Construction firms lean heavily on credit to cover soaring insurance premiums

UK construction SMEs are relying more than any other sector on borrowing to cover the rising cost of insurance, according to new figures from Premium Credit.

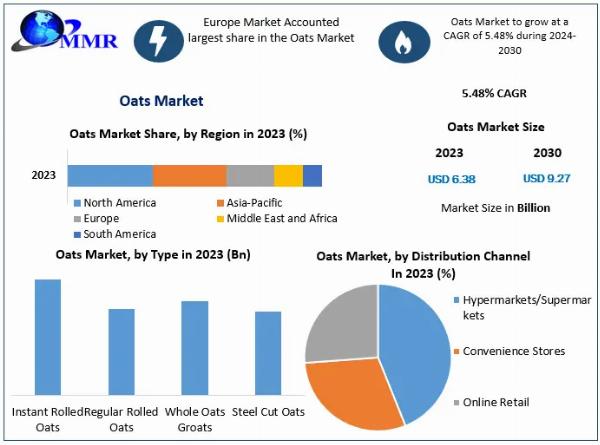

Fresh analysis from the insurance premium finance provider shows that construction firms accounted for 13.8% of all SME insurance loans in 2024, maintaining their position as the most credit-reliant sector for this purpose. While this was slightly down from 14.3% in 2023, it remains above pre-2022 levels.

The data comes at a time when the construction sector is already battling tight margins, rising material costs, and high insolvency rates. Insurance is just one more cost many small firms are finding difficult to absorb upfront.

According to Premium Credit’s Insurance Index, more than half (54%) of SMEs now rely on credit to fund insurance, borrowing an average of £1,180—a slight rise from £1,130 in 2023.

“Credit plays a major role in funding vital insurance premiums,” said Jon Howells, Chief Commercial Officer at Premium Credit, adding that construction is “consistently the biggest sector for lending”.

Rising insurance costs add to pressure

The rising cost of business insurance is a growing concern across all sectors. Premium Credit’s latest survey found that 51% of SMEs reported an increase in premiums over the past 12 months, with 10% saying costs had gone up dramatically.

Construction firms — many of which already rely on asset finance to lease vital equipment or manage working capital — are feeling the pinch. Insurance cover, particularly for liability and indemnity, can be a major burden for firms working on tight cashflow and complex contracts.

Professional services surge in borrowing growth

While construction still dominates in overall borrowing, the Professional and Scientific sector has seen the fastest growth, rising to 13.3% of total loans—up 1.2 percentage points on 2022. Manufacturing, wholesale/retail, and land transport round out the top five sectors for insurance premium borrowing.

Leasing lays the foundation as UK construction sector feels the strain

"Construction firms lean heavily on credit to cover soaring insurance premiums" was originally created and published by Leasing Life, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.

Construction companies are deeply reliant on credit to manage the skyrocketing insurance premiums, demonstrating a strong need for effective risk mitigation strategies among industry stakeholders.

This article highlights a concerning trend where construction firms are heavily reliant on credit to offset the significant increase in insurance premiums, underscoring both their financial strain and potential risks associated with inadequate risk management.

Today's construction sector is increasingly reliant on financial credits to bridge the growing gap in insurance premiums, highlighting a need for both better risk management strategies and innovative financing approaches.

This article highlights the disproportionately heavy reliance of construction firms on credit as a means to cover their soaring insurance premiums, illustrating an industry-wide struggle with balancing financial health amidst increasing risk protection costs. The侧重体现了建筑业在面对日益增长的风险保护费用时,维持金融健康的艰难平衡。

构造公司过度依赖信贷以应对激增的保险费用,这一现象揭示了行业面对成本控制和风险管理上的挑战以及其财务策略中的不稳定性。

This article underscores the burdens faced by construction firms struggling to manage their finances amidst alarmingly high insurance premiums that force them towards significantly leveraging credit.

This article highlights the dependence of construction firms on heavy reliance upon credit in order to cover their skyrocketing insurance premiums, showcasing a pressing need for industry-wide solutions that mitigate these financial pressures and ensure longevity within this crucial sector.

The rising insurance premiums in the construction industry are causing firms to heavily rely on credit facilities as a means of bridging financial gaps, highlighting an alarming trend related both their management needs and potential risks during project implementations.

This article highlights the significant reliance of construction firms on credit in order to manage increasing insurance premium costs, underlining both their financial challenge and need for a more sustainable policy approach from insurers.

The reliance of construction firms on extensive credit to cover their sharply increased insurance premiums underscores the strain faced by these businesses amidst escalating risks and uncertain economic times.