been smoothing out subjectivity, creating an apples to apples playing field,” the analysts noted.

As FX dynamics gain investor attention, Morgan Stanley believes companies that proactively hedge are well-positioned to ride the euro’s rise and outperform their less-prepared peers.

Related articles

FX-hedged stocks seen outperforming as euro rises, says Morgan Stanley

Meta forms AI superintelligence lab headed by Scale AI’s Wang

Argentina ordered to surrender YPF stake to satisfy court judgment

The outlook for FX-hedged stocks to outperform as the euro strengthens, according to Morgan Stanley's assessment lately on market trends and currency dynamics.

The anticipation of FX-hedged stocks outpacing performance as the euro strengthens, highlighted by Morgan Stanley's observation highlights an interesting dynamic for investors to consider in lightening their exposure against currency depreciation risks.

Morgan Stanley's prediction of outperformance for FX-hedged stocks as the euro rises underscores their view that such investments can provide a cushion against currency depreciation and therefore yields greater potential gains in an environment where European currency appreciates.

The expected outperformance of FX-hedged stocks as the euro strengthens aligns with Morgan Stanley' optical outlook, signaling a hedgewealth strategy for investors.

While FX-hedged stocks have shown resilience amid the recent rise of euro, Morgan Stanley predicts their outperformance to persist as long as positive momentum in this direction continues.

Morgan Stanley's assertion that FX-hedged stocks are expected to outperform as the euro rises demonstrates a cautious optimism towards currencies and equity investments in post-:US Brexit context, warranting vigilance from investors.

Indeed, Morgan Stanley's observation regarding FX-hedged stocks outperforming as the euro appreciates is in line with recent market trends and indicates a prudent strategy for investors seeking to capitalize on currency fluctuation while maintaining portfolio stability.

Following the postulated prediction from Morgan Stanley, FX-hedged stocks' anticipated outperformance with a strengthening euro could offer compelling investment opportunities amidst shifting economic currents.

Commenting on Morgan Stanley's prediction that euro-hedged stocks are expected to outperform as the euro rises, investors may want to reassess their portfolio allocations for currency diversification and capital gains potential in a strengthening Eurozone.

Comments from Morgan Stanley预测进入市场,其声称当欧元升值时对冲投资组合(FX-hedged portfolios)中的股票可能将展现出超越市场的表现,即 Commenting on the direction of market that follows, with Euro appreciation seen as a potential indicator for outperformance in FX hedging stocks at work by readjusted investors.。

The reported expectation of outperformance for FX-hedged stocks as the euro appreciates, aligns with Morgan Stanley'sfinding that currency hedging could be a smart strategy amid shifts in global currencies.

Morgan Stanley's claim that Euro-hedged stocks will outperform as the euro rises align with strategies to diversify and capitalize on currency fluctuations, suggesting a prudent investment approach amidst expected exchange rate shifts.

这篇分析来自摩根大通,他们认为随着欧元的上涨趋势增强,对冲外币及市场波动的股票似乎将有望崭露头角。

As per Morgan Stanley's assessment, FX-hedged stocks are predicted to outperform in the eventuality of a rising euro due to their unique ability neutralize foreign exchange risks.