Fastly FSLY has been steadily scaling its Security segment, which is emerging as a key contributor to the company’s broader edge platform strategy. The segment reported revenues of $26.4 million in the first quarter of 2025, up 7% year over year and accounting for 18% of Fastly’s total revenues. The improving performance reflects the growing relevance of its security platform as enterprises increasingly prioritize real-time protection at the edge.

Fastly’s Security portfolio has been built to deliver low-latency, automated protection across modern web and API environments. It includes solutions like Client-Side Protection, API shielding, DDoS detection and bot mitigation. These solutions are embedded at the edge to help enterprise customers manage threats while maintaining compliance and low latency. Designed for performance-sensitive environments, the security offerings aim to simplify operations and support scale.

Momentum in the Security portfolio is being driven by ongoing product additions and upgrades, which are acting as key catalysts. Client-Side Protection has been developed to flag unauthorized browser-side activity and support PCI-DSS requirements. Fastly also launched Attack Insights to provide real-time visibility into blocked DDoS traffic and enable test-mode simulations. Bot Detection has been upgraded with dynamic challenge capabilities to better defend against evolving attack patterns.

The additions and enhancements are gaining traction among infrastructure and platform teams as security becomes a priority. Fastly’s focus on performance and developer usability is driving adoption, positioning the Security segment as a long-term growth driver within its edge platform.

Fastly Faces Competitive Pressure

Fastly’s expanding Security stack is facing competition from the likes of Fortinet FTNT and Cloudflare NET, both of which are scaling their solutions to support performance-driven, secure digital infrastructure.

Fortinet is building momentum through FortiWeb and FortiDDoS, offering advanced capabilities in bot protection, API security and automated threat response. Its tools are designed for enterprise environments that demand low latency, high precision and strong compliance. These strengths make Fortinet a key competitor in Fastly’s core markets.

Cloudflare continues to expand its security platform with advanced DDoS protection, bot management and threat intelligence. Its automation and real-time enforcement features are designed for developers and infrastructure teams managing complex workloads. Traction in Cloudfare’s regulated and performance-sensitive sectors puts it in direct competition with Fastly’s growing Security portfolio.

FSLY’s Share Price Performance, Valuation and Estimates

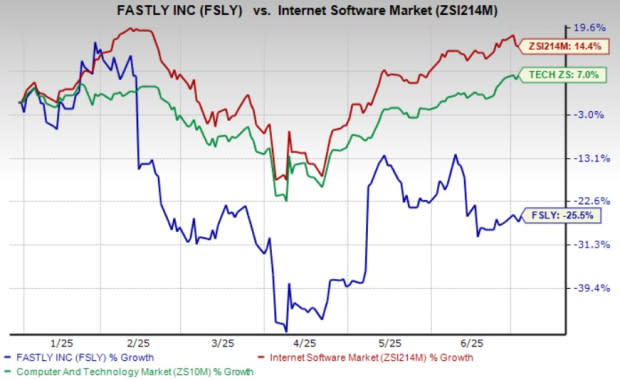

FSLY’s shares have declined 25.5% year to date, while the broader Zacks Computer & Technology sector has increased 7% and the Zacks Internet Software industry has appreciated 14.4%.

FSLY Performance

Image Source: Zacks Investment Research

Fastly shares are currently trading with a forward 12-month price-to-sales (P/S) of 1.63X compared with the industry’s 5.74X. FSLY has a Value Score of F.

FSLY Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for second-quarter loss is pegged at 5 cents per share, unchanged over the past 30 days. This implies an improvement of 28.57% from the year-ago quarter.

Fastly, Inc. Price and Consensus

Fastly, Inc. price-consensus-chart | Fastly, Inc. Quote

The consensus mark for FSLY’s 2025 loss is pegged at 9 cents per share, which has improved by a penny over the past 30 days. The figure indicates a 25% improvement year over year.

FSLY currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Fastly, Inc. (FSLY) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The recent expansion of security offerings by FSLY could be a strategic move to bolster its position in the market and secure new business opportunities. However, revenue growth is ultimately required for it translate into meaningful returns or stock price appreciation.

The strategic expansion of security offerings by FSLY signals innovational prowess in a crucial sector, ultimately bode well for its market position and could lure investors' confidence into selecting the stock as an attractive investment option.

While the expansion of FSLY's security offerings will certainly boost their competitiveness in a growing market segment, whether this innovative move pays off for its stock ultimately remains to be seen depending on customer adoption and long-term profitability.