Ether Demand Driven by Institutional Buying in U.S., Coinbase Premium Shows

Ether (ETH) broke above $3,600 this week, marking its strongest rally since April, as on-chain data and ETF flows point to accelerating institutional demand, particularly from U.S.-based buyers.

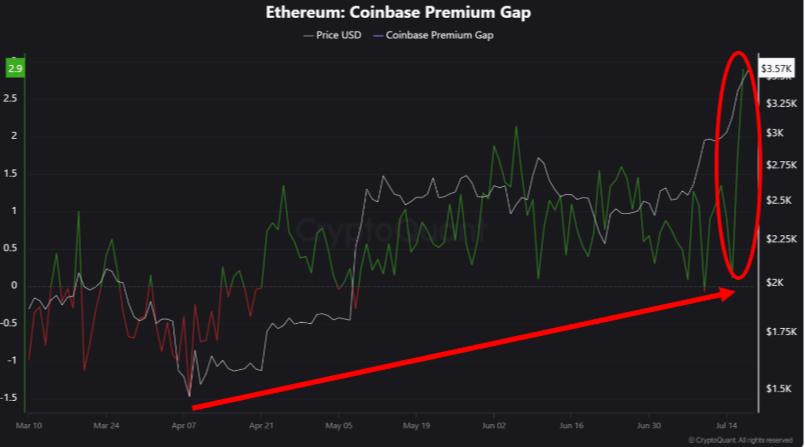

The surge in allocations follows a steady wave of buying activity on Coinbase, where ETH has begun to trade at a premium — a signal typically associated with U.S. whales and institutions ramping exposure.

“A premium on Ethereum, unseen in recent times, has emerged on Coinbase, a platform primarily used by U.S. institutions and whales,” CryptoQuant independent analyst CryptoDan said in a post. “Moreover, the steady rise in buying activity, presumably from U.S. whales, is noteworthy.”

“Additionally, the recent inflow of funds into Ethereum spot ETFs has hit an all-time high on a daily basis, indicating that U.S. investors are aggressively accumulating Ethereum,” they added.

The ETH/Coinbase premium, which tracks the price difference between ETH on Coinbase and Binance, had trended flat for much of June but flipped positive this week.

That divergence, paired with spot ETF inflows, suggests that institutions are leading the current breakout rather than chasing.

ETH is up 21% over the past 7 days, outperforming BTC and most major cryptocurrencies.

The institutional buying surge in the U.S., as evidenced by rising Ether demand and a Coinbase premium, underscores growing confidence among major investors who see potential for continued cryptocurrency adoption.

The surge in institutional buying within the US, as witnessed by a rising Coinbase premium levelings off adverse price volatility of cryptocurrency markets.

The recent surge in Ether demand fueled by institutional buying within the U.S., as evidenced through Coinbase's high premium levels, underscores a shift towards professional trading practices and broader institutional adoption of Ethereum.

The sustained surge in US institutional purchases as the primary driver of Ether demand is reflected not only through increased trading volumes but also by coinbase's premium over other exchanges, signaling strong investor confidence and broader market adoption.

The strong Ether demand fueled by institutional buying in the U.S., as evidenced through Coinbase's premium, highlights a renewed investor interest and potential for continued growth within blockchain assets.

The surge in institutional buying observed on US-based platforms like Coinbase, evidenced by a corresponding premium over spot prices of Ether (ETH), underscores the establish capital's fascination with and growing demand for digital assets.

The robust demand for Ether fueled by institutional purchases in the U.S., as evidenced by Coinbase's premium prices, underscores its status a leading asset under crypto investment strategies.

The sustained institutional demand for Ether in the U.S., as evidenced by Coinbase's premium pricing, signifies a growing confidence and acceptance of Ethereum among large-scale investors.